Freddie Mac posted strong third-quarter earnings early Tuesday morning, nearly tripling its net income in the second quarter.

The executives at the government-sponsored enterprise waved the flag of success, pointing to the banner earnings.

“This reflects the growing strength of our business model as well as an improving quality of execution,” said Freddie Mac CEO Donald Layton. “And we’re doing this while increasingly protecting taxpayers through credit risk transfer, transacting greater volumes with more offerings than ever before – we recently reached a milestone of $1 trillion of mortgages with significant credit risk transferred.”

According to the results, Freddie Mac’s net income surged to $4.7 billion for the third quarter of 2017, up from $1.7 billion for the second quarter of 2017.

The company reported comprehensive income of $4.7 billion for the third quarter of 2017, compared to comprehensive income of $2 billion for the second quarter of 2017.

Freddie Mac attributed the growth to a $2.9 billion (after-tax) benefit from a non-agency mortgage-related securities litigation settlement and "continued strong underlying business fundamentals."

The settlement dates back to July and deals with a multibillion-dollar lawsuit between the Royal Bank of Scotland Group and the Federal Housing Finance Agency, as conservator of Fannie Mae and Freddie Mac.

At the time, the FHFA announced a $5.5 billion settlement to resolves all claims in the lawsuit FHFA v. The Royal Bank of Scotland Group plc et al., in the United States District Court for the District of Connecticut.

Of the $5.5 billion settlement, Royal Bank of Scotland paid approximately $4.525 billion to Freddie Mac and approximately $975 million to Fannie Mae.

By breaking down Freddie Mac's earnings, these underlying business fundamentals include growing its guarantee business. Freddie's total guarantee portfolio grew 5% from last year, increasing to $1.98 billion.

Additionally, the government-sponsored enterprise provided approximately $299 billion in liquidity to the mortgage market during the first nine months of 2017. This includes funding nearly 1.1 million single-family homes and 530,000 multifamily rental units.

And while the mortgage-related securities litigation settlement contributed to the quarter's growth, profit would still be high without it. Excluding the settlement, comprehensive income would have been approximately $1.8 billion.

“We clearly had a strong quarter – even excluding the large legal settlement, Freddie Mac made a profit of $1.8 billion,” said Freddie Mac CEO Donald Layton.

Based on Freddie Mac's net worth amount of $5.3 billion as of Sept. 30, 2017 and the Capital Reserve Amount of $600 million in 2017, the company's dividend requirement to Treasury in December 2017 will be $4.7 billion.

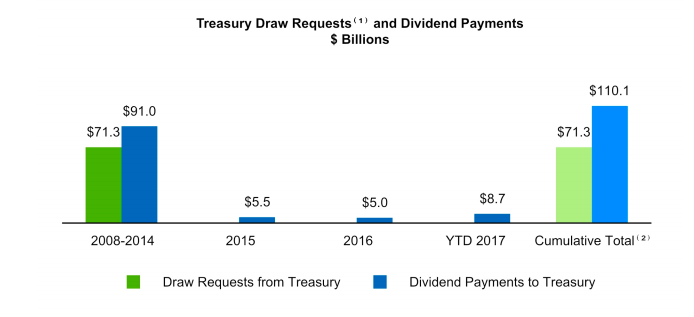

This chart below shows Freddie’s Treasury draw and dividend payments since it went into conservatorship in 2008.

Click to enlarge

(Source: Freddie Mac)

As seen in the chart above, through Sept. 30, aggregate cash dividends paid to Treasury totaled $110.1 billion, excluding the scheduled December 2017 dividend obligation of $4.7 billion. This means that Freddie Mac has returned more than $110 billion to taxpayers.

In addition, while the applicable capital reserve amount is $600 million for 2017, it will be zero beginning on Jan. 1, 2018, as required by the government starting next year.

Freddie cautioned that the declining capital reserve amount required under the terms of the Purchase Agreement increases the risk of it having a negative net worth. And as a result, it would have to draw from Treasury.

Layton concluded, “This performance is evidence of good progress toward our goal to be one of the best-run financial institutions in the country, while successfully delivering on our public policy mission. We call this our transformation to ‘A Better Freddie Mac.’”

“We’re better at managing our risks, better at disposing of legacy assets, and getting better all the time at serving our customers – helping them meet the nation’s critical need for housing, especially for lower-income families and first-time homebuyers,” he said. “We’re proud of this transformation, and we’re committed to getting even better.”