Everybody’s doing it, and now Bank of America is doing it too.

Bank of America revealed Wednesday that it is launching a digital mortgage platform, which allows customers to complete the mortgage application process either via their mobile device or on Bank of America’s website.

The revolution towards fully digitizing the mortgage application process really kicked off over two years ago when Quicken Loans rolled out its “Rocket Mortgage” in November 2015.

Since then, megabanks like Wells Fargo, JPMorgan Chase, and CitiMortgage, along with nonbank lenders like Caliber Home Loans, United Wholesale Mortgage, and Guild Mortgage, unveiled their own version of the digital mortgage.

And while JPMorgan Chase and Wells Fargo’s digital mortgage platforms are still in development and due to roll out later this year, Bank of America’s digital mortgage platform, which it calls the “Digital Mortgage Experience, is available now.

According to the bank, the application has “advanced” prefill capabilities, which allows for many aspects of their mortgage application, like their contact information and banking and investment data from their Bank of America accounts, to be auto-populated.

The bank claims that this can “significantly” reduce the time and effort involved with applying for a mortgage, and said that borrowers using the digital mortgage platform can receive a conditional approval the same day they apply.

“Everything we do starts and ends with clients, and the Digital Mortgage Experience is designed to make their lives simpler,” D. Steve Boland, head of consumer lending at Bank of America, said. “Our new end-to-end experience empowers clients with complete convenience and control, while also offering unique access to lending experts every step of the way.”

Customers using the bank’s digital mortgage platform can also easily access one of the bank’s “lending specialists” to help them in the application process. The bank claims that its digital mortgage platform is “one of the only solutions in the industry with this feature.”

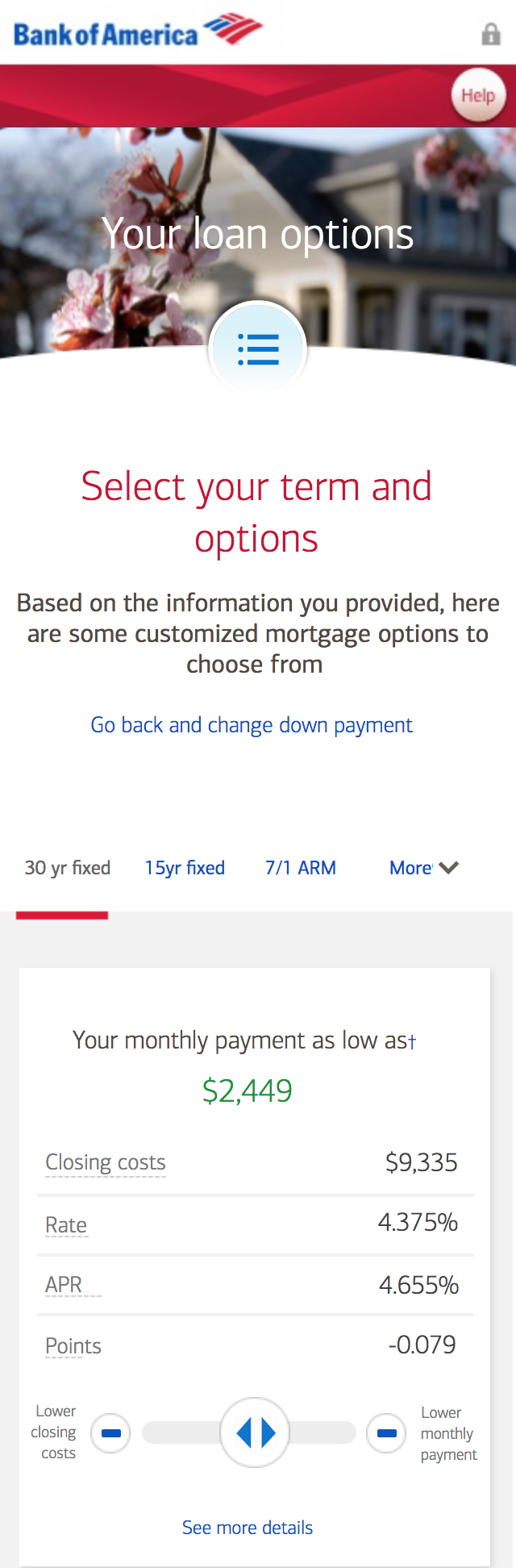

Customers using the “Digital Mortgage Experience” also can customize their loan options, including choosing flexible monthly payments, closing costs and loan terms, as seen in the image to the right (Click to enlarge. Image courtesy of Bank of America).

Users can also choose to lock in their interest rate or choose to lock it later.

Bank of America’s digital mortgage platform also integrates “seamlessly” with the bank’s “Home Loan Navigator” to track their loan, view action items, upload documents, and review and acknowledge disclosures, all from their mobile device.

“The new Digital Mortgage Experience is about making things easy, intuitive, simple and fast,” said Michelle Moore, head of digital banking at Bank of America. “It’s the latest example of our high-tech, high-touch approach to serving clients – we designed the Digital Mortgage Experience by listening to our customers, understanding their needs, and delivering the full experience to them right in our award-winning mobile app.”

And the bank boasts quite a few digital customers. The bank said that its digital banking platform serves nearly 35 million digital clients, including more than 24 million active mobile users.

According to the bank, last year, mobile banking clients logged into their accounts 4.6 billion times, or approximately 190 times per user, and deposited 123 million checks via mobile.

And now, they can get their mortgage from their phone, too.

To get a look at Bank of America’s digital mortgage platform, click here to watch a video provided by the bank.