Market trends such as rising interest rates and tight inventory triggered a rise in defect, fraud and misrepresentation risk in June for the seventh consecutive month, according to the Loan Application Defect Index from First American Financial Corp., a provider of title insurance, settlement services and risk solutions for real estate transactions.

The frequency of defects, fraudulence and misrepresentation in the information submitted in mortgage loan applications increased 1.2% from May to June. This is an increase of 16.7% from June last year.

Despite this increase, the risk level is still down 17.6% from its peak in October 2013.

“Following seven straight months of increases, the Loan Application Defect Index is now at the same level as almost two years ago in July 2015,” First American Chief Economist Mark Fleming said. “The market shift toward more purchase mortgages, coupled with rising rates and tight inventory, is generating the consistent upward trend in defect risk.”

“Purchase transactions are inherently more at risk of defects, fraud and misrepresentation, and the pressures resulting from one of the strongest sellers’ markets in recent memory compounds the risk of an error on a loan application,” Fleming said.

The index estimates the frequency of defects, fraudulence and misrepresentation in the information submitted in mortgage loan applications. The Defect Index reflects estimated mortgage loan defect rates over time, by geography and by loan type.

The Defect Index for refinance transactions increased 2.9% from the previous month and 16.7% from June last year. For purchase transactions, risk increased 1.1% month-over-month and 13.8% annually.

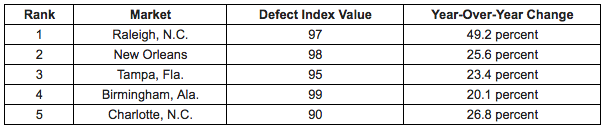

The chart below shows the top five metros with the highest risk index:

Click to Enlarge

(Source: First American)

“Raleigh, N.C., is currently the riskiest market in the country, with a high level that is growing quickly,” Fleming said. “In fact, all of the markets in this list are in the South.”

“Combining the levels of risk and rate of change rankings of loan application defect, fraud, and misrepresentation risk reveals that major markets in North Carolina and Florida are high risk and the risk in these markets continues to grow at a strong pace,” he said.