Before buying a home, most borrowers look to save up for a down payment and build up their credit, however, in some areas, buying may actually require a lower FICO than when trying to rent.

Nationwide, the average credit score needed to rent an apartment was 650, while those with a score of 538 and below were typically rejected, according to a recent study by RENTCafé based on tenant screening data from RentGrow, a resident screening service.

Of course, that differed depending on the class of apartment a tenant was looking to move in to. The chart below shows the breakdown for high-, mid- and low-end apartments.

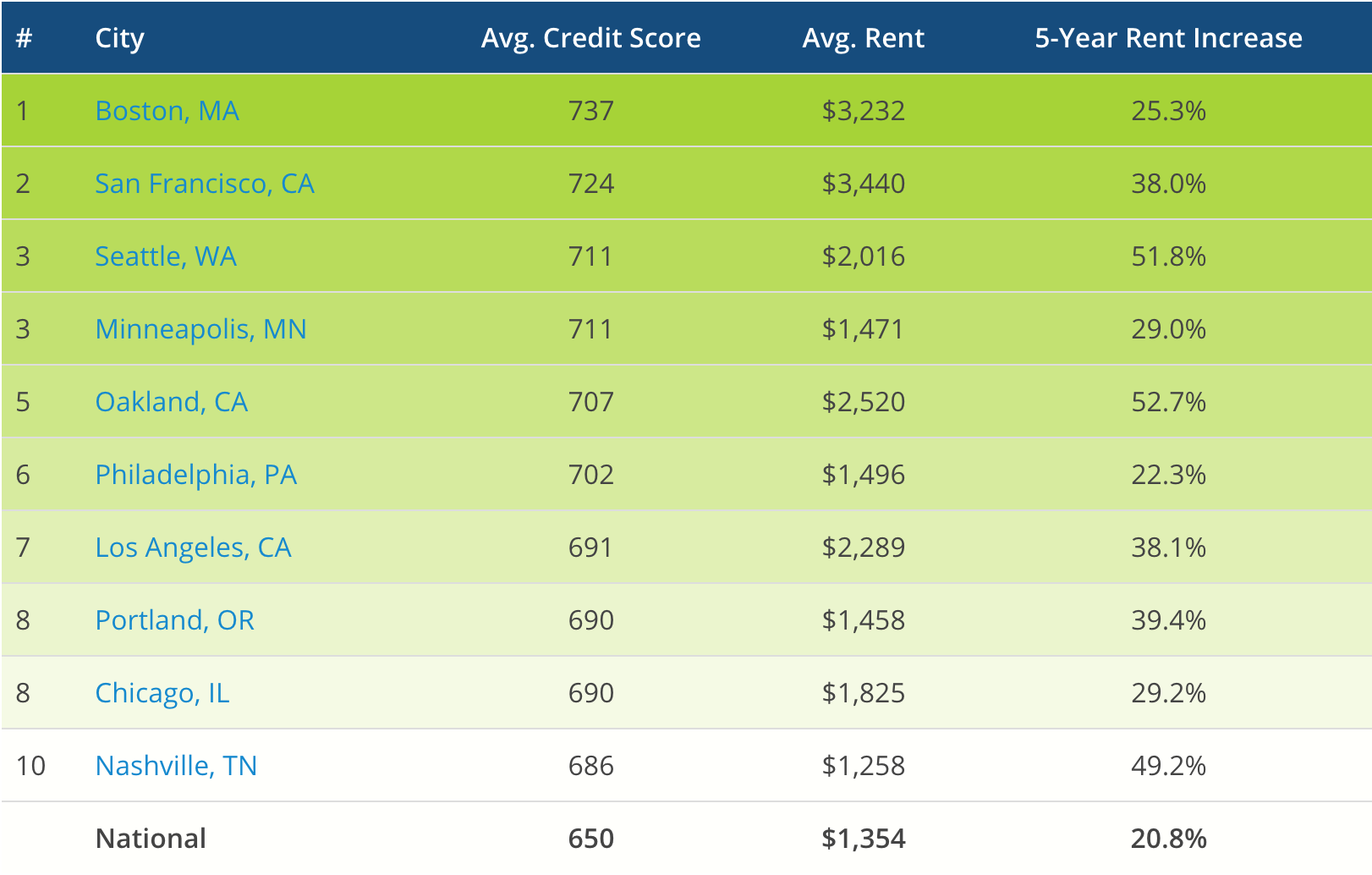

What’s more, the rent prices for each of these cities is also incredibly high at $3,440 in San Francisco, $3,232 in Boston and $2,016 in Seattle. The chart below shows the top 10 cities with the highest average approved credit scores for renting in 2017.

Click to Enlarge

(Source: RENTCafé)

In Boston, for example, the average rejected credit score came in at 667 for apartments in 2017. However, for a mortgage loan from the Federal Housing Administration a borrower must have a FICO score of 580 to qualify for the 3.5% down-payment program.

As of October 2017, Zillow’s Home Value Index shows the median home value in Boston is $561,000. In order to pay the same amount for rent as one would pay for a home in Boston, borrowers who put 3.5% down could afford a home priced at $500,000, slightly lower than the area’s median home price if they secured an interest rate of 5%.

Not only could buying a home cost less each month for homeowners, but with the area’s rising FICO score requirements, it is also easier to get accepted.

Once again the numbers show – buying a home trumps renting.