Despite recording a net loss for the second quarter, private mortgage insurer Radian Group managed to report a strong quarter for new mortgage insurance written.

Headquartered in Philadelphia, Radian provides private mortgage insurance, risk management products and real estate services to financial institutions through two business segments: mortgage insurance and mortgage real estate services.

According to the company’s financial results, new mortgage insurance written surged to $14.3 billion for the quarter, an increase of 43% compared to $10.1 billion in the first quarter of 2017 and an increase of 11% compared to $12.9 billion in the prior-year quarter.

And total primary mortgage insurance in force as of June 30, 2017, grew to $191.6 billion, an increase of 3% compared to $185.9 billion as of March 31, 2017, and an increase of 8% compared to $177.7 billion as of June 30, 2016.

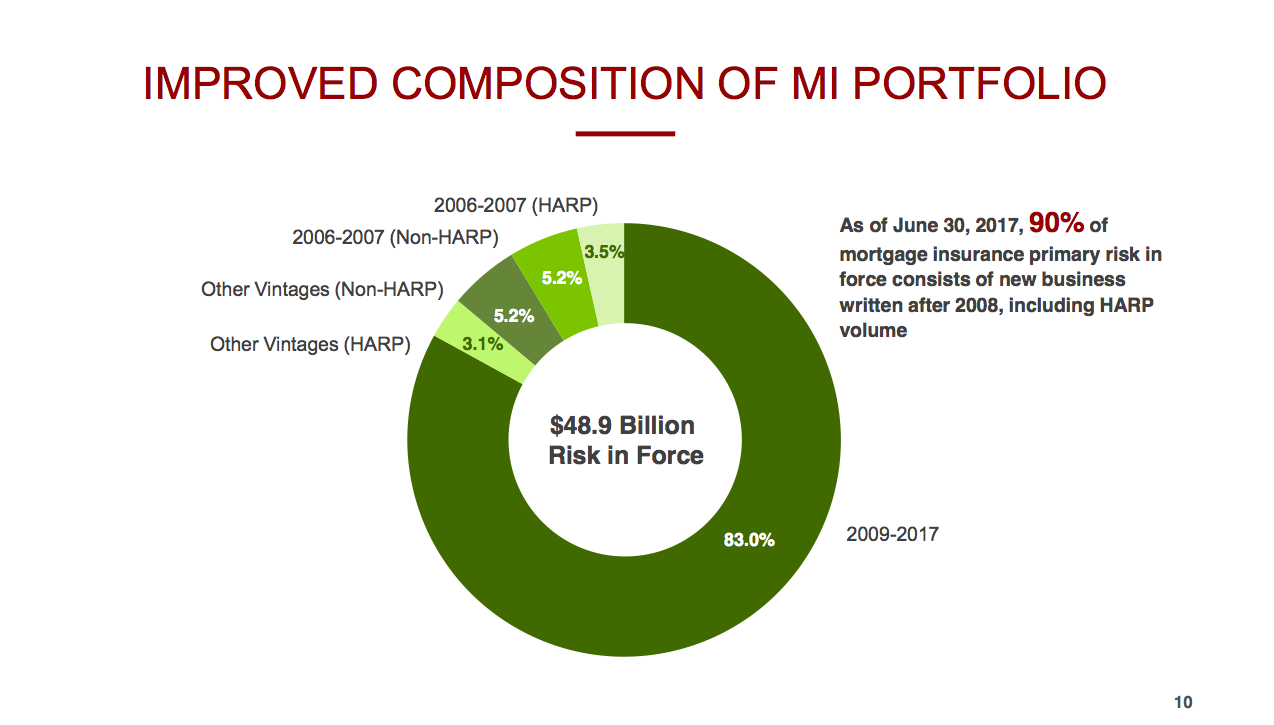

The growth represents an improvement in the composition of Radian’s mortgage insurance portfolio continues, with 90% consisting of new business written after 2008, including those loans that successfully completed the Home Affordable Refinance Program (HARP).

See the chart below for a break down of Radian’s mortgage insurance portfolio.

