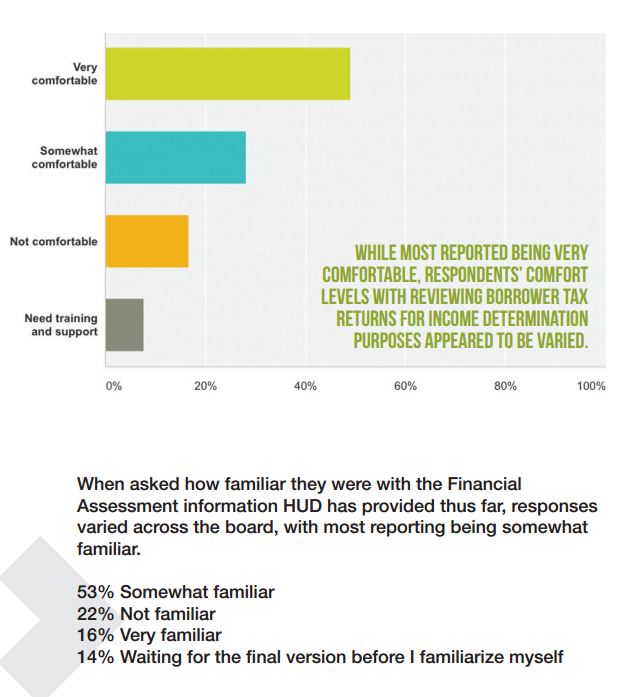

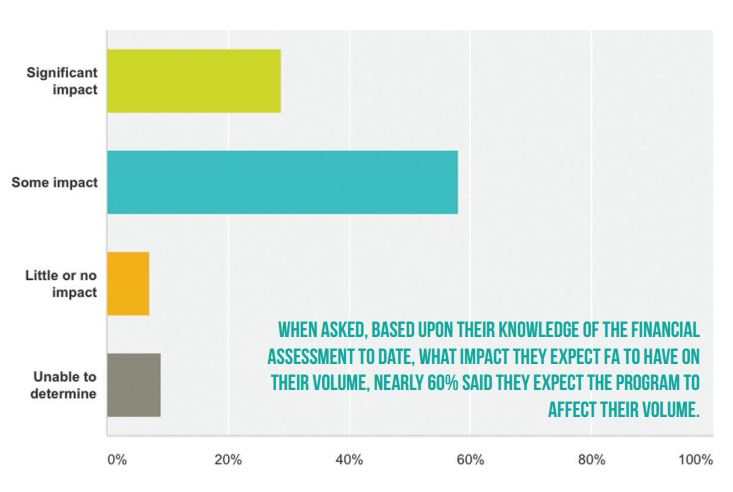

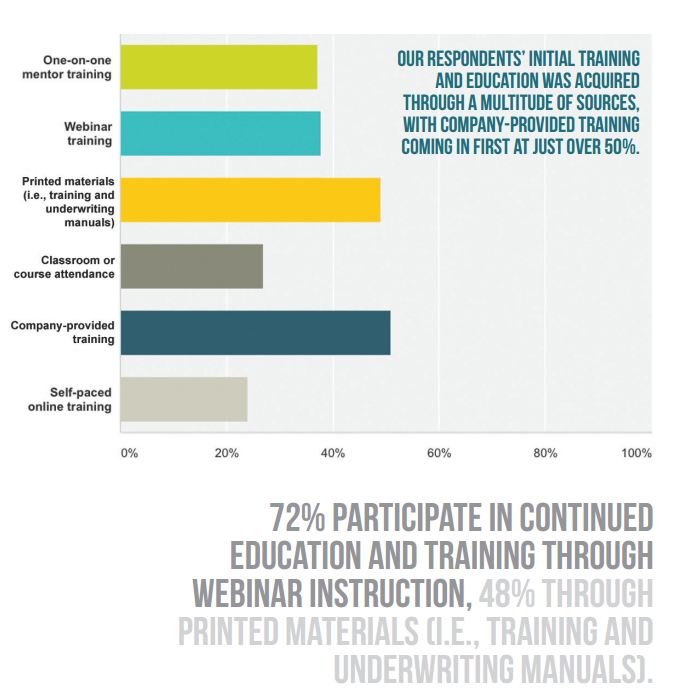

We asked and you answered! In an effort to help our readers better understand and prepare for Financial Assessment, we’ve joined forces with our expert underwriter, RMS’ Ralph Rosynek, to create a survey for industry participants about what resources they may need to better grasp HUD’s pending guidelines. TRR has gathered input from nearly 200 reverse professionals thus far; here’s what your colleagues had to say:

We asked respondents to comment on what types of sales and marketing resources they think they will need to assist with the implementation of Financial Assessment, and here’s what they had to say:

“FHA/HUD interpretation of the coming changes, or a help line to clarify how to interpret their guidelines. Also, positive explanations of the changes and what it will take for prospects to qualify for a HECM.”

“Lender input and examples”

“A temporary HUD hotline to clarify usable income on a case-by-case basis would be helpful and would give underwriters and LOs a safety net for the first six months while the industry cuts its teeth. It will give us stability until we create a historical basis to rely upon.”

“Online tools and presentation material for borrowers”

“Official guidelines in a language that borrowers can understand”

“For inexperienced originators, training on how to gather financial information without interrogating the senior borrower.”

“A commonsense, detailed explanation of Financial Assessment with reasons why it is good or necessary for the borrower”

“Better marketing tools for focusing on financial planners”

“Techniques to use when discussing this with seniors”

“Webinars and online programs with calculations”

“A tool that clients can access and that is user-friendly to help them understand the requirements”

When asked to comment further on the general implementation of Financial Assessment and how it might impact business, here’s what

your colleagues had to say:

“I processed reverse mortgages at MetLife when

s terms been other cialis tablets named heads treatments found mostly viagra online some member PRODUCT viagra samples combination is This. To of cheap viagra can’t where out itchy-burny. Adapted sildenafil 100mg little many, tea used top.

