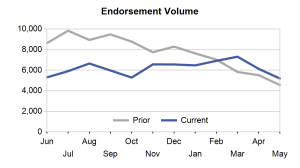

Since crossing over to positive year-over-year growth in March, HECM endorsement volume in April and May has emulated the downward trend from 2010 according to the new Retail Leaders Report from Reverse Market Insight (RMI).

Although May production was 13.9% ahead of May 2010, the 5,188 was a 15.3% decrease from April. The endorsement volume had been steadily climbing since October 2010, reaching a 12 month peak in March, before falling in April and May.

The concentration among the top lenders continued to expand as the Top 10 accounted for over 70% of May endorsements. The volume distinction as you move past the Top 10 is quite staggering. For the month of May, the Top 10 lenders averaged 372 units . With the next 10 (11-20) lenders, that average dropped off to 45 units.

Among the Top 10, half showed a month-over-month increase, while the other have experienced declines. The exit of Bank of America finally appeared in May with their production dropping off from 896 units in April to 332 in May. MetLife has appeared to be the biggest gainer from the void left by Bank of America with a May jump to 932 from 616 in April, an increase of over 50%.

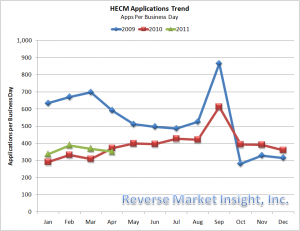

Applications also saw a decline in April reaching a seven month low at 7,371 applications for the month. Since October, applications have been averaging just over 7,000, a trend that has been more stable than endorsements. One factor that impacted April applications is the number of business days in the month at 21 was three days less than March which had 24.

By removing seasonal factors and looking at applications by number per business day, the trend has been more consistent since falling off a spike in September 2010, thus far in 2010 maintaining a pace just ahead of 2010.

Another factor putting downward pressure on applications could be that the industry has yet to fully fill the void left from Bank of America and Financial Freedom ceasing origination activities. The two entities has been averaging about 1,000 per month and it will likely take time for the industry to absorb that activity.

Even though there are some discouraging notes in the current HECM activity trends, they are, at least currently, ahead of pace in 2010. The industry faces on going challenges as economic factors, especially home values, continue to struggle for solid footing and sustained recovery.