As home prices rise and interest rates increase, potential home buyers are not the only ones affected by the affordability changes.

Homeowners who previously bought their home using an adjustable-rate mortgage are now seeing an increase in their monthly mortgage and interest payments, with more increases yet to come, according to the June 2018 Mortgage Monitor report from Black Knight.

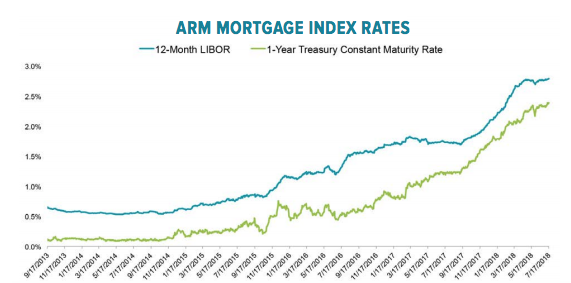

The report showed these increases to ARM rates are due to the increases in LIBOR and Constant Maturity Treasury rates.

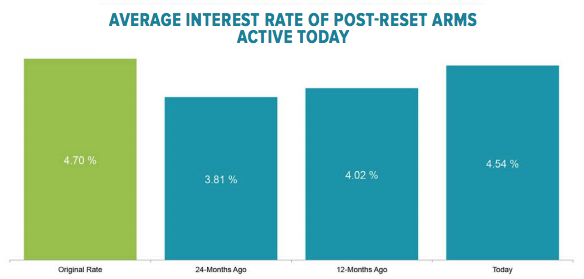

The average rate on post-reset ARMs has risen by more than 0.5% over the past 12 months, and about 0.75% over the past two years, according to the report. This pushes the average ARM interest rate to more than 4.5%.

Click to Enlarge

(Source: Black Knight)

Black Knight explained that borrowers had been the beneficiary of downward reductions in their rates and payments after the financial crisis, