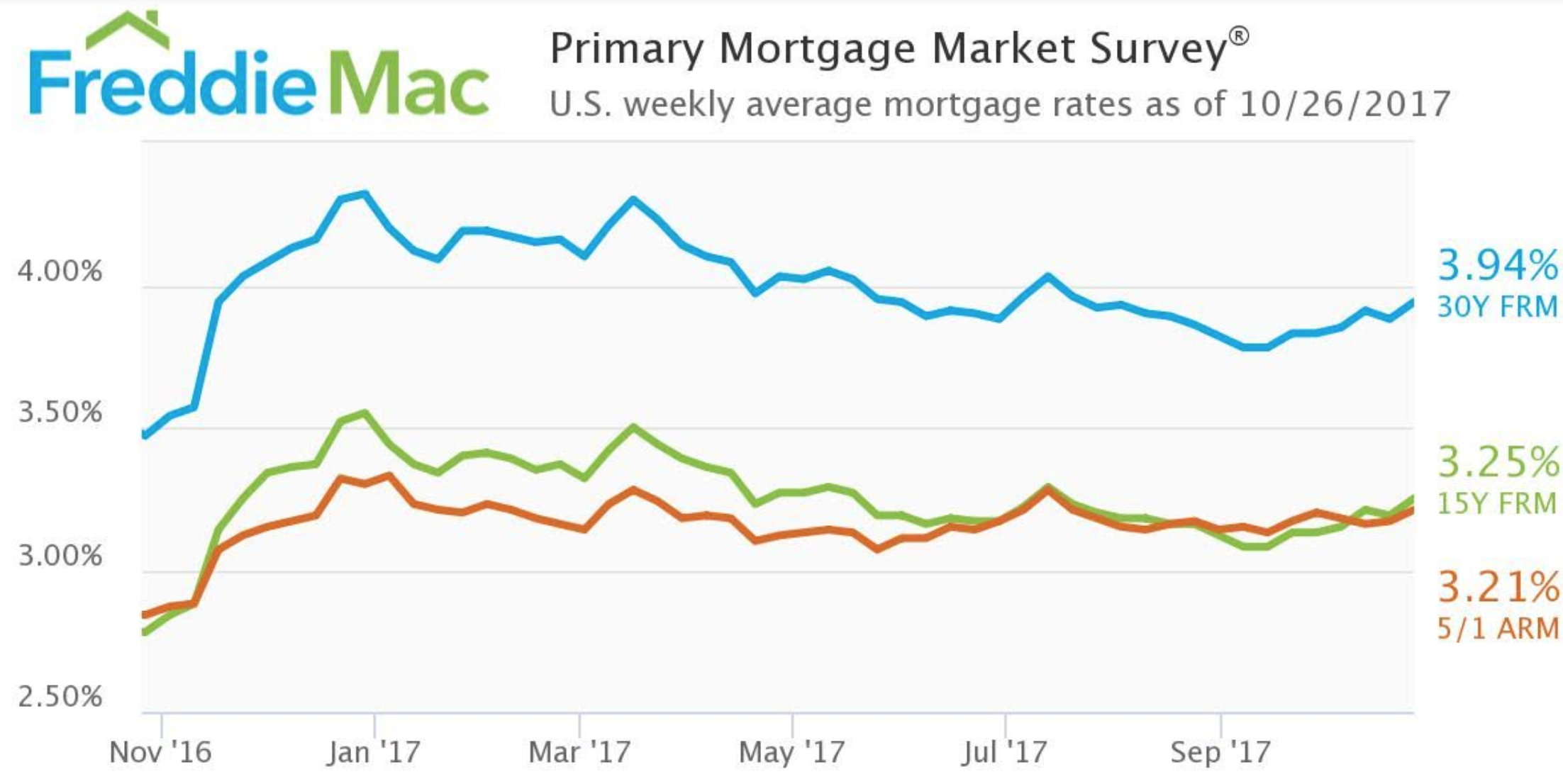

The 30-year fixed-rate mortgage increased to its highest point in the past three months, nearly hitting the 4% mark, according to Freddie Mac’s latest Primary Mortgage Market Survey.

“The 10-year Treasury yield surged this week, jumping 12 basis points,” Freddie Mac Chief Economist Sean Becketti said. Mortgage rates typically, but not always, follow the behavior of the 10-year, but with a week or so lag time.

Click to Enlarge

(Source: Freddie Mac)

The 30-year fixed rate mortgage increased to 3.94% for the week ending October 26, 2017. This is up from 3.88% last week and 3.47% last year.

The 15-year FRM also increased, hitting 3.25%. This is up from 3.19% last week and 2.78% last year.

The five-year Treasury-indexed hybrid adjustable-rate mortgage came in at 3.21%, up from 3.17% last week and 2.84% last year.

“The 30-year mortgage rate followed suit, increasing six basis points to 3.94%,” Becketti said. “Today’s survey rate is the highest rate in three months.”