Home prices increased in May from last month and last year, an increase that will only continue to rise, according to the CoreLogic Home Price Index and HPI Forecast.

Home prices increased 6.6% nationally from May 2016 to May 2017 and 1.2% from last month, CoreLogic’s HPI showed.

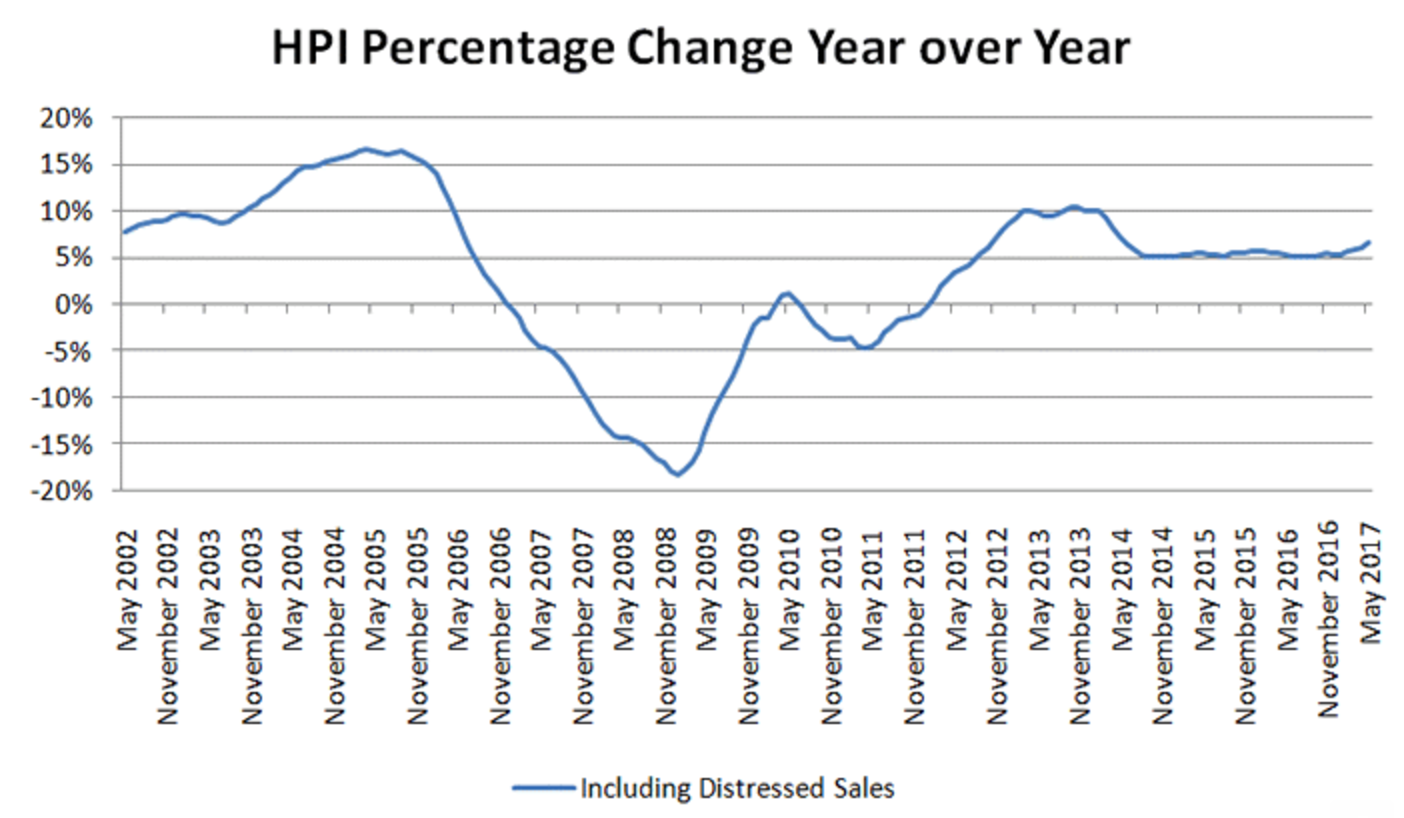

The chart below shows the HPI history over the past 15 years:

Click to Enlarge

(Source: CoreLogic)

“The market remained robust with home sales and prices continuing to increase steadily in May," CoreLogic Chief Economist Frank Nothaft said. “While the market is consistently generating home price growth, sales activity is being hindered by a lack of inventory across many markets.”

“This tight inventory is also impacting the rental market where overall single-family rent inflation was 3.1% on a year-over-year basis in May of this year compared with May of last year,” Nothaft said. “Rents in the affordable single-family rental segment, defined as properties with rents less than 75% of the regional median rent, increased 4.7% over the same time, well above the pace of overall inflation.”

Looking ahead, the CoreLogic HPI Forecast shows home prices will increase 5.3% annually by May 2018 and 0.9% from May to June.

The CoreLogic HPI Forecast is a projection of home prices using the CoreLogic HPI and other economic variables. Values are derived from state-level forecasts by weighting indices according to the number of owner-occupied households for each state.

“For current homeowners, the strong run-up in prices has boosted home equity and, in some cases, spending,” CoreLogic President and CEO Frank Martell said. “For renters and potential first-time homebuyers, it is not such a pretty picture.”

“With price appreciation and rental inflation outstripping income growth, affordability is destined to become a bigger issue in most markets,” Martell said.