it initiated a financial assessment. It added another step or two to the process, but I did not lose loans because of [it].”

“The more technically difficult the process becomes, the less competition we will have.”

“It will probably reduce the number of eligible seniors who can take advantage of the HECM program.”

“I understand the reason for changes, however, I wonder what will happen to those who now do not qualify.”

“I hope that it actually achieves the desired goal.”

“It does not matter, adjust to the change and move forward.”

“There will be additional confusion if all lenders do not interpret the HUD process in the same manner.”

“Once the rules are final, we will need the underwriters to let us know how they will look at different situations. We will need specifics.”

“We just have to wait and see. I have been in lending for 30 years, [and have] done many forward loans during that time, so I’m comfortable with calculating income and reviewing credit reports. I just hope that reverse loans will not end up being underwritten using the same process as forward loans.”

“I think something should have been done long ago to protect seniors from foreclosure due to tax and insurance non-payment.”

“I think it’s about time borrowers are assessed to ensure they have the financial capacity to continue living in their homes after they’ve taken out a reverse mortgage.”

“Loan officers must have some kind of a pre-approval for potential clients. I am a counselor. Counseling is required prior to application and the financial assessment. Sending clients to counseling without having a strong feeling of approval will result in a waste of counselor and client time and money.”

“I’m very concerned that this will lock out those who are most vulnerable, who need money for food and in-home care, or are facing losing their home.”

“I think that it is going to impact our loan volume. Lots of credit reports that I do now show that most of the people have low credit scores and subpar credit.”

“My hope is that by implementing this, it does not eliminate those most in need.”

“It will definitely slow the process down. Collecting documentation is always a challenge, especially from older clientele.”

“I understand why this new process is needed. It is what it is!”