The homeownership rate inched up slightly in the second quarter, but not for all racial and ethnic groups.

The homeownership rate increased to 64.3% in the second quarter, up just slightly from 64.2% in the first quarter and from 63.7% in the second quarter of 2017, according to the latest report from the U.S. Census Bureau.

While this may not seem like much statistically, realtor.com Chief Economist Danielle Hale pointed out that this represents an additional 1.8 million owner-occupied households over the past year.

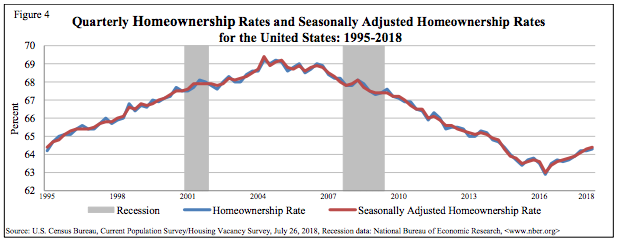

The homeownership rate has been steadily increasing, but the chart below shows it has a long way to go in order to catch up with its pre-crisis or even historical levels.

Click to Enlarge

(Source: U.S. Census Bureau)

“The rise in homeownership in the spring was consistent with the last few quarters, so while there appears to be a slowdown in the growth rate of home sales and prices, it has not slowed rising homeownership,” Freddie Mac Chief Economist Sam Khater said.

“However, homeownership today is a full percentage point below the 50-year average, and this lag reflects the long-lasting scars from the Great Recession and the lopsided nature of this recovery,” Khater said. “Despite years of continuous job growth and a slowly improving economy, it was only last year where we started to see an uptick in homeownership.”

The white American homeownership rate increased to 72.9% in the second quarter, up from 72.4% in the first quarter and 72.2% in the first quarter last year, other groups did not see that same increase.

The black homeownership rate fell from 42.2% in the first quarter and from 42.3% in the second quarter of 2017 to 41.6% in the second quarter this year. The Hispanic homeownership rate also fell from 48.4% in the first quarter to 46.6% in the second quarter. However, this is still up from 45.5% in the second quarter of 2017.

The homeownership rate for Asian, Native Hawaiian and Pacific Islanders increased to 58%, up from 57.3% in the first quarter and 56.5% in the second quarter last year.

Millennials also continue to increase their share in homeownership as those under 35 saw an increase from 35.3% in the first quarter this year and the second quarter last year to 36.5% in the second quarter of 2018, the highest rate among Millennials in five years.

“Over the past two years, Millennials have been on a home shopping spree, driving a bump in the overall homeownership rate in Q2,” Zillow Senior Economist Aaron Terrazas said. “Homeownership among younger households still remains well below pre-crisis and pre-bubble norms, but those same groups are currently experiencing some of the biggest gains.”

Likewise, the homeownership rate for those ages 35 to 44 years increased to 60%, up from 59.8% in the first quarter and 58.8% in the second quarter of 2017. The homeownership rate for those ages 45 to 54 years increased to 70.6% in the second quarter, up from 70% in the first quarter and 69.3% last year.

The older generations, however, saw slight declines in their homeownership rate. The homeownership rate for those ages 55 to 64 years decreased from 75.4% last quarter and last year to 75.1% in the second quarter. The rate for those 65 years and older also decreased slightly to 78%, falling from 78.5% last quarter and 78.2% last year.

The national homeowner vacancy rate remained steady at 1.5% in the second quarter this year.