Bank of America reported its earnings for the second quarter Tuesday morning, and as expected, lower mortgage banking income created a drag on earnings.

The bank reported an increase of 10% in its net income to $5.3 billion during the first quarter. This is also up from last quarter’s $4.9 billion.

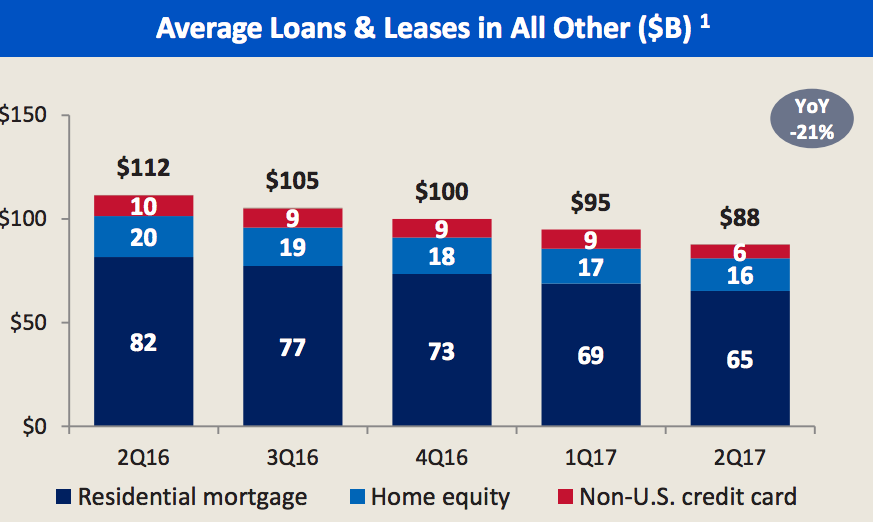

However, mortgage banking income created a drag on noninterest income, which increased 6% to $11.8 billion in the second quarter. The increase was driven primarily by the sale of the non U.S. consumer credit card business and higher investment banking fees, and partially offset by lower gains from the sale of debt securities and lower equity investment income.

Within the consumer banking sector, noninterest income decreased slightly to $2.55 million, down from $2.59 million last year. This drop is due mainly to the drop in mortgage banking income.

But while mortgage banking income is down, the chart below shows residential mortgage loans increased from last quarter and last year.

Click to Enlarge

(Source: Bank of America)

The bank reported an increase of 12% in earnings per share to $0.46. This is up from $0.41 last year.

The bank’s revenue also increased 7% to $22.8 billion this quarter, up from $21.3 in the second quarter of 2016.

“Against modest economic growth of 2%, we had one of the strongest quarters in our history,” CEO Brian Moynihan said. “All of our businesses delivered strong results, with several setting new records.”

“The investments we made to transform how we serve clients produced 500 basis points of operating leverage in the quarter,” Moynihan said. “We achieved our 60% efficiency ratio target, and we continued to manage credit risk carefully in line with responsible growth.”

“This supports our plan to return $17 billion in capital during the next four quarters, including a 60% increase in the quarterly common dividend,” he said.