Mixing it up from the standard monthly complaint report, the Consumer Financial Protection Bureau’s June snapshot presented a detailed breakdown of consumer complaints in all 50 states and the District of Columbia.

“The Bureau’s ability to receive and process consumer complaints enables us to hear directly from people about their concerns and helps us prioritize our work to protect others against similar problems,” said CFPB Director Richard Cordray. “This report provides valuable information to the CFPB and the public about issues and trends we are seeing from each state.”

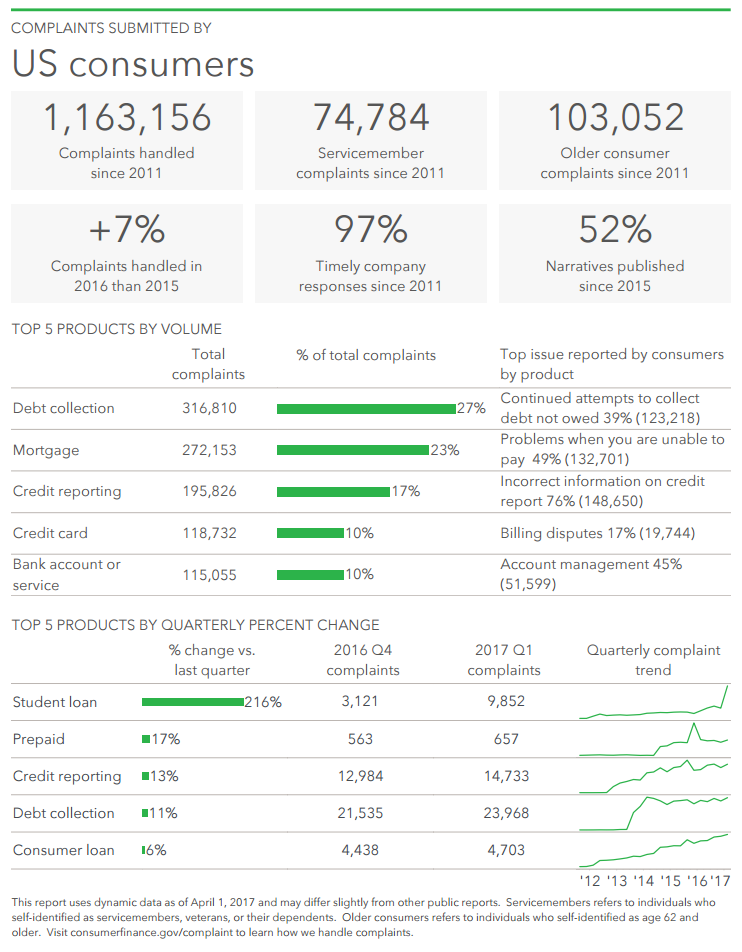

The CFPB handles more than 20,000 complaints every month, and overall, it has received more than 1,163,156 complaints since 2011.

The chart below dissects all the complaints, showing which financial areas received the most complaints. One note: The CFPB considers a response to be timely if the company responds within 15 days.

Click to enlarge

(Source: CFPB)

