Home prices showed yet another surge in April as year over year values increased for all 50 states, according to the latest Home Price Index report from CoreLogic, a global property information, analytics and data-enabled solutions provider.

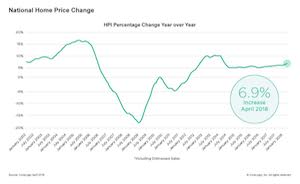

Home prices increased 6.9% nationally from April 2017 to April 2018, and increased 1.2% from the prior month, according to the report.

The chart below shows home prices have been steadily increasing at the same rate for the past several years.

(Source: CoreLogic)

“The best antidote for rising home prices is additional supply,” CoreLogic Chief Economist Frank Nothaft said. “New construction has failed to keep up with and meet new housing growth or replace existing inventory. More construction of for-sale and rental housing will alleviate housing cost pressures.”

An analysis of home values in the country’s 100 largest metropolitan areas based on housing stock, indicates 40% of metropolitan areas had an overvalued housing market as of April 2018, CoreLogic reported.

Another 28% of the top 100 metropolitan areas were undervalued while 32% were at value. When looking at only the top 50 markets, 52% were overvalued, 14% were undervalued and 34% were at-value.

The national home-price index is projected to increase by 5.3% from April 2018 to April 2019, according to the CoreLogic HPI Forecast.

The forecast is an econometric model that projects calculations from analyzing state level forecast, which are measured by the number of owner-occupied households for each state.

As of April, Florida’s recovery is promising, but experts say another natural disaster could hinder its growth.

“Florida continues to show price resiliency after Hurricane Irma in 2017. Despite the impact of the hurricane, prices were up 5.8% across the state compared to a year ago,” CoreLogic President and CEO Frank Martell said. “CoreLogic data projects continued gains to home prices in Florida for the remainder of 2018. However, gains could be erased if a significant storm makes landfall again.”