All across America, millions of households are struggling to find a place to rent they can afford. Moderate income renters – those earning between 81% and 120% of their area median income – are no different. While these renters make too much to qualify for subsidized housing, they are increasingly burdened by rapidly increasing rental housing costs.

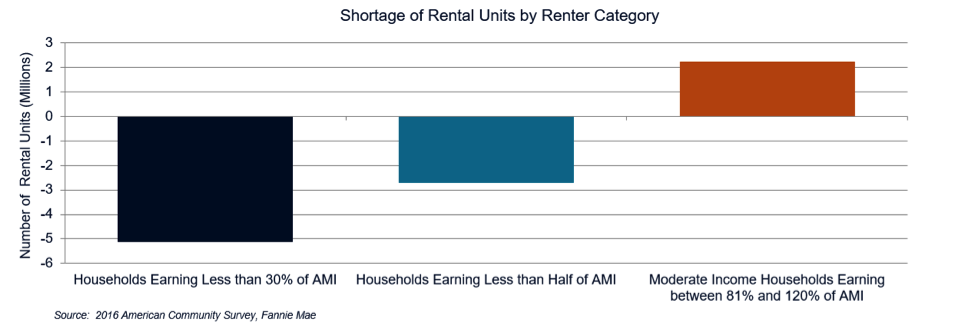

At first glance, it would appear that these rising rental costs are due to a supply/demand imbalance for moderate income renters. However, according to the American Community Survey, there should actually be a surplus of just over 2.1 million rental units for moderate income renter households.

(Click to enlarge)

What is driving moderate income rent?

If we have a surplus of units, why are rents for moderate income renters rising? We believe the answers to this question can be found in the lower and upper ends of the income spectrum.

Today, there is an estimated shortage of over 2.7 million units for renters who make less than half of their area median income. That shortage grows to over 5 million units for extremely low-income renters.

According to the National Low Income Housing Coalition, for every 100 very low income renter households in the United States, there are only 55 affordable rental units available to rent. It gets worse for extremely low income households, where only 35 affordable units exist per 100 renters.

As a result of these shortages, very low and extremely low income families are forced to spend up in order to live in rental units that would typically be available for moderate-income renter households.

As shown in the figure below, more than half of all very low and extremely low income renter households occupy rental housing units that are only affordable to renters at higher income levels. In other words, the critical shortage of supply that exists for renter households at the lowest ends of the income spectrum is bleeding up into the middle market and contributing to the upward pressure on moderate income rents.

(Click to enlarge)

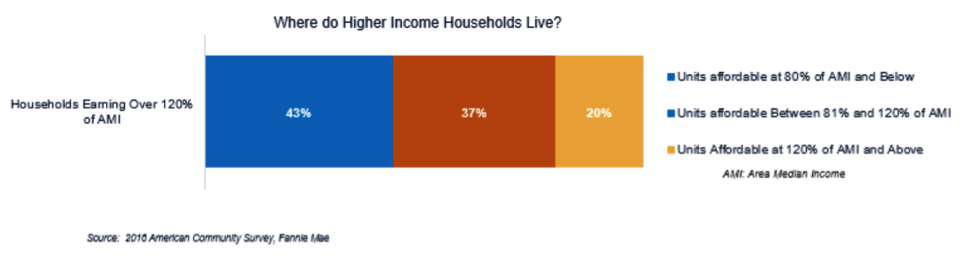

Rental units for moderate income households are also being absorbed by renters at higher incomes, whose numbers have grown by over 3 million households since the end of the recession. In fact, 37% of higher income households occupy units affordable to moderate income renters.

(Click to enlarge)

The bottom line is that if you are in the lower end of the income spectrum and need housing, you will find a way to pay for it even if that means paying rent at levels that are not affordable at your level of income. Conversely, if you are making a higher income and live in a moderately priced unit, you do not have to move and you can stay in that unit until you either relocate electively to another rental unit or purchase a home.

As a result, that surplus of 2.1 million units for moderate income renters has been soaked up by renters both at lower and higher income levels, effectively squeezing out the middle.

