Mortgage interest rates now sit at the highest level in more than a year, thanks to five straight weeks of increases.

The latest data from Freddie Mac’s Primary Mortgage Market Survey shows that the 30-year fixed mortgage rate just hit its highest mark since December 2016.

According to Freddie Mac’s report, the 30-year fixed-rate mortgage averaged 4.32% for the week ending Feb. 8, 2018. That’s an increase of 10 basis points from last week, when it averaged 4.22%.

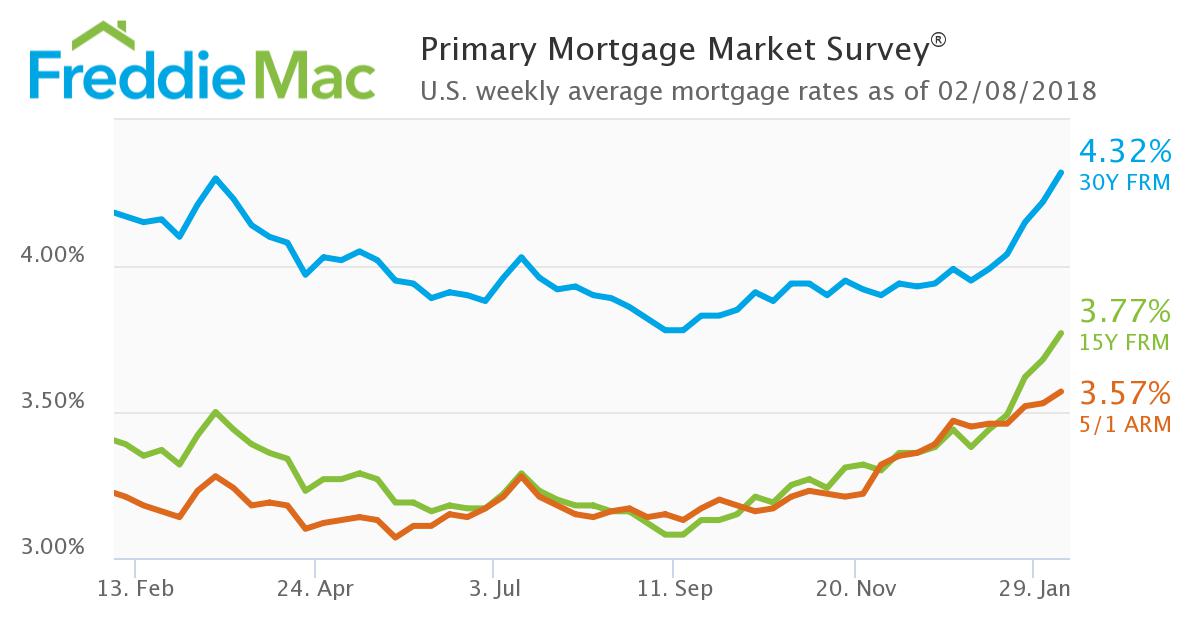

In fact, the 30-year FRM has increased in every week in 2018 so far, as seen in the chart below.

(Click to enlarge. Image courtesy of Freddie Mac)

One year ago at this time, the 30-year FRM averaged 4.17%.

According to Len Kiefer, Freddie Mac’s deputy chief economist, the cause for this week’s sharp increase was Monday’s market madness.

“The U.S. weekly average 30-year fixed mortgage rate rocketed up 10 basis points to 4.32% this week. Following a turbulent Monday, financial markets settled down with the 10-year Treasury yield resuming its upward march,” Kiefer noted.

“Mortgage rates have followed. The 30-year fixed mortgage rate is up 33 basis points since the start of the year,” Kiefer added.

“Will higher rates break housing market momentum? It's too early to tell for sure, but initial readings indicate housing markets are sustaining their momentum so far,” Kiefer concluded. “The MBA reported that purchase applications are up 8% from a year ago in their latest Weekly Mortgage Applications Survey.”

Freddie Mac’s report also showed that the 15-year fixed-rate mortgage and 5-year Treasury-indexed hybrid adjustable-rate mortgage both increased as well.

According to Freddie Mac’s report, the 15-year FRM averaged 3.77% this week, up from last week when it averaged 3.68%. A year ago at this time, the 15-year FRM averaged 3.39%.

The report also showed that the 5-year Treasury-indexed hybrid ARM averaged 3.57% this week, up from last week when it averaged 3.53%. Last year at this time, the 5-year ARM averaged 3.21%.