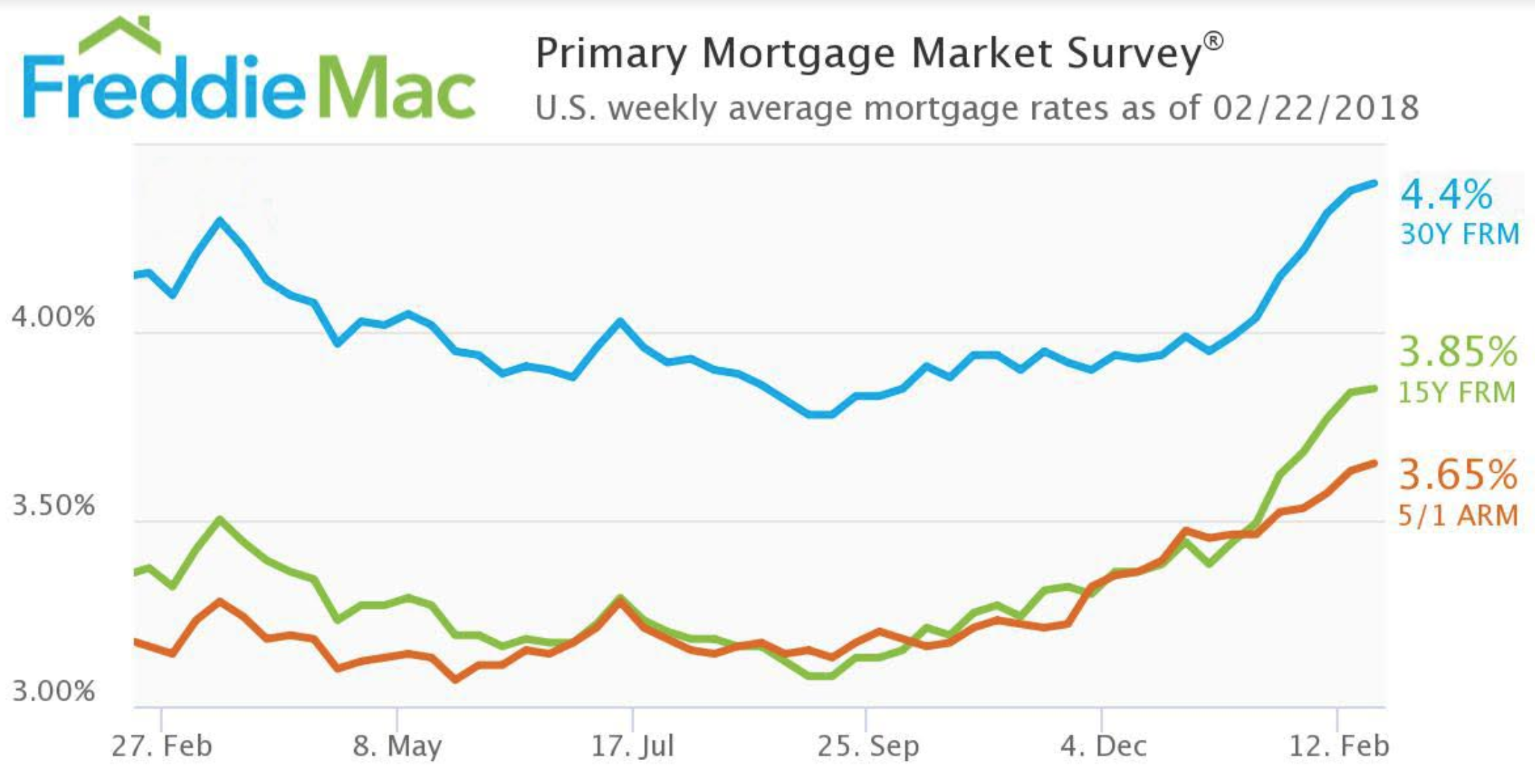

Mortgage rates increased once again for the seventh consecutive week, and the 30-year rate even hit its highest point since April 2014, according to Freddie Mac’s Primary Mortgage Market Survey.

“Fixed mortgage rates increased for the seventh consecutive week, with the 30-year fixed mortgage rate reaching 4.4% in this week’s survey; the highest since April of 2014,” said Len Kiefer, Freddie Mac deputy chief economist. “Mortgage rates have followed U.S. Treasury’s higher in anticipation of higher rates of inflation and further monetary tightening by the Federal Reserve.”

Click to Enlarge

(Source: Freddie Mac)

The 30-year fixed-rate mortgage increased to 4.4% for the week ending February 22, 2018. This is up from 4.38% last week and from 4.16% this time last year.

The 15-year FRM also increased, rising one basis point to 3.85%, up from 3.84% last week and from 3.37% last year.

The five-year Treasury-indexed hybrid adjustable-rate mortgage increased from last week’s 3.63% and last year’s 3.16% to 3.65% this week.

“Following the close of our survey, the release of the FOMC minutes for February 21, 2018 sent the 10-year Treasury above 2.9%,” Kiefer said. “If those increases stick, we will likely see mortgage rates continue to trend higher.”