Working toward solutions

The need to build and rehabilitate more affordable units is urgent, and we believe that there are three key ways in which the multifamily industry can address this issue.

1. Increase the supply of affordable rental housing where the demand for affordable rental housing is the greatest.

That means building more units that are affordable for very low and extremely low income households. Simply put, if the demand for very low and extremely low income rental housing is overwhelming the supply of existing moderate income units, it only makes sense to focus first on increasing the number of units that are affordable for our lowest income households.

One of the main challenges to increasing the supply of affordable housing for renters at the lowest end of the income spectrum is that the cost of building new apartment units far exceeds what affordable rents can support. This makes it impossible for a developer to recoup their costs or make a reasonable profit on an affordable rental housing property without some form of assistance.

Attracting private capital to the low-income housing rental market

The federal Low Income Housing Tax Credit was created to help bridge this cost gap by offering a subsidy to developers who agreed to set aside a portion of their units at affordable rents. Since its creation in 1986, the LIHTC program has leveraged private and public resources to create over 3 million rentals that serve over 7 million families.

This year, Fannie Mae re-entered the LIHTC equity investment business after a decade-long hiatus, and we are actively pursuing investments to increase and preserve the supply of affordable housing stock. Additionally, we have improved our LIHTC forward commitment debt product to provide additional support for developers looking to build new affordable rental housing units.

2. Preserving and improving affordable rental housing units that exist today.

Since 2005, the United States has lost over 100,000 units of rental housing per year due to obsolescence. To make matters worse, the majority of those lost units were affordable to the lower income renters where the demand for units is the greatest.

While the threat of obsolescence is especially acute for deeply affordable housing units, there is also a growing need to preserve and improve rental housing properties that are affordable to the middle market of renters – including those that are “naturally affordable” without rent or income restrictions. One of the best ways to do that is to extend the useful life of the property and reduce renter utility costs by making the property more energy- or water-efficient.

Thus far in 2018, three out of every four units financed by a Fannie Mae Multifamily Green loan was affordable to low income renter households. Our financing is now projected to save property owners $49,000 per year in reduced expenses. Those savings not only help extend the useful life of the property, but they also make it easier for owners to operate their properties at affordable rent levels. Renters are beginning to see the benefit as well – they are projected to save more than $130 per year in reduced utility bills.

3. Preserving the affordability of units for the people who live there.

Increasingly, state and local governments are developing local initiatives that seek to create and/or preserve the affordability of rental housing units for moderate income households. We applaud these efforts and provide pricing discounts for properties that participate in these programs.

With so many state and local affordable housing initiatives scattered across the country, we also believe that it is important for the industry to have a centralized database of these initiatives.

That is why we have worked with the Grounded Solutions Network to launch a national Inclusionary Housing Database Map. This interactive web-based tool includes data on over 800 state and local housing initiatives and will provide developers, state and local officials, and affordable housing practitioners with more information to understand, develop best practices around, and create more effective state and local programs to support the need for affordable rental housing across the country.

Finally, we need to acknowledge and address the rising costs of development and regulatory compliance. Preserving, creating, and improving affordable rental housing cannot be successful if we don’t also work together to address the issue of rising costs. Developers are continually looking for ways to lower costs today by purchasing materials in bulk, investing in energy efficient improvements, exploring new construction techniques, and vertically integrating their organizations to control expenses.

State, local, and federal governments can also do their part by working to ensure that the cost of complying with their regulations are not a disincentive to affordable housing development. While many regulations are necessary, care needs to be taken to ensure that the time and cost of compliance does not impede the creation of new affordable housing units.

Making affordable housing happen, together

There is no one solution to our affordable housing crisis and it will take a dedicated public-private partnership to address it. One thing is clear: The recent affordability issues that have arisen for moderate income renters is symptomatic of larger underlying problems. And in order to resolve those issues, we need to ensure that we are focusing resources where the underlying problems exist.

That means building more affordable units for our lowest income renters. It means preserving and extending the useful life of all rental properties to reduce operating and tenant costs. It also means developing new incentives to support innovative approaches that reduce the cost of construction and regulatory compliance. Taken together, these solutions represent a good first step towards making rental housing more affordable for renters across the income spectrum.