The Republican tax plan is in, and an investigation reveals one place stands to lose far more than any other under the new plan.

To recap – the Tax Cuts and Jobs Act will slash the mortgage interest deduction in half from $1 million to $500,000, double the standard deduction and reducing the capital gains exemption, allowing homeowners to deduct profits from a home sale only once every five years, instead of two. Read a full analysis of the new plan here.

The GSEs Fannie Mae and Freddie Mac also say it could trigger yet another bailout for them, so there’s that. But the lower corporate tax rate could also allow them to quickly pay back the draw – read all about that here.

But the mortgage interest deduction debate has been going on for a while. A quick search on HousingWire shows articles debating the mortgage interest rate going back seven years.

Before the Republicans announced their intent to slash the mortgage interest rate deduction, the National Association of Realtors argued that even an increase in the standard deduction could be detrimental to the MID as it would make it irrelevant for all but the wealthiest Americans.

However, in one state, the effects of the cut could be much more far-reaching.

You guessed it – California.

Using the IRS statements of income data from 2015 and filed in 2016 compiled LendingTree, these are the top metro areas where homeowners utilize the mortgage interest deduction, all of which are located in California:

1. San Francisco – with 24% of tax filers claiming mortgage deduction of an average $16,167

2. Samford-Norwalk – with 32% of tax filers claiming mortgage deduction of an average $15,237

3. San Jose – with 28% of tax filers claiming mortgage deduction of an average $14,815

4. Orange County – with 27% of tax filers claiming mortgage deduction of an average $13,938

5. Santa Cruz-Watsonville – with 27% of tax filers claiming mortgage deduction of an average $13,496

6. Oakland – with 30% of tax filers claiming mortgage deduction of an average $13,406

7. Ventura – with 29% of tax filers claiming mortgage deduction of an average $13,257

At this point, another state comes into the picture, taking the eighth spot with Honolulu, Hawaii, with 22% of tax filers claiming an average $13,092 in mortgage deduction. However, the list then continues on with more metros from California.

9. Santa Barba-Santa Maria-Lompoc – with 22% of tax filers claiming mortgage deduction of an average $13,053

10. Los Angeles-Long Beach – with 21% of tax filers claiming mortgage deduction of an average $12,904

11. San Diego – with 26% of tax filers claiming mortgage deduction of an average $12,727

12. Salinas – with 20% of tax filers claiming mortgage deduction of an average $12,279

13. Santa Rosa – with 28% of tax filers claiming mortgage deduction of an average $12,067

14. San Luis Obispo-Atascadero-Paso Robles – with 28% of tax filers claiming mortgage deduction of an average $11,825

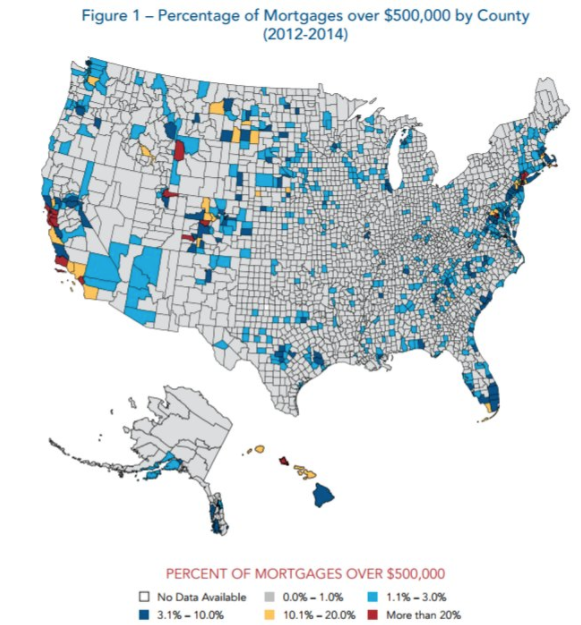

Needless to say, Californians could see a hard hit if the new tax bill passes. Experts point out that only about 5% of U.S. mortgages are more than $500,000, but the map below, produced by the National Low Income Housing Coalition, shows the majority of these homes are either in California or in the Northeast.

Click to Enlarge

(Source: NLIHC)

“The plan targets to cap the deduction for new buyers to homes under $500,000, while current owners are grandfathered in up to $1 million,” LendingTree Chief Economist Tendayi Kapfidze said. “This creates an incentive to current owners to remain in their property as moving to a new home would expose them to a higher tax bill. Thus, the supply of existing homes between $500K to $1 million could be pressured.”