#div-oas-ad-article1, #div-oas-ad-article2, #div-oas-ad-article3 {display: none;}

MORTGAGE TECH PRODUCT SHOWCASE

Tavant Technologies has been in the lending industry for more than 17 years working with lenders and financial institutions of all shapes and sizes. That experience gives the company keen insight into the mortgage process and informs their view that a true digital transaction is much more than simply providing brilliant-looking portals or mobile applications.

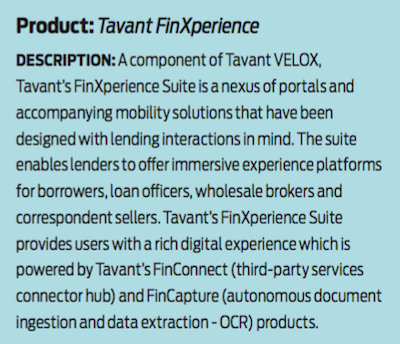

With Tavant’s FinXperience Suite, lenders have the ability to not only keep all their customers and partners engaged in an immersive experience with real time statuses and process updates, but most importantly, to provide them with the ability to drive the lending transaction in a seamless manner.

With Tavant’s FinXperience Suite, lenders have the ability to not only keep all their customers and partners engaged in an immersive experience with real time statuses and process updates, but most importantly, to provide them with the ability to drive the lending transaction in a seamless manner.

“We recognize that the industry is moving away from custom-built monolithic software and is embracing the ‘as a utility’ model more than ever before,” said Mohammad Rashid, head of consumer lending practice for Tavant. “We have since the inception of the product suite seen a tremendous response and acceptance in the lending community which is a testimony to our thought leadership and a validation of our decision to convert our learnings from over the years into products.”

With the Tavant FinXperience Suite, lenders have a singled unified experience platform that they can roll out to their customers, loan officers as well TPO partners. Their investment into a single platform yields returns across a smooth brand experience for their customers and partners.

“The single, unified platform offers them faster time to market with game-changing ideas as well as costing them half of what they would spend on getting three to four different platforms to accomplish the same business objectives,” Hassan Rashid, CRO of Tavant said.

Tavant FinXperience Suite stands out from similar products in the marketplace because it not only provides an exceptional front-end experience layer, but also creates a true digital transaction. By bringing data from all related third-party and transactional sources (using FinConnect) and extracting data from documents involved in the transactions (using FinCapture), FinXperience has proved to be a real differentiator in the industry.

One of Tavant’s core values is to build products that enhance efficiency and productivity, improve loan production quality and reduce process excesses. FinXperience exemplifies this value, incorporating ease of use, AI and machine learning and seamless integration with a lender’s current ecosystem. It’s all part of Tavant’s bigger mission to create products that are ubiquitous in the segments it caters to.

“Our teams and individuals constantly look for ideas, then innovate, build and present them during Tavant TechConnect — an annual innovation showcase event,” Vibhor Mishra, head of marketing for Tavantsaid. “Then we employ world-class engagement and support models to make it easy for our customers to adopt and leverage our products.”