The single-family housing market is seeing a temporary jump in purchase applications in the face of three expected hikes in the interest rate from the Fed according to a report from Capital Economics. The recent release of job growth numbers revealing that unemployment is below 4% for the first time since 2001, have all but guaranteed the interest rate hikes and potential homebuyers are rushing to pull the trigger and lock down new digs before the impending interest rate hike in June.

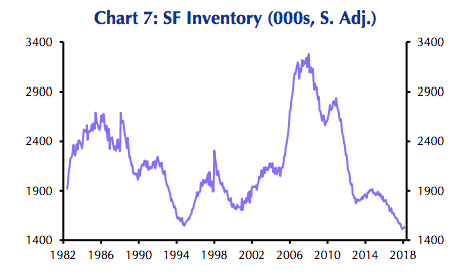

The single-family housing market is staring down a shortage that is putting upward pressure on prices, pushing annual growth on the Case-Shiller measure to 6.3% in February according to Capital Economics’ report. To make matters worse, home construction starts dropped 5.5% month-over-month, the largest contraction in over seven years with no sign of supply relief for a strained inventory (see graph below).

(Courtesy of Capital Economics)

This is good news for those who are selling right now, as evidenced by a slight rise in homes up for sale and a big jump in purchasing applications.

Right now, home purchasing applications are at a nine-year high, according to Capital Economics' analysis of the Mortgage Bankers Association's application data (see chart below). This is in stark contrast to refinance applications, which are near a 10-year low. All this despite steadily worsening affordability which hit a nine-year low in February. Odds are, once the interest rates go up, it will put a chill on this sales rush, and buyers will hibernate until they can get a better deal.

(Sources: Capital Economics; MBA)