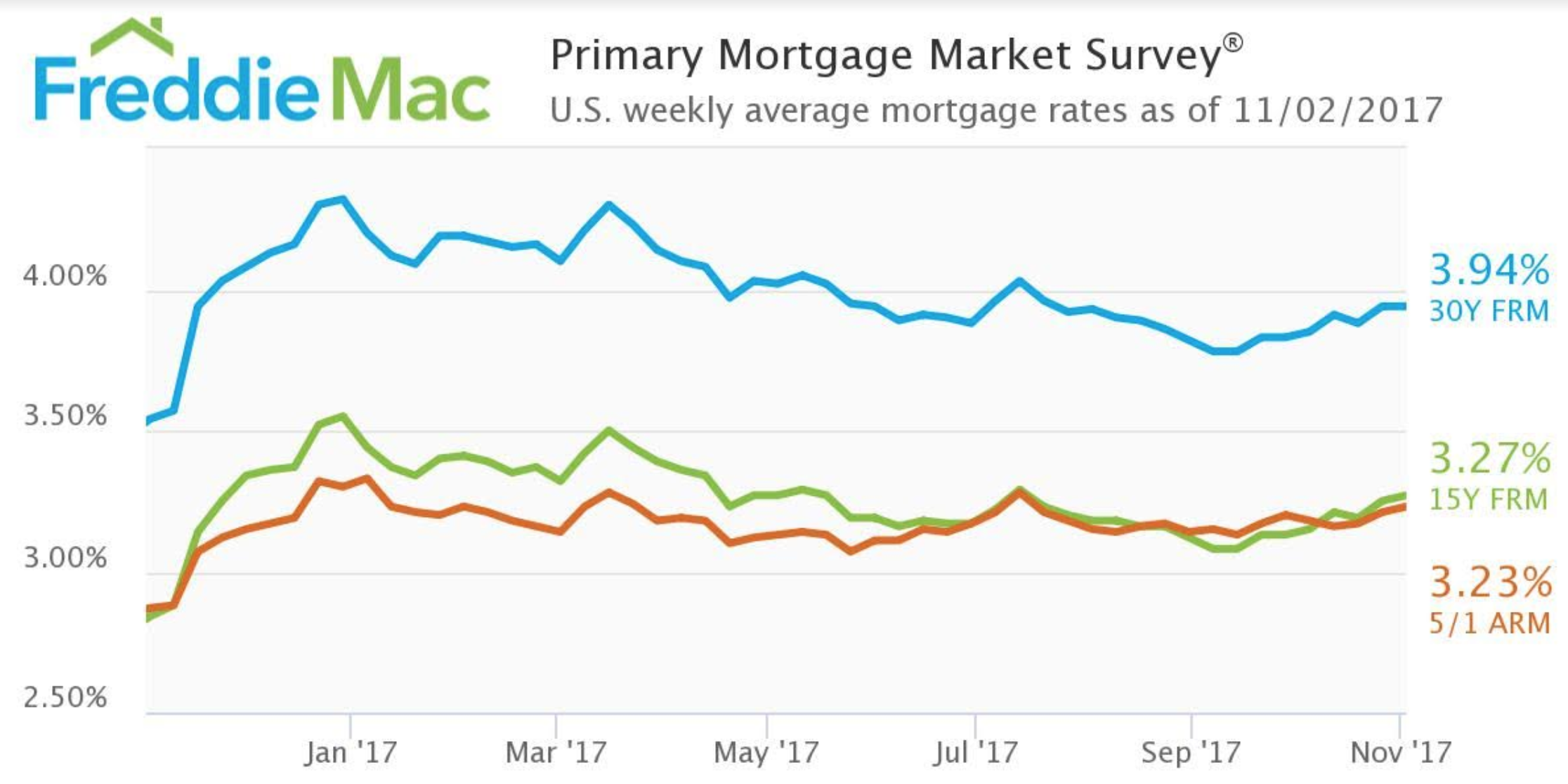

After surging to the highest rate in months last week, mortgage rates held steady, according to Freddie Mac’s Primary Mortgage Market Survey.

“Following a strong surge last week, rates held relatively flat this week,” Freddie Mac Chief Economist Sean Becketti said. “The 30-year mortgage rate remained unchanged at 3.94%, while the 10-year Treasury yield dipped roughly four basis points.”

Click to Enlarge

(Source: Freddie Mac)

The 30-year fixed-rate mortgage held steady at 3.94% for the week ending November 2, 2017. This is the same level as last week, but up from 3.54% last year.

The 15-year FRM increased slightly to 3.27%, up from 3.25% last week and from 2.84% last year.

The five-year Treasury-indexed hybrid adjustable-rate mortgage also increased slightly, moving to 3.23%. This is up from 3.21% last week and 2.87% last year.

Becketti explained interest rates in the coming week will depend on how the market reacts to President Donald Trump’s pick for the next Federal Reserve chair.

“The markets’ reaction to the upcoming announcement of the next Fed chair may impact the movement of rates in next week’s survey,” he said.

Wednesday evening, the White House reportedly notified Federal Reserve Governor Jerome Powell that Trump intends to nominate him as the next Federal Reserve chair Thursday morning.