Whether Millennials want to buy a home or not, there first has to be a home available to purchase. In an interview with HousingWire, Daren Blomquist, senior vice president at ATTOM Data Solutions, identified three key factors keeping housing inventory in a drought, barring entrance for aspiring young homeowners.

The current inventory shortage isn’t new though. The same challenges plagued housing in 2016 are predicted to stick around through 2017.

Beyond the standard explanations for why Millennials put off buying a home, such as student debt, tighter lending standards and simply not wanting to sacrifice everything to buy a home, young home shoppers have to choose from a shallow pool of home options and compete with millions of other young buyers trying to do the same. It’s a hard situation.

Before assuming Millennials don’t want to buy a home, take a look at the three factors they’re facing regarding limited inventory.

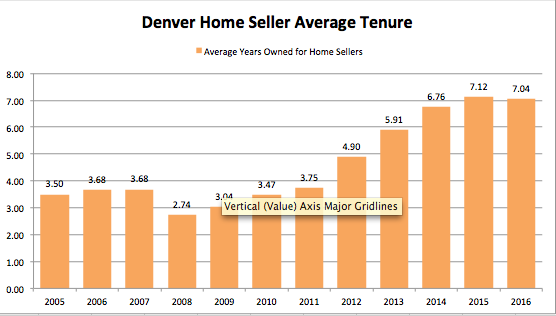

1. Average homeownership tenure:

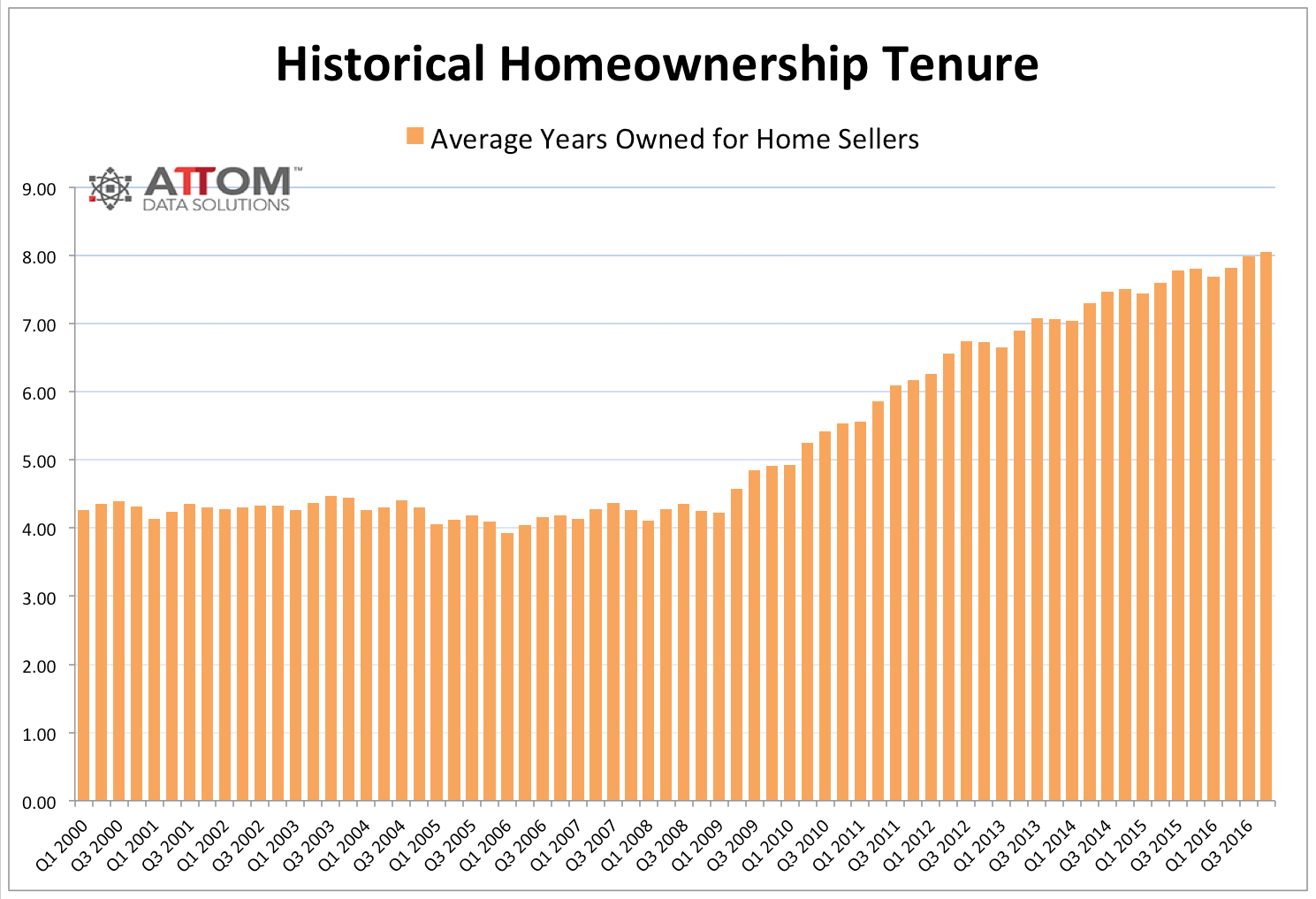

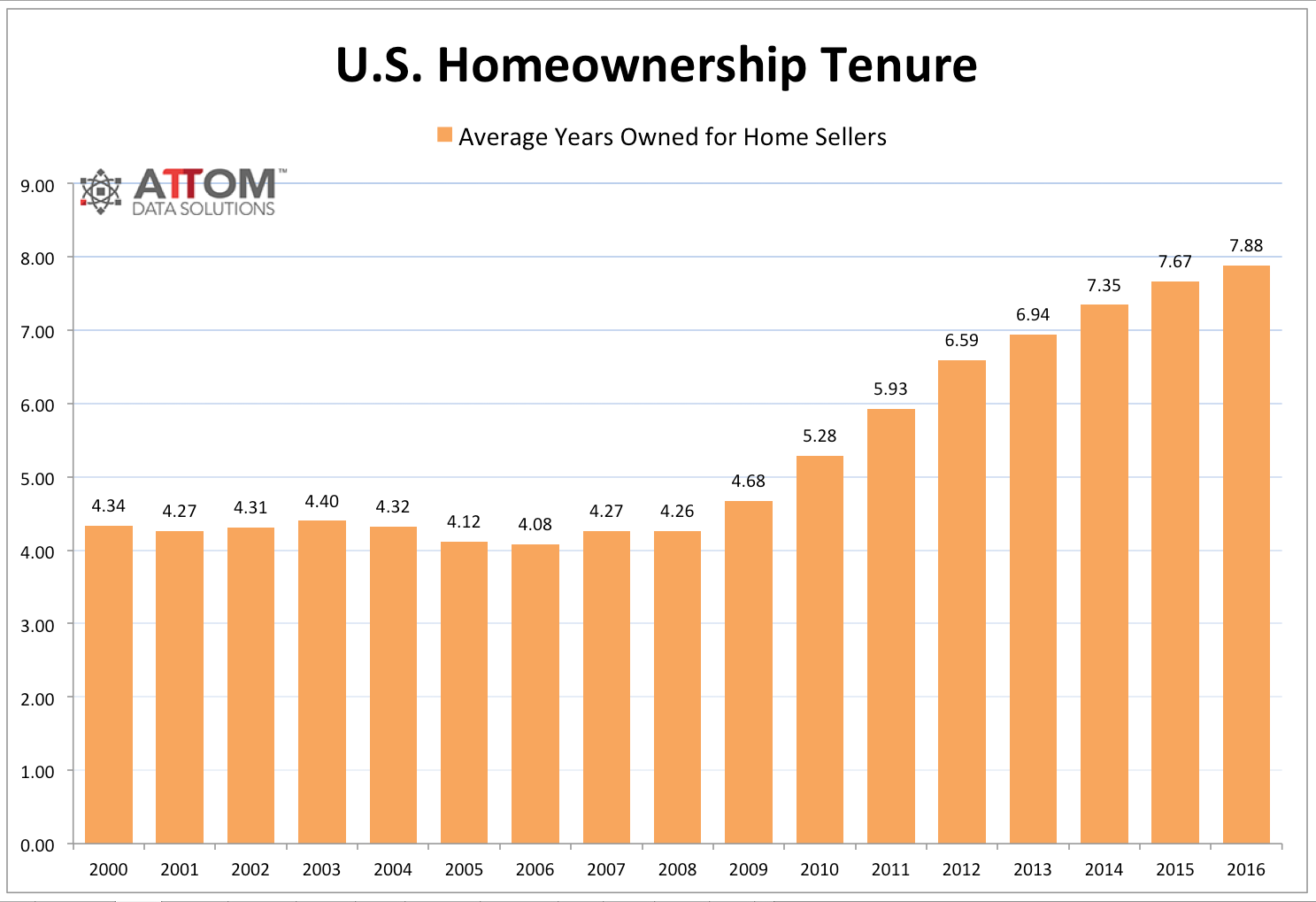

Since the early 2000s, there’s been a significant shift in the average homeownership tenure, nearly doubling in time length. In 2007, the average tenure came in at 4.08 years, compared to 7.88 years a decade later in 2016.