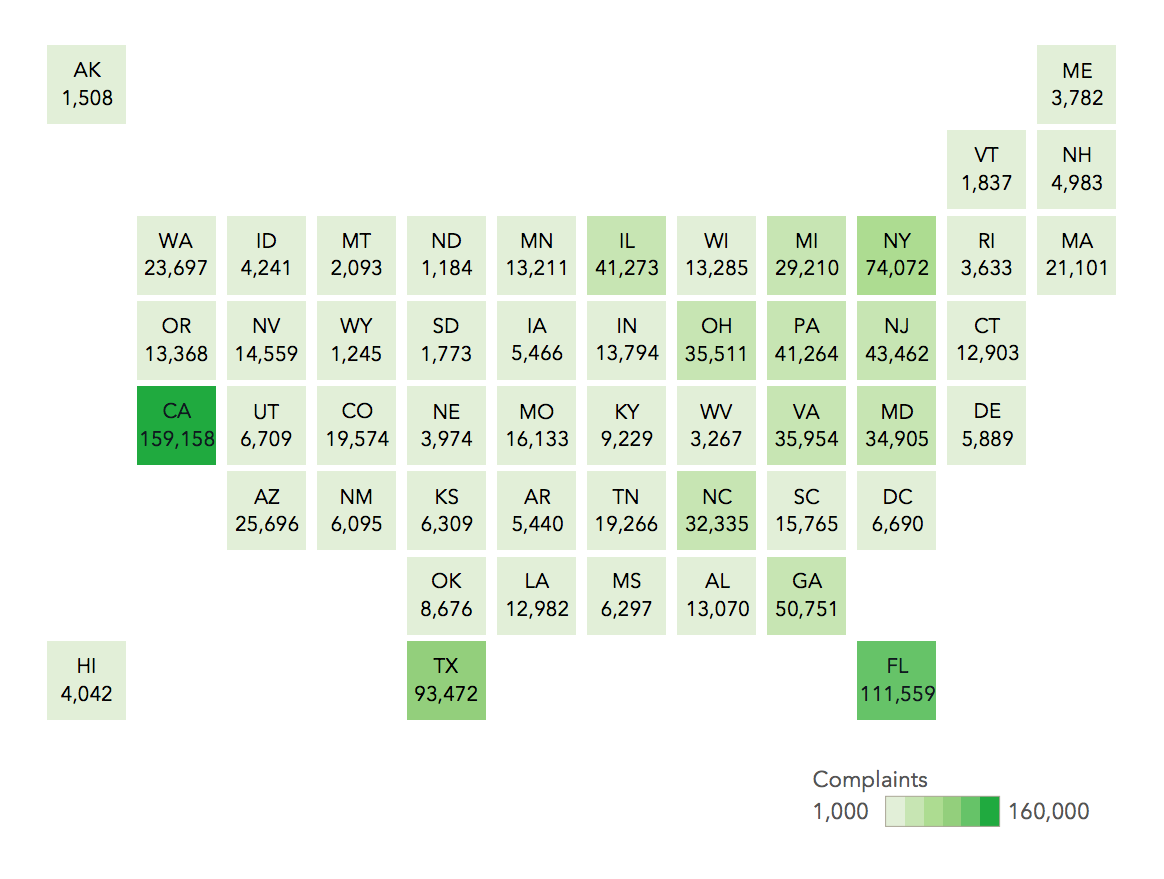

Meanwhile, the charts below highlight the three states with the most complaints: California (159,158), Florida (111,559), and Texas (93,472). Check here for the full report.

But first, the chart below gives an overview of the number of complaints each state receives.

Click to enlarge

(Source: CFPB)

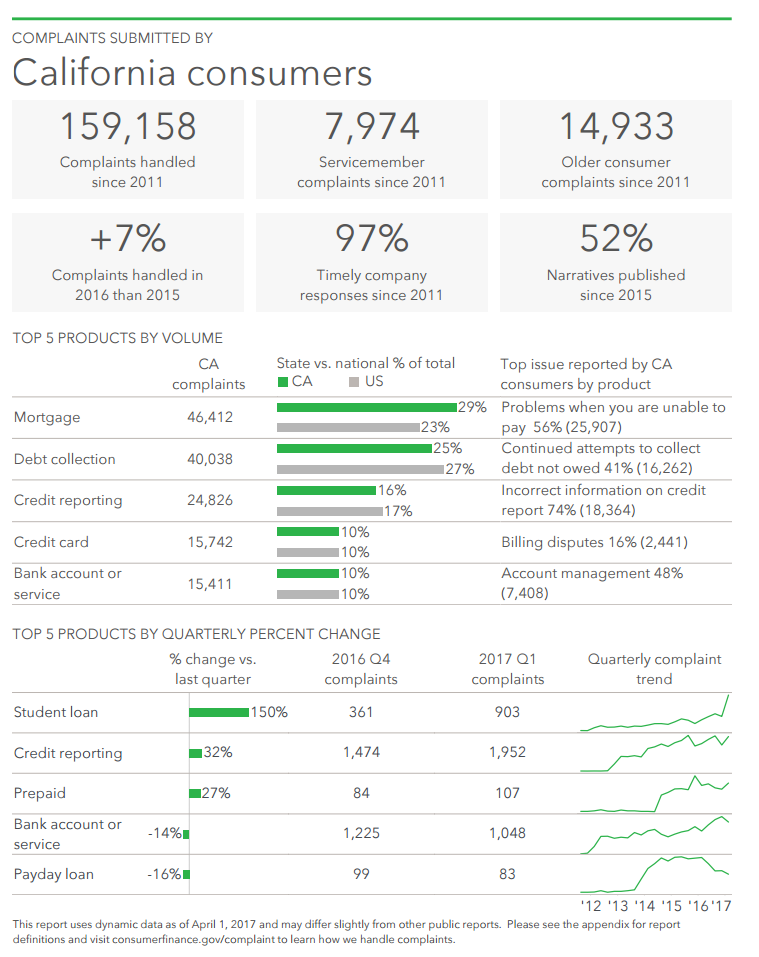

1. California consumers

In total, California received 159,158 complaints, with mortgage complaints coming in as the No. 1 most complained about category.

Click to enlarge

(Source: CFPB)

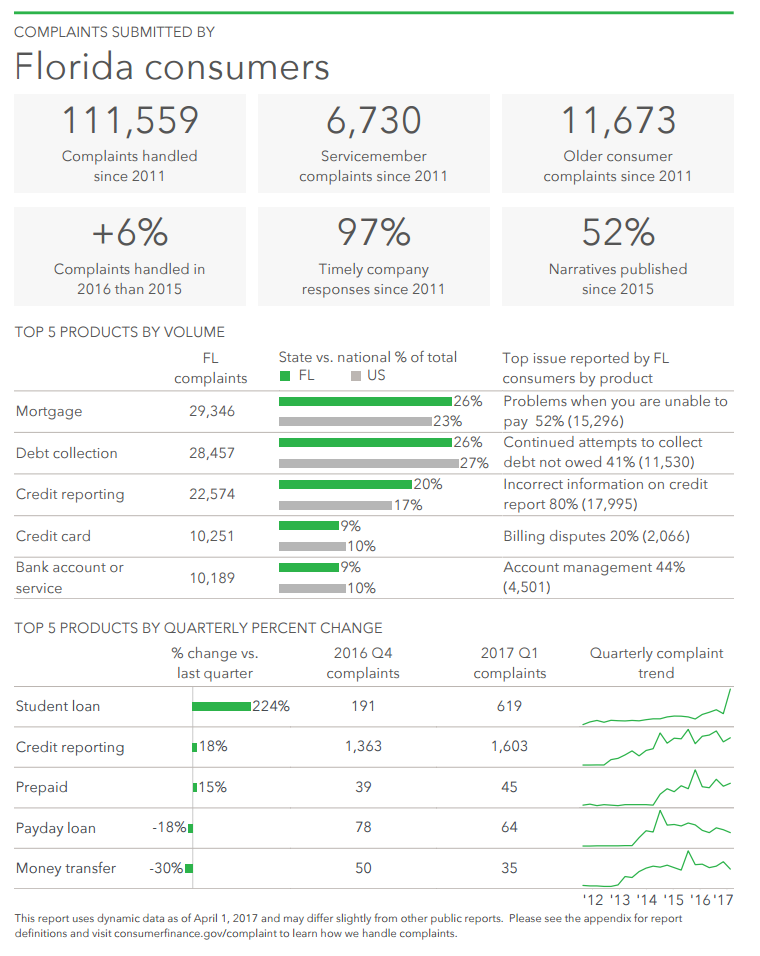

2. Florida consumers

In total, Florida received 111,559 complaints, with mortgage and debt collections complaints coming in as the top complained about categories.

Click to enlarge

(Source: CFPB)

3. Texas consumers

In total, Texas received 93,472 complaints, with debt collection complaints coming in as the No. 1 most complained about category.

Click to enlarge

(Source: CFPB)