Gross domestic product was a disappointment, shrinking in the first quarter despite the recent tax cuts passed at the end of 2017.

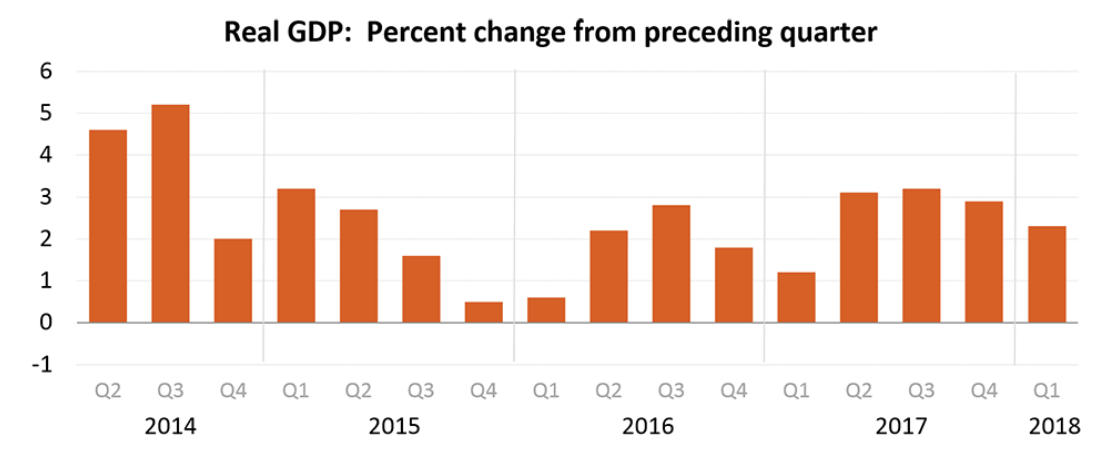

Real GDP increased at an annual rate of 2.3% in the first quarter of 2018, according to the advance estimate from the Bureau of Economic Analysis. This is down from the fourth quarter’s increase of 2.9%.

“The slowdown in GDP growth to 2.3% annualized in the first quarter, from 2.9% in the final quarter of last year was something of a disappointment since the tax cuts should have provided an immediate boost,” Capital Economics Chief Economist Paul Ashworth said.

“Nevertheless, given that the economy has repeatedly swooned in the first quarter in recent years, the Fed won’t be too concerned,” Ashworth said. “After all, 2.3% is still above most estimates of the economy’s potential growth rate.”

The chief economics commentator for The Wall Street Journal summed it up like this, “Bottom line: Trump promised 3% sustained supply-sided growth; a demand-driven burst lasting from 2017 to 2019 doesn't qualify. It will be a while before we know if the U.S. got the former, not just the latter.”

Check out his whole tweetstorm stream here:

1/9 A tweetstorm on reading q1 growth slowdown & whether tax cut is working. Deceleration from q4 (2.9% saar) to q1 (2.3%) distorted by hurricane-driven q4 spike in car sales & home repairs. Excluding motor vehicles and residential investment, growth went from 2% to 2.7%.

— Greg Ip (@greg_ip) April 27, 2018

The advanced estimate is based on source data that is incomplete and subject to further revisions. The BEA will release a second estimate later next month.

Click to Enlarge

(Source: BEA)

And the National Association of Realtors claimed that this lower GDP is reflective of an ongoing housing crisis.

“The latest GDP growth rate of 2.3% is short of what is possible,” NAR Chief Economist Lawrence Yun said. “Residential investment spending showed zero growth because single-family and condominium construction have not been growing meaningfully. In America today, there is a major housing crisis.”

“Consumers are facing high rent growth and are having difficulty saving up for down payment because of fast appreciating home prices,” Yun said. “The acute housing shortage in most parts of the country can easily be relieved with more construction. Therefore, regulatory relief for small-sized banks will facilitate more construction loans for small-sized homebuilders.”

He explained that local communities can also help by providing training in construction work to help ease the shortage.

The increase in real GDP in the first quarter reflected positive contributions from nonresidential fixed investment, personal consumption expenditures, exports, private inventory investment, federal government spending, and state and local government spending.

However, while these areas may have increased, personal consumer expenditure, residential fixed investment, exports and state and local government spending all saw a deceleration. Also, imports, which are a subtraction in the calculation of GDP, increased.

But these were partially offset by an upturn in private inventory investment and a deceleration in imports.

Current-dollar personal income increased $182.1 billion in the first quarter, compared with an increase of $186.4 billion in the fourth quarter. Decelerations in personal interest income, rental income and nonfarm proprietors’ income were largely offset by accelerations in wages and salaries and in government social benefits.

Here is a breakdown of the estimate:

Current-dollar GDP: Increased by 4.3% or $211.2 billion to $19.97 trillion

Gross domestic purchases price index: Increased by 2.8%

Personal consumption expenditures: Increased by 2.7%