Click to enlarge

(Source: Radian)

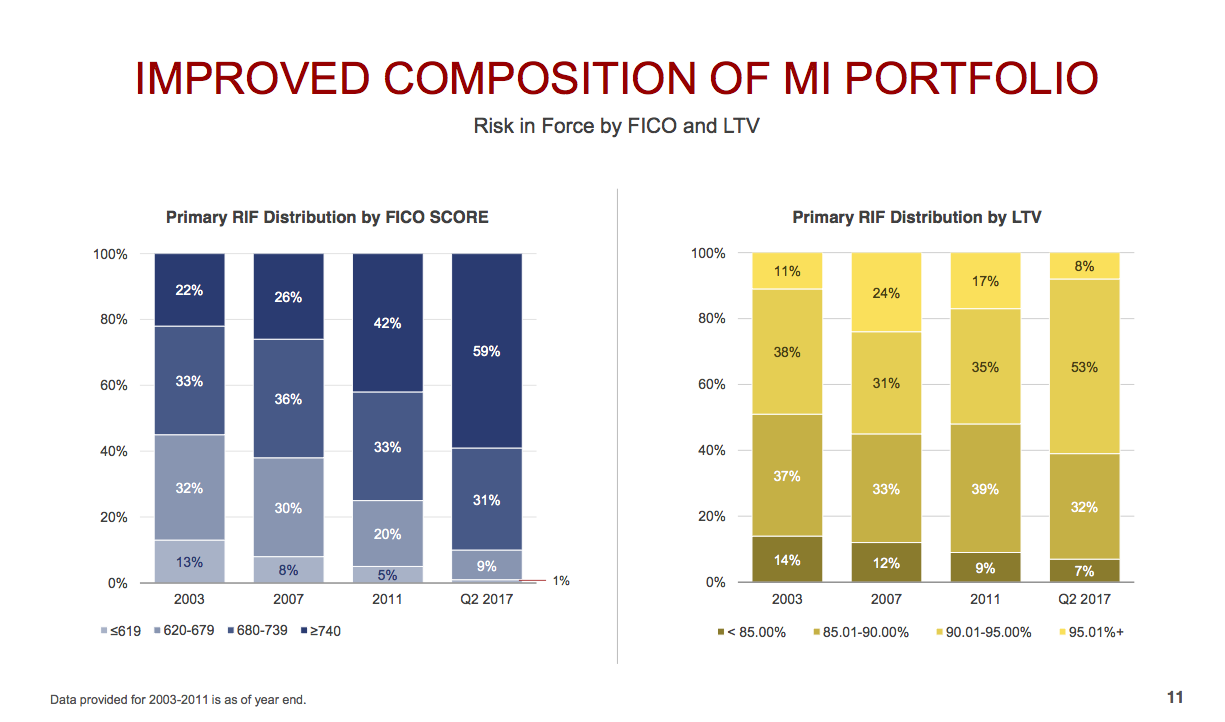

This second chart shows the improved composition of Radian’s mortgage insurance portfolio.

Click to enlarge

(Source: Radian)

Overall, the company reported a net loss for the quarter ended June 30, 2017, of $27.3 million, or $0.13 per diluted share. This compares to net income for the quarter ended June 30, 2016, of $98.1 million, or $0.44 per diluted share.

Radian attributed the net loss in the second quarter of 2017 to after-tax, non-cash impairment charges of $130.9 million associated with an impairment of goodwill and other intangible assets related to its Services segment.

After a strategic review of the Services business lines to date, Radian decided to restructure this business and expects to incur charges relating to the changes necessary to reposition this business for sustained profitability.

The restructuring plans are not final, so the company cannot provide an estimate of its total expected restructuring charges at this time

But, the company currently expects that charges would not exceed $25 million on a pretax basis and, depending on the finalization and implementation of its restructuring plans, such charges could be materially less.

Radian will provide an update during the third quarter, upon completion of its strategic review.

Radian’s CEO Rick Thornberry commented on the news, saying, “I am pleased to report on our strong operating performance in the second quarter, including a 26% increase in adjusted diluted net operating income per share, 8% growth in our mortgage insurance in force and a 12% increase in tangible book value per share.”

“I continue to be excited about the opportunities ahead for Radian. We have a unique opportunity to leverage our market-leading Mortgage Insurance franchise combined with our core capabilities across the Services segment to deliver high-value and relevant products and services,” said Thornberry. “Successfully capturing these opportunities will enable us to further deepen customer relationships, grow sustainable revenues and profitability and increase stockholder value.”

Other financial highlights include:

- Total net premiums earned were $229.1 million for the quarter ended June 30, 2017, compared to $221.8 million for the quarter ended March 31, 2017, and $229.1 million for the quarter ended June 30, 2016.

- The mortgage insurance provision for losses was $17.7 million in the second quarter of 2017, compared to $47.2 million in the first quarter of 2017, and $50.1 million in the prior-year period.

- Total mortgage insurance claims paid were $91.3 million in the second quarter, compared to $82.1 million in the first quarter of 2017, and $90.7 million in the second quarter of 2016.