Freddie Mac revealed Tuesday that its multifamily portfolio increased significantly in the first quarter.

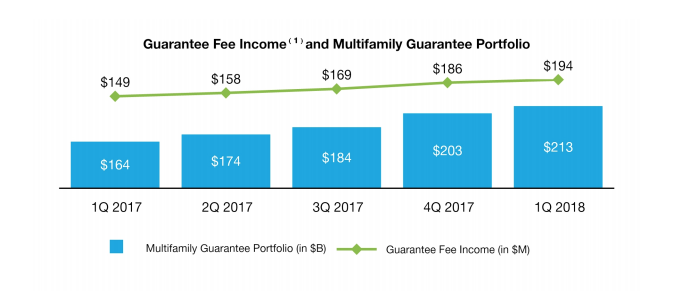

According to its quarterly earnings report, Freddie Mac's multifamily guarantee portfolio saw a 30% growth spurt year-over-year, climbing from $149 billion in the first quarter of 2017 to $213 billion in the first quarter of this year (as seen in the graph below).

Freddie Mac noted that the growth was driven by an increase in K Certificates (Freddie Mac guaranteed structured pass-through certificates) and SB Certificates (Freddie Mac guarantees senior classes of securities issued by third-party trusts and backed by Multifamily Small Balance Loans).

(Click to enlarge; image courtesy of Freddie Mac)

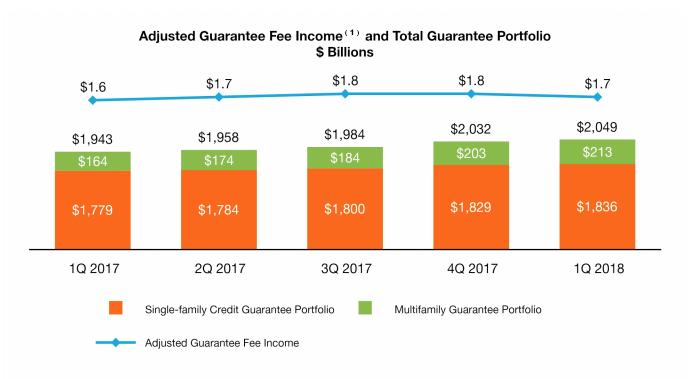

Though the single-family portion of Freddie Mac’s portfolio still far outstrips the multifamily portion (as seen in the graph below), the multifamily portfolio’s rate of growth reflects the growing importance of the multifamily industry in the American housing market.

(Click to enlarge; image courtesy of Freddie Mac)

Demand has been increasing for the better part of a decade. Last year, the industry appeared to hit its cycle peak. Q1 numbers indicate the beginning of moderation in the multifamily market.

According to data provided to HousingWire by CBRE Research, there are 588,300 units under construction in the U.S., the highest since the firm began tracking multifamily in 2006. Overall construction starts are beginning to moderate after 2017’s fever pitch in new product. According to CBRE's report, last year saw the highest number of apartment completions since the financial crisis.

Supply and demand appear to be in balance for the time being as net absorptions rose to 230,000 units, and deliveries fell to 260,000 units in Q1.

Going forward, Freddie Mac said that it expects to reduce the modeled capital required for credit risk on this quarter’s $13 billion of new originations by 90%. According to the release, Freddie Mac has already transferred roughly 90% of the risk on the multifamily guarantee portfolio.