Home prices increased once again in July, making more than one-third of the top 100 U.S. cities overvalued, according to the latest Home Price Index from CoreLogic, property information, analytics and data-enabled solutions provider.

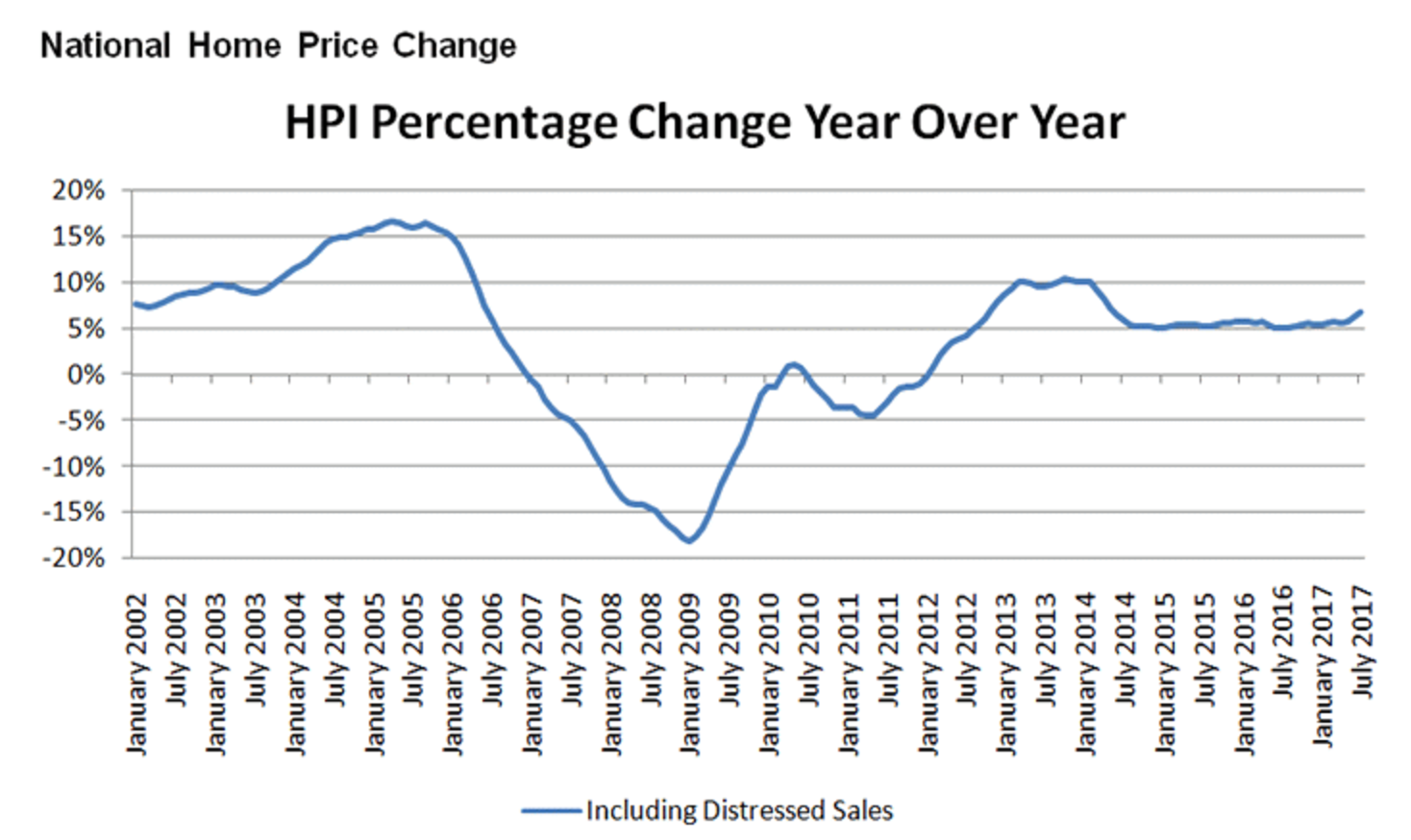

Home prices increased 6.7% in July annually from July 2016 and 0.9% monthly from June, CoreLogic’s HPI showed.

Click to Enlarge

(Source: CoreLogic)

CoreLogic also predicted home prices will increase 5% by July 2018 and 0.4% in August, according to the HPI Forecast. The CoreLogic HPI Forecast is a projection of home prices using the CoreLogic HPI and other economic variables. Values are derived from state-level forecasts by weighting indices according to the number of owner-occupied households for each state.

“In July, home price growth in the Pacific Northwest and mountain states led the nation with the highest appreciation rates,” CoreLogic Chief Economist Frank Nothaft said. “The sharp increase in prices in Washington and Utah has been especially striking, with home price growth in both states accelerating by 3% points since the beginning of this year.”

CoreLogic found out of the country’s top 100 metropolitan areas, 34% became overvalued in July, according to its Market Conditions Indicators data. The MCI showed 28% of the top markets were undervalued and 38% were at value.

The MCI analysis categorizes home prices in individual markets as undervalued, at value or overvalued by comparing home prices to their long-run, sustainable levels, which are supported by local market fundamentals, such as disposable income.

“Home prices in July continued to rise at a solid pace with no signs of slowing down,” CoreLogic President and CEO Frank Martell said. “The combination of steadily rising purchase demand along with very tight inventory of unsold homes should keep upward pressure on home prices for the remainder of this year.”

“While mortgage interest rates remain low, affordability cracks are emerging as over a third of U.S. top cities are now overvalued,” Martell said.