After several years of steady improvements, mortgage servicer satisfaction decreased due to customers having significant declines in their overall brand perceptions, according to J.D. Power’s 2017 U.S. Primary Mortgage Servicer Satisfaction Study.

Brand perceptions worsened due to customers indicating their mortgage servicer is more focused on profit than on their customers, creating long-term effects on the company’s future business.

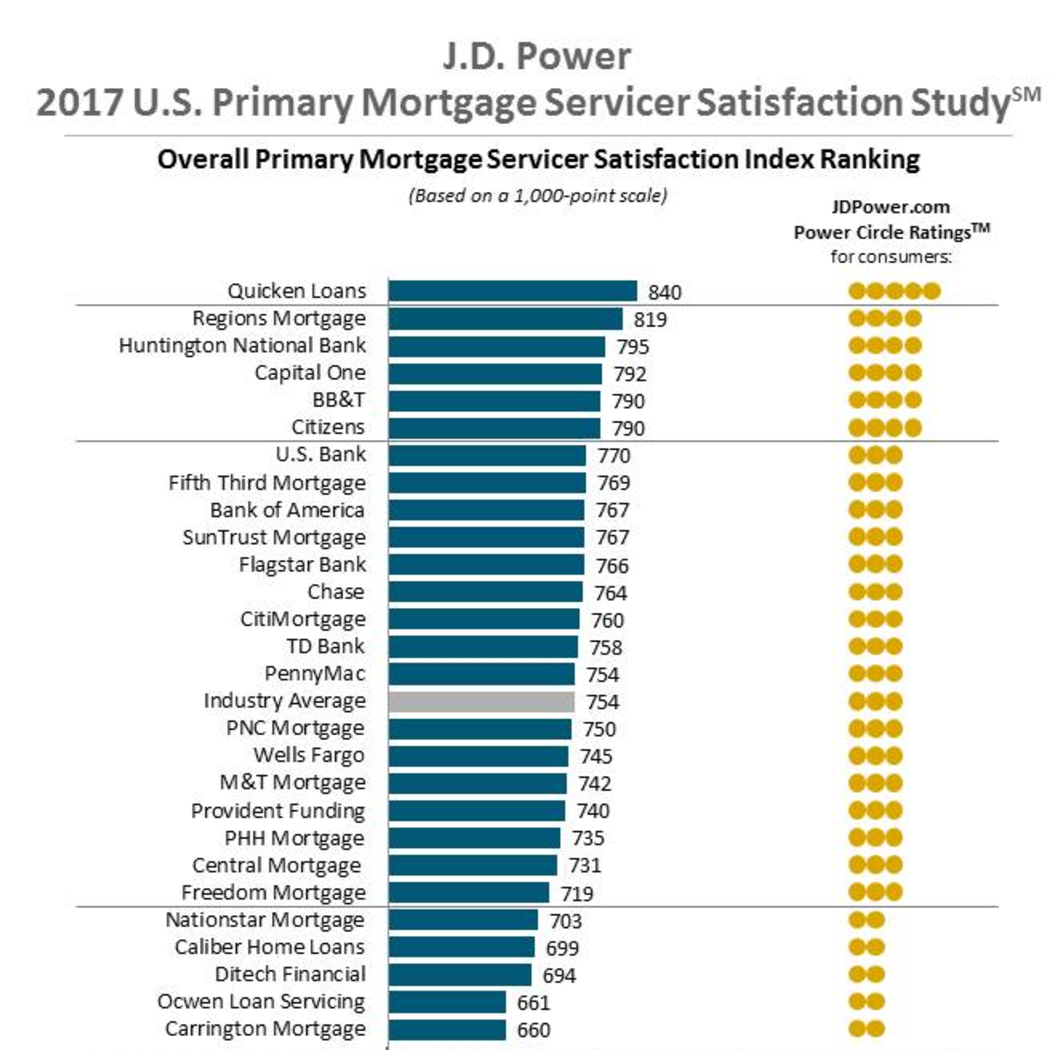

The study measured customer satisfaction with the mortgage servicing experience in six factors: new customer orientation, billing and payment process, escrow account administration, interaction; mortgage fees and communications. Satisfaction is calculated on a 1,000-point scale.

“The past few years have not been easy for mortgage servicers as they’ve struggled with regulatory and market pressures, but still managed to deliver on customer satisfaction,” said Craig Martin, J.D. Power senior director of mortgage practice. “Now, as that trend starts to shift and customer satisfaction levels off, it is critical that mortgage servicers continue to balance the demands of this tough marketplace with the needs of their customers.”

“Based on our research, mortgage servicers have three very clear areas of opportunity to help drive success: effective onboarding, high-functioning self-service tools and call center best practices that optimize customer contact in step with changing customer demographics and needs,” Martin said.

Quicken Loans once again took the top position, marking the fourth consecutive year, with a score of 840. Regions Mortgage followed with a score of 819 and Huntington National Bank came in third with 795.

But the top three most improved servicers are Bank of America with a score of 767, Nationstar Mortgage with a score of 703 and Ditech Financial with 694. These companies increased by 26, 29 and 37 points respectively.

The chart below shows where each company ranked on overall primary mortgage servicer satisfaction:

Click to Enlarge

(Source: J.D. Power)