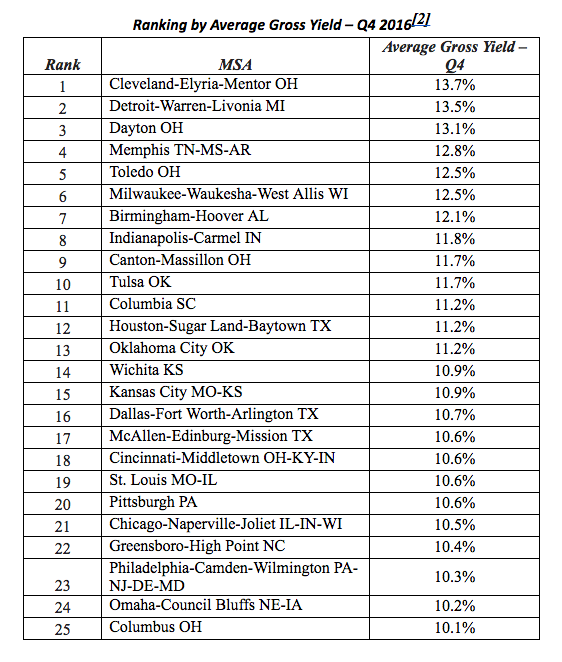

RentRange, a provider of market data and analytics for the housing industry, released its latest ranking of the 25 U.S. metropolitan statistical areas by highest average gross yield for single-family homes during the fourth quarter of 2016.

“Looking at average gross yield rates, Cleveland, Detroit and Dayton top our list of markets with the highest returns for single-family homes,” said Dennis Cisterna, chief revenue officer with RentRange Data Services. “These three markets fall within the Rust Belt region, which was once dominated by an industrial-powered economy and is now experiencing population loss and economic decline.”

There are variables for investor to keep in mind though, as Cisterna points out.

“For investors, whether you are an everyday investor or an institutional investor, it is vital to analyze each property to determine whether it will produce the returns you expect prior to purchasing a single-family residential investment property,” he said.

For example, look at Detroit, which is second on the list. While Detroit is ranked at No. 2, the report stated that yields have declined from a year ago, perhaps due to recent economic improvements.

As a result, if economic conditions continue to improve, yields may continue to fall as a result of a potential rise in home prices. This would mean investors would obtain less of a profit.

Keeping this in mind, here is the full list from RentRange of the top 25 markets.

Click to enlarge

(Source: RentRange)