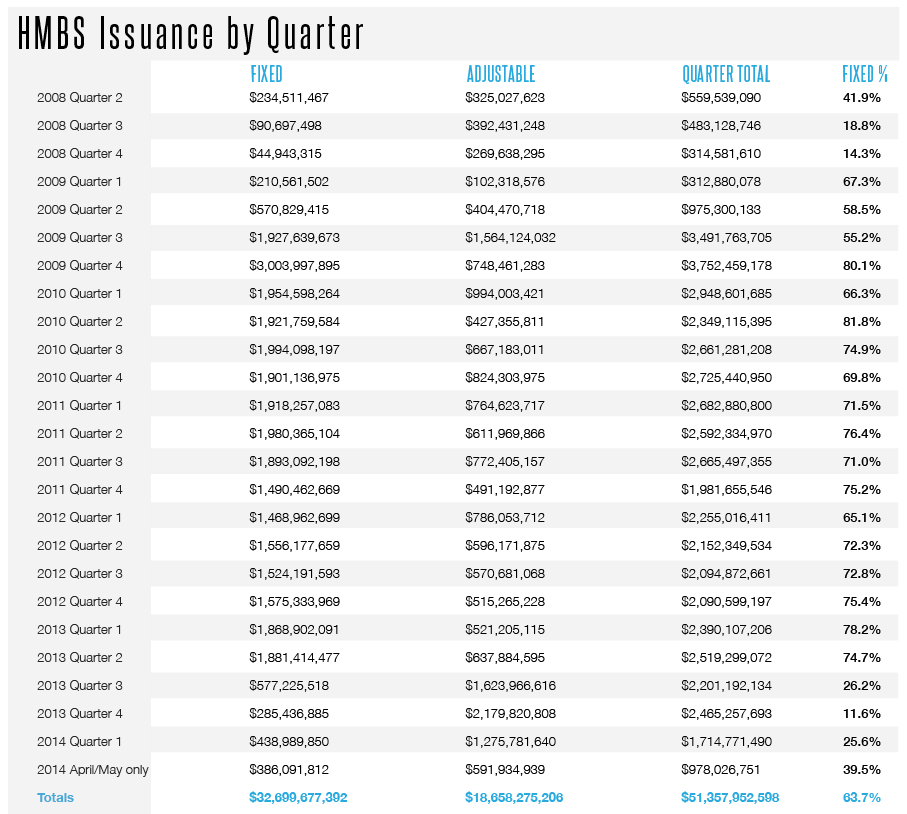

The history of HMBS issuance reveals a lot about the recent history of the reverse mortgage industry. In 2008 and 2009, it shows the tentative, low-volume beginnings of Ginnie Mae’s HMBS program, and the impact of Fannie Mae’s fade from the HECM whole loan market.

The golden era of HMBS was from 2010 through the first half of 2013, with high fixed-rate volume, steadily rising HMBS prices and big bank issuers. Since the second half of 2013, the numbers reveal the dramatically lower volume and shift away from fixed-rate HECMs as big bank issuers withdrew from origination and FHA lowered PLFs and imposed other restrictions.

Here’s a look at how HMBS issuance has fluctuated in the past five and a half years: