Now that more than a full year passed since the implementation of the Consumer Financial Protection Bureau’s TILA-RESPA Integrated Disclosure rule in October 2015, ARMCO released the Mortgage QC Industry Trends Report for the fourth quarter of 2016 and calendar year 2016.

The report is based on post-closing quality control loan data captured by the company’s ACES Analytics benchmarking software. The report also analyzes post-closing quality control data from more than 65 lenders, comprising more than 75,000 unique loans selected for random full-file reviews. Defects are categorized using the Fannie Mae loan defect taxonomy.

ARMCO also noted that data for any given calendar quarter is analyzed approximately 90 days after the end of the quarter to allow for sufficient elapsed time for the post-closing quality control cycle to be completed.

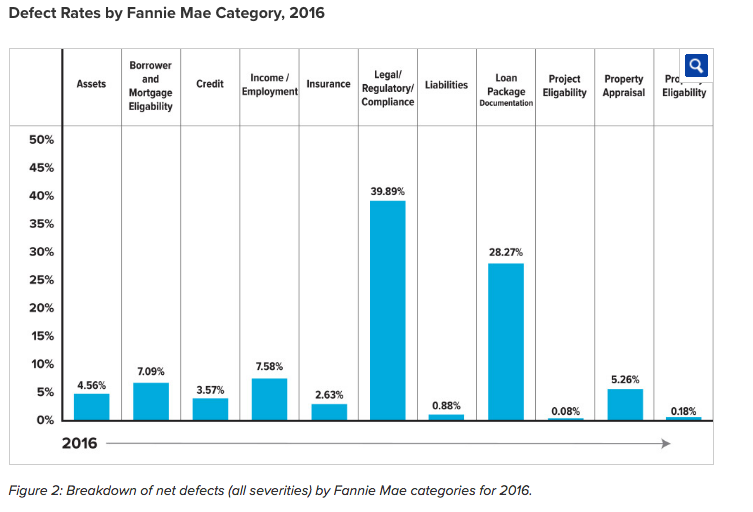

According to the report, legal/regulatory/compliance and loan package documentation were the leading defect categories in 2016.

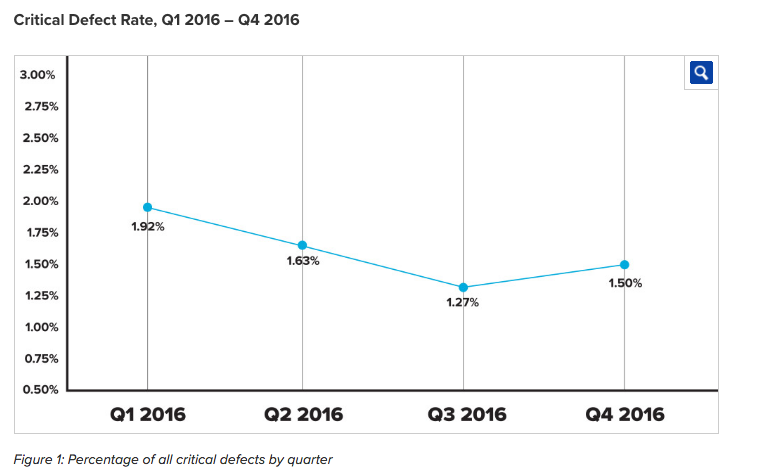

The chart below shows the overall percentage of loans with critical defects as a percentage of total closed loans for the past four calendar quarters.

Click to enlarge

(Source: ARMCO)

The report explained that much of lenders’ Q1 2016 efforts were driven by trial-by-fire efforts, resulting in a spike in the industry’s critical defect rate, seen in the chart above.

However, thanks to a wave of corrective actions, along with a surge in the amount of resources directed at solving these issues, the critical default rate dropped in the third quarter 2016.

The top three TRID-related defects for 2016, as reported in conjunction with post-closing quality control reviews, are:

- Final Loan Estimate and/or Closing Disclosure not in file for review

- Timing of borrower receipt of Closing Disclosure

- Fee tolerance violation with invalid Change of Circumstance

All of TRID related defects fall in the legal/regulatory/compliance category. The chart below shows a breakdown of all reported net defects (critical and non-critical) in accordance with Fannie Mae defect categories.

Click to enlarge

(Source: ARMCO)

“The data suggests lenders are getting more adept at complying with critical TRID-related issues. However, new areas of concern are beginning to spring up and an early correlation can be linked to a more purchase-focused market,” said Phil McCall, chief operation officer of ARMCO.

As seen in the first chart, the critical default rate increased to 1.50% in the fourth quarter 2016, which the report attributed to an uptick in purchase transactions.

In Q3 2016, purchase transactions accounted for just less than 48% of the benchmark data, but by the end of Q4, they accounted for more than 51%.

The report stated that the change in the overall make-up of loan production is a predictive indicator of possible changes in 2017.

And as a result, the industry is likely to see increased defects associated with a purchase driven market.

“Lenders need to learn from their own defects if they want to protect themselves against compliance-related issues, but they also need to stay apprised of changing trends if they want to mitigate the increased risk of fraudulent activity that is inherent with a purchase-driven market,” said McCall.