In reference to today’s Case-Shiller report showing home prices continue on an upward trajectory, Zillow Senior Economist Aaron Terrazas said: “Getting a mortgage remains incredibly affordable.”

Nonetheless, as HousingWire reporter Kelsey Ramírez states, “Homebuyers are going to continue to need larger loans as home prices increase.”

The good news for homebuyers is that the average size of their new mortgages is actually going down, for now.

According to the Federal Housing Finance Agency, the average loan amount for all loans was $312,900 in April.

That’s down $4,400 from $317,300 in March.

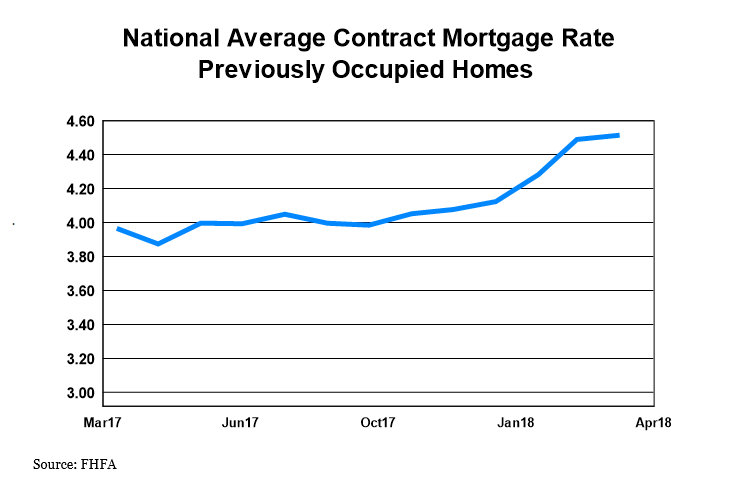

But, there is no denying that mortgage rates will keep going up.

According to the FHFA, the average interest rate on all mortgage loans was 4.49%, up seven basis points from 4.42% in March.

The average interest rate on conventional, 30-year, fixed-rate mortgages of $453,100 or less was 4.64%, up 10 basis points from 4.54% in March.

The effective interest rate on all mortgage loans was 4.63% in April, up 13 basis points from 4.5% in March. The effective interest rate accounts for the addition of initial fees and charges over the life of the mortgage.