Banks are now consistently loosening their credit standards every year as they slowly ease up from the strict standards set in place after the financial crisis.

The loosening, however, is by no means a return to the way banks did business in the run-up to the crisis, with underwriting practices remaining satisfactory for the past 12-month period, according to the Office of the Comptroller of the Currency’s 22nd Annual Survey of Credit Underwriting Practices.

The survey is a compilation of examiner observations and assessments of credit underwriting standards and practices at 93 of the largest national banks and FSAs supervised by the OCC. The survey results cover the 12-month period ending June 30, 2016, and the survey also covers loans totaling $5.2 trillion, representing 90% of all loans in the federal banking system.

As it stands, credit overall in the mortgage market is very tight. Laurie Goodman recently penned a blog for the Urban Institute that brought the severity of the credit situation into the spotlight, urging that “a near-zero-default environment is clear evidence that we need to open up the credit box and lend to borrowers with less-than-perfect credit." This is slowly starting to change.

As a whole, the OCC survey found that underwriting practices among national banks and federal savings associations (FSAs) eased for a fourth consecutive year in 2016.

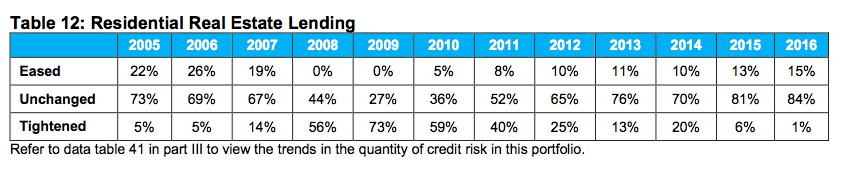

This was especially true for residential real estate loans, a trend also witnessed in the 2015 survey.

Click to enlarge

(Source: OCC)

For residential lending, 15% of banks eased practices, a level not seen since 2007, the survey reported.

The easing is attributed to the changes in the competitive environment, market strategy, risk appetite and product performance.

“During the 12-month survey period, underwriting practices remained satisfactory. But an increasing tolerance for looser underwriting has resulted in a continued movement from more conservative to more moderate underwriting practices,” said Grace Dailey, senior deputy comptroller and chief national bank examiner. "While this movement is consistent with past credit cycles at a similar stage, credit risk is expected to increase if the trends we see today continue.”