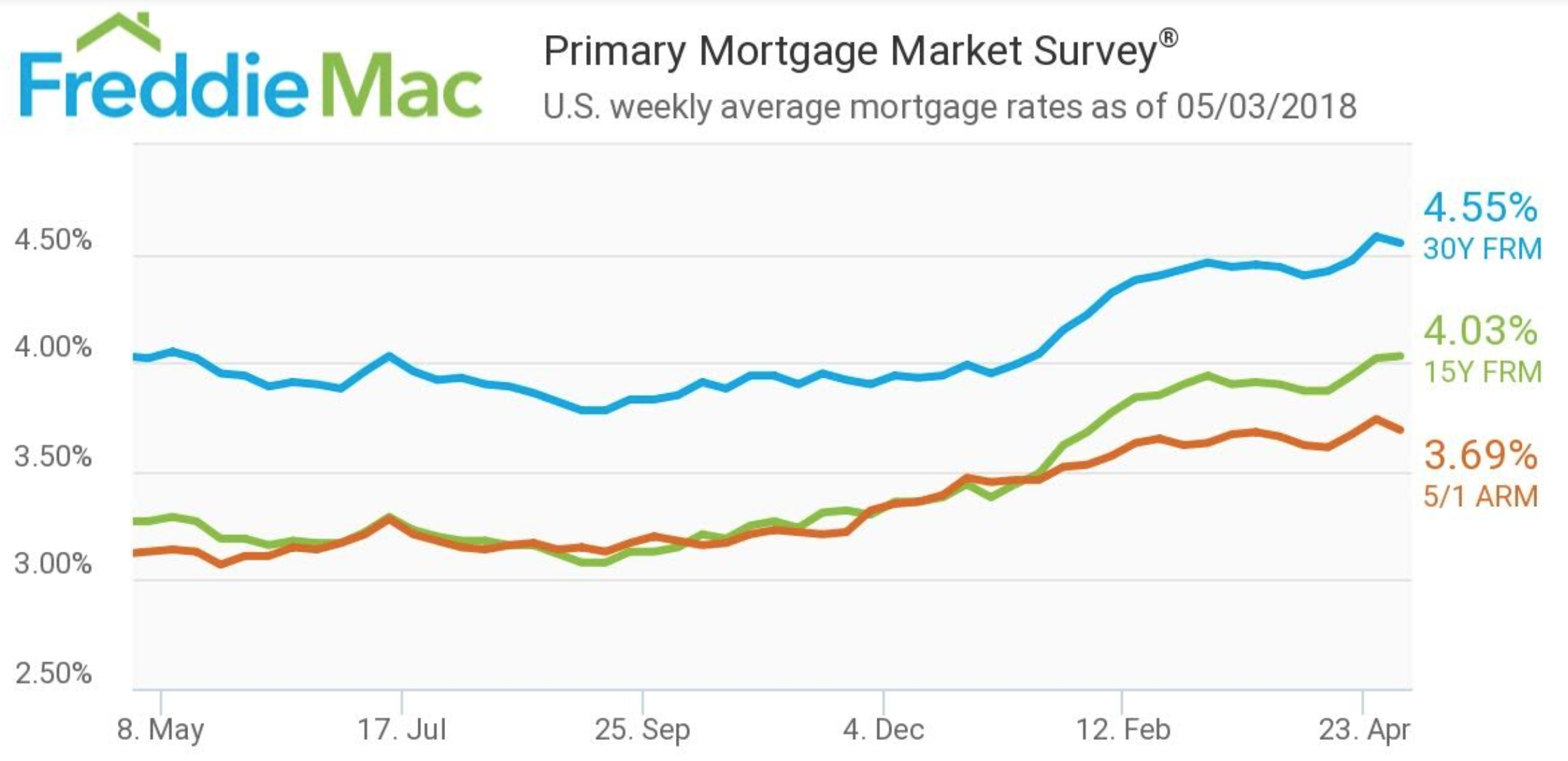

Mortgage interest rates have continued to increase, and last week even hit the highest level since 2013, but they decreased for the first time in weeks, according to Freddie Mac’s weekly Primary Mortgage Market Survey.

And what’s more, it seems even the previous increasing trend hasn’t dampened the demand of this year’s homebuyers.

“While mortgage rates have increased by one-half of a percentage point so far this year, it has not impacted home purchase demand, which continues to grow this spring,” Freddie Mac Chief Economist Sam Khater said. “The observed buyer resiliency in the face of higher rates reflects the healthy economy and strong consumer confidence, which are important drivers of home sales activity.”

Click to Enlarge

(Source: Freddie Mac)

The 30-year fixed-rate mortgage decreased to 4.55% for the week ending May 3, 2018. This is down slightly from last week’s 4.58%, but still up from 4.02% last year.

The 15-year FRM, on the other hand, increased slightly, moving up from 4.02% last week to 4.03% this week. This is also up from 3.27% last year.

The five-year Treasury-indexed hybrid adjustable-rate mortgage decreased to an average 3.69%. This is down from 3.74% last week, but up from 3.13% last year.

But despite the significant jump in mortgage interest rates from last year, first-time homebuyers have managed to increase their market share.

“It’s also good news that first-time buyers appear to be having more success so far this year, despite higher borrowing costs and home prices,” Khater said. “Our data through April shows that first-timers represent 46% of purchase loans, up from 43% over the same period a year ago.”