Quick – what’s the No. 1 market in the U.S.?

If you answered San Francisco, you would have been right, that is, if we were talking about home prices. But we’re not.

In terms of new home starts, the Dallas/Ft. Worth area remains the No. 1 market in the country with 35,090 housing starts per year, according to data from Metrostudy, a provider of primary and secondary market information to the housing and related industries.

In fact, its housing starts even continue to grow, jumping 12.1% year-over-year in the second quarter, the data showed. And annual closings soared, rising 20.8% annually, the largest increase since the third quarter of 2013.

Metrostudy explained this increase in closings follows six months of builders delivering affordable homes in the $200,000 to $300,000 range. The median new home price even dropped in the Dallas-Ft. Worth area by 1.7% from last year to $325,400.

Early this year, Freddie Mac predicted new home sales will be the driving factor of housing growth this year as the market struggles to produce enough inventory for the rising demand for homes.

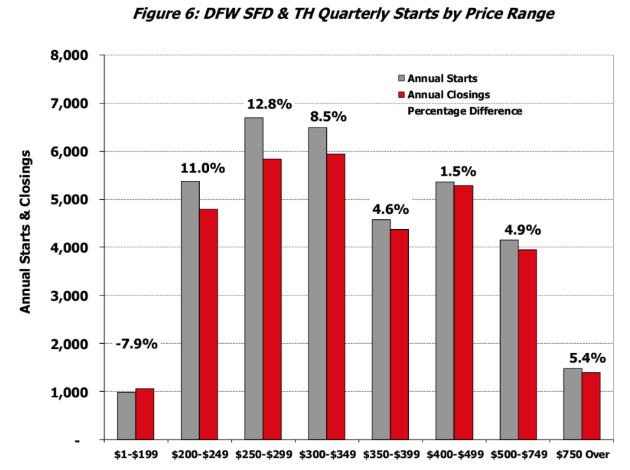

And now, that market just got a little more affordable as builders concentrate market growth in the more affordable market segments. The chart below shows what percentage of new home starts are built in each price range.

Click to Enlarge

(Source: Metrostudy)

The data further enforces the shifting demand for lower-priced homes.

“As builders and developers push to deliver smaller lots and more affordably priced product, expect the median price to fall,” said Paige Shipp, regional director of Metrostudy’s Dallas-Fort Worth market. “In a market where new and resale price appreciation significantly outpaced wage growth, a lower median price indicates that more homebuyers will be able to afford new homes.”

“The median resale price of $258,000 is 5.7% higher than 2017,” Shipp said. “As the median new home price drops and resale price increases, the delta between new and resale narrows. Currently, the difference between the median resale and new home price is 26.1%. The greatest difference in price was 50% in 2015.”

But this comes at a time when, across the U.S., affordability dropped to a 10-year low due to low mortgage inventory, rising home prices and even Canadian lumber tariffs, according to the latest report from the National Association of Home Builders.