As a result, Millennials can’t buy as much since fewer homes are being listed on the market for sale.

The first two charts from ATTOM Data Solutions show a breakdown of the historical homeownership tenure over the last 17 years. One chart gives a quarterly breakdown, while the other gives a yearly breakdown.

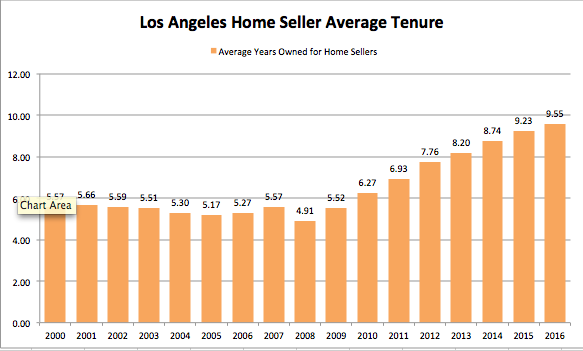

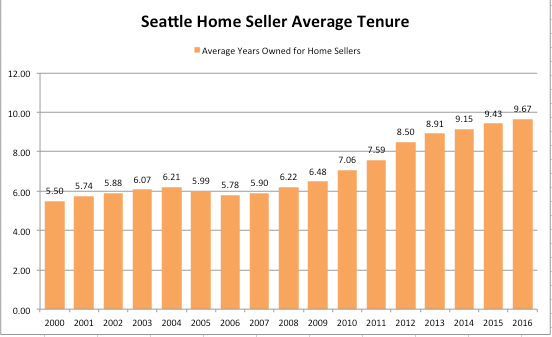

As an added bonus, we're including a few extra chart breakdowns for several key markets, with some worse than the national average.

Click to enlarge

(Source: ATTOM Data Solutions)

Click to enlarge

(Source: ATTOM Data Solutions)

Click to enlarge

(Source: ATTOM Data Solutions)

Click to enlarge

(Source: ATTOM Data Solutions)

Click to enlarge

(Source: ATTOM Data Solutions)

2. Everyone refinanced

Blomquist went on to explain that thanks to historically low interest rates, everyone who could has already refinanced into a low rate and they want to keep that rate.

Although this is great for everyone who secured a low rate, it’s also stopping homeowners from leaving their starter home and upgrading into a new home.

And rates are only projected to rise. In the two weeks after the election, the 30-year mortgage rate jumped 40 basis points, surging to 3.94% and now sits above 4%.

3. Investors are going after starter homes

Investors are picking off a lot of the ideal homes for first-time homebuyers.

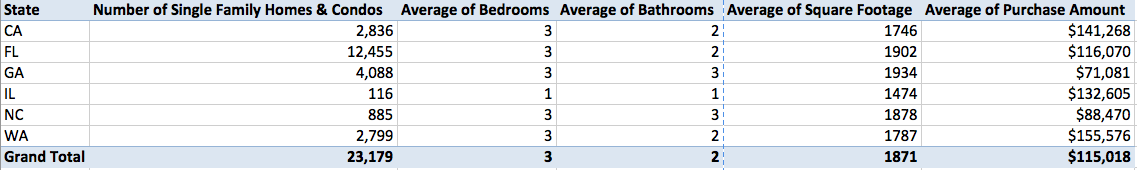

Blomquist said ATTOM Data Solutions looked at more than 23,000 properties owned by Blackstone Group’s single-family rental operator, Invitation Homes, which is about 48% of their total portfolio, and found a lot of their inventory is what Millennials would be interested in: 3-bed, 2-bath homes with average square footage of 1,871 and value of below $250,000.

And even worse for first-time homebuyers, investors are reaping the benefit of home prices rising. Invitations Homes has gained an estimated 114% in home value on this portfolio since purchase.

The chart below gives a breakdown of Invitation Homes’ portfolio.

Click to enlarge

(Source: ATTOM Data Solutions)

So yes, Millennials simply might not want to buy a home, but there is also a gaping hole in housing inventory that’s stopping them. And young aspiring homeowners aren’t the only group dealing with this. Lynn Fisher, the MBA’s vice president of research and economics, recently said there will be about a 13 million to 16 million increase in additional households in the U.S. over the next decade.