The Federal Housing Finance Agency proposed a new rule Thursday which would establish new housing goals for Fannie Mae and Freddie Mac for 2018 through 2020.

Now, the FHFA is requesting comments on its proposed rule. When finalized, these new rules will replace the current rules which expire at the end of 2017.

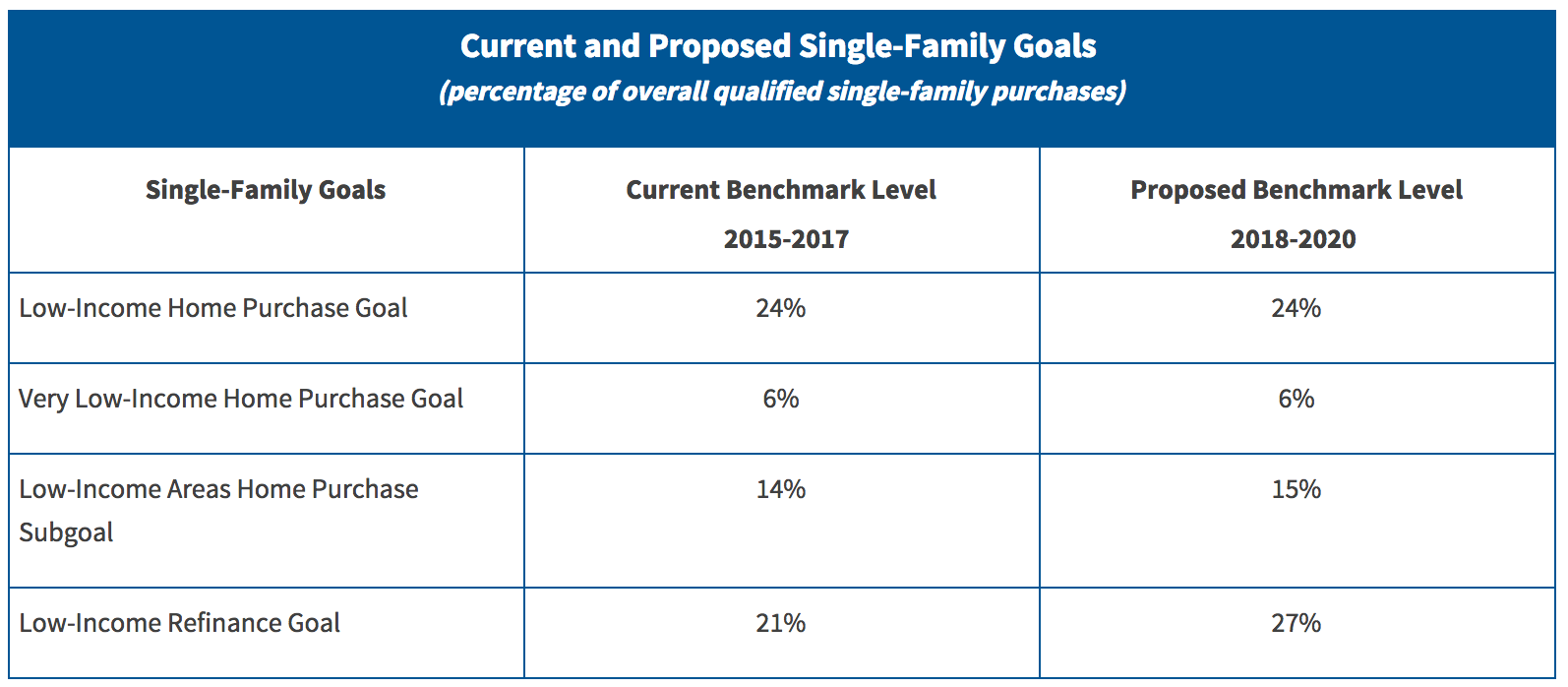

Here are the new goals the proposed rules would establish for single-family housing goals:

Click to Enlarge

To meet a single-family housing goal, the percentage of mortgage purchases must surpass the benchmark level set in advance by the FHFA or the market level for that year. The market level is determined retrospectively each year, based on the actual goal-qualifying share of the overall market as measured by FHFA based on Home Mortgage Disclosure Act data for that year.

This chart shows the newly proposed multifamily goals:

Click to Enlarge

To meet a multifamily housing goal, the company must purchase mortgages on multifamily properties with rental units affordable to families in each category. The FHFA measures the GSEs’ multifamily goals performance against the benchmark levels set by FHFA.

The FHFA explained that as the GSEs remain in conservatorship, their mission of supporting a stable and liquid national market for residential mortgage financing continues.

The FHFA requested interested parties are invited to submit comments on the proposed rule within 60 days of publication in the Federal Register. Comments can be submitted to the Federal Housing Finance Agency, Division of Housing Mission and Goals, 400 7th Street, S.W., Washington, DC 20219 or via FHFA.gov.