Earlier this week, LendingTree put out a report that showed that borrowers who shop around for their mortgage could save thousands of dollars per year.

LendingTree’s business is, of course, helped by borrowers shopping around for mortgages, as lenders and other financial services providers pay LendingTree for the “chance to compete” for the business of consumers who search the site.

And as it turns out, borrowers are increasingly shopping around for mortgages on LendingTree, and that’s doing wonders for LendingTree’s business.

According to LendingTree, total loan requests processed by its site grew by 48% in the second quarter compared to the same time period last year, to 5.4 million.

And that increase in loan requests translated into record revenue, both overall and in several of LendingTree’s business segments – including mortgages.

According to LendingTree, the company saw record revenue from mortgage products in the second quarter, with the mortgage segment pulling in $71.5 million in revenue.

That’s an increase of 28% over the second quarter of 2016, when mortgage segment revenue was $56 million. The increase was primarily driven by growth in purchase revenue, although refinance revenues grew more than 10%, the company said.

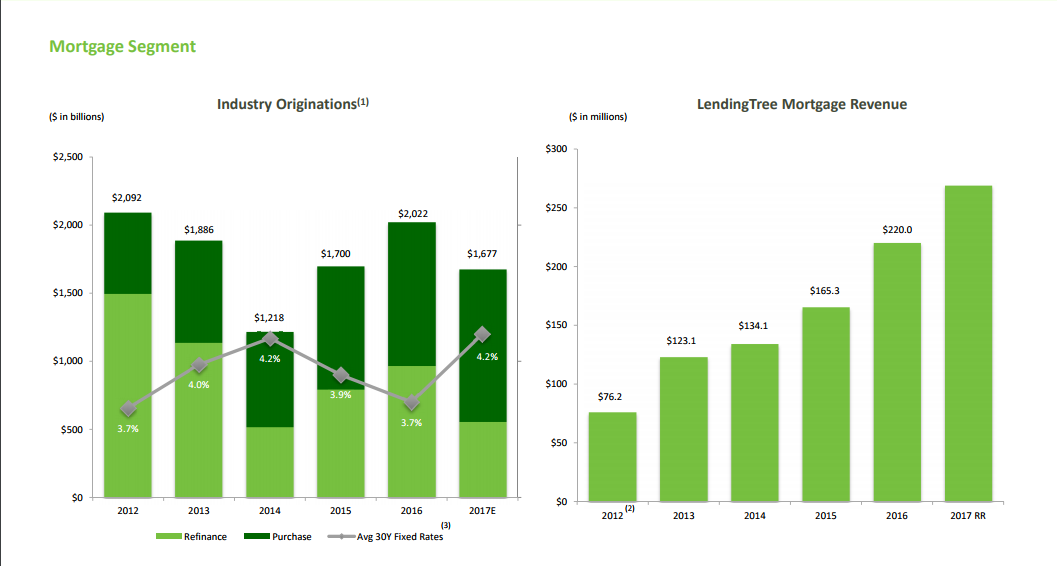

In a presentation for investors that accompanied the company’s second quarter financial results, LendingTree showed just how much the company’s mortgage segment has grown in the last few years.

In 2012, for example, revenue from the mortgage segment was $76.2 million for the year. In 2017, the company appears to be on track for mortgage revenue of approximately $275 million, as shown the graphic below.

(Click to enlarge. Courtesy of LendingTree)

Additionally, LendingTree also saw record revenue from non-mortgage products, which the company defines as home equity, reverse mortgage, personal loan, credit card, small business loan, student loan, auto loan, home services, insurance, deposit and personal credit products.

That segment saw revenue of $81.3 million in the second quarter, which represents an increase of 112% over the same time period last year.

Within that segment, LendingTree’s home equity revenue grew $6.9 million over the second quarter of 2016, representing growth of more than 100%.

Overall, the company’s total revenue also set a record of $152.8 million, which is up 62% from the second quarter of 2016 total of $94.3 million.

And the company expects that growth to continue.

LendingTree is currently projecting revenue of between $155 million and $160 million in the third quarter, which would be an increase of 64% – 69% over the third quarter of 2016.

“Record revenue and continued growth across the board are the highlights of LendingTree's record second quarter results,” Doug Lebda, LendingTree’s chairman and CEO, said.

“We continued to grow our network as lenders increasingly recognize the value in partnering with LendingTree, and we’re seeing substantial growth in consumer demand, solidifying the efficacy of LendingTree's business model,” Ledba added. “Simultaneously, we are executing well against our long-term strategic initiatives to expand into new products, strengthen relationships with consumers, improve the consumer experience and optimize across the board. I’m extremely proud of our results and am even more excited about the opportunities ahead.”