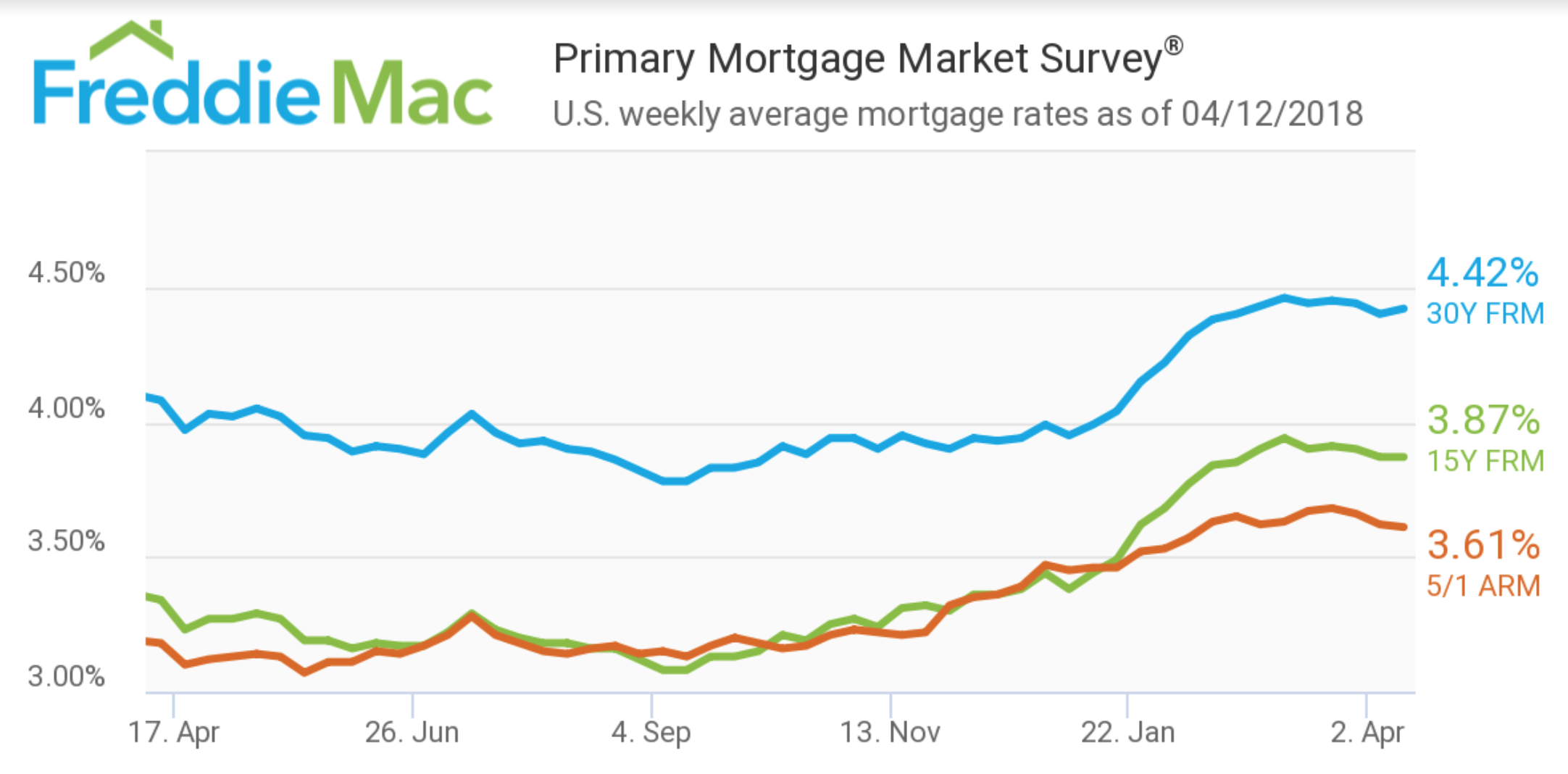

Mortgage rates moved up slightly, but could soon jump higher if inflation continues to increase, according to Freddie Mac’s Primary Mortgage Market Survey.

“Mortgage rates have been holding steady over the past two months,” said Len Kiefer, Freddie Mac deputy chief economist. “The U.S. weekly average 30-year fixed mortgage rate was 4.42% in this week’s survey. Rates have bounced around 4.4% since mid-February.”

“Rates could break out and head higher if inflation continues to firm,” Kiefer said. “The U.S. Bureau of Labor Statistics reported this week that the Consumer Price Index increased 2.4% over the 12 months ending in March, the largest 12-month increase in a year. Members of the Federal Reserve’s Federal Open Market Committee are looking at inflation indicators to help determine the appropriate path for policy.”

Click to Enlarge

(Source: Freddie Mac)

The 30-year fixed-rate mortgage increased to 4.42% for the week ending April 12, 2018. This is up from last week when it averaged 4.4% and from last year’s 4.08%.

The 15-year FRM remained the same at 3.87%, but up from last year’s 3.34%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage dipped slightly to 3.61%, down from 3.62% last week. However, this is still up from last year’s 3.18%.

“If inflation continues to trend higher, we may see two or three more rate hikes from the Fed this year, and mortgage rates could follow,” Kiefer said. “For now, mortgage rates are still quite low by historical standards, helping to support homebuyer affordability as the spring home-buying season ramps up.”