Freddie Mac announced it sold $22.4 million in deeply non-performing loans serviced by New Penn Financial to VRMTG ACQ, a minority, woman-owned business.

The GSE sold 113 loans via auction to the company as part of its Extended Timeline Pool Offering. The transaction is expected to settle in May 2018.

Freddie Mac began marketing its transaction on February 15, 2018 to potential bidders, including minority- and women-owned businesses, nonprofits, neighborhood advocacy funds and private investors active in the NPL market.

This is the second pool of loans VRMTG ACQ has bought from the GSEs this week. On Tuesday, the company won a bid on $34 million in non-performing loans from Fannie Mae.

The company was founded by Vivien Huang, who, according to the company’s website, served a managing director at Goldman Sachs and JPMorgan Chase. Huang also worked at Lehman Brothers, Credit Suisse and Freddie Mac.

According to the firm’s website, the company “seeks to generate long-term returns in securitized products, distressed credit and whole loans.” The firm’s current investment focus is “distressed U.S. residential non-performing loans.”

The loans in the pool have been delinquent for an average of more than two years, and are therefore more likely to have been evaluated for or are in various stages of loss mitigation. This could include modification or other alternatives to foreclosures, or are in foreclosure.

Mortgages that were previously modified and subsequently became delinquent comprise approximately 65% of the pool balance. The pool is geographically diverse and has a loan-to-value ratio of approximately 113%, based on broker price opinion.

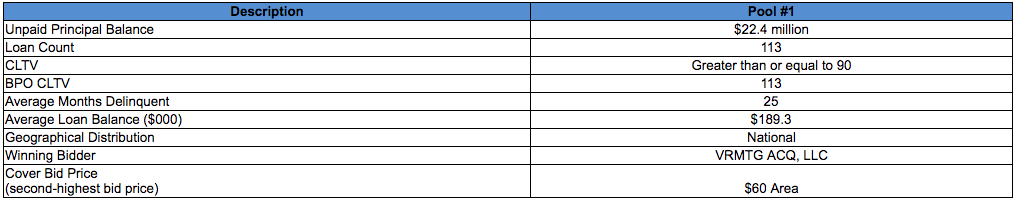

The chart below shows the details of the pool, and its winning bidder.

Click to Enlarge

(Source: Freddie Mac)

Advisors to Freddie Mac on the transaction are JPMorgan Chase and The Williams Capital Group, a minority-owned business.