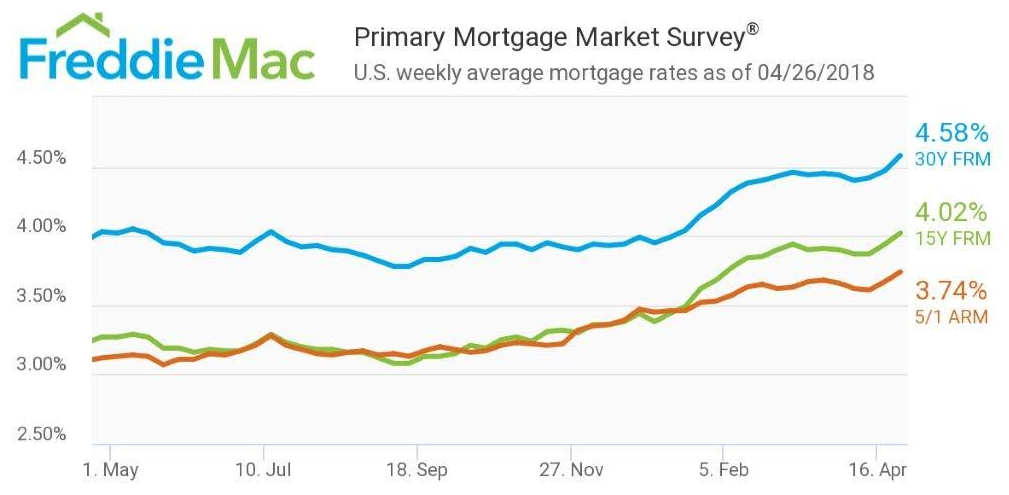

Mortgage rates shot up this week, reaching their highest point since 2013, according to the latest Primary Mortgage Market Survey from Freddie Mac.

“Mortgage rates are now at their highest level since the week of August 22, 2013,” Freddie Mac Chief Economist Sam Khater said.

Click to Enlarge

(Source: Freddie Mac)

The 30-year fixed-rate mortgage surged ahead to 4.58% for the week ending April 26, 2018. This is up 11 basis points from 4.47% last week and up from 4.03% this time last year.

The 15-year FRM also increased, rising from 3.94% last week and 3.27% last year to this week’s 4.02%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage increased to 3.74%. This is up from 3.67% last week and from 3.12% last year.

“Higher Treasury yields, driven by rising commodity prices, more Treasury issuances and the steady stream of solid economic news, are behind the uptick in rates over the past week,” Khater said.

Tuesday, the 10-year Treasury note increased to the psychologically important 3% mark, a four-year-high, before falling once again to end the day just below 2.99%. Then, Wednesday, the yields once again climbed up, surpassing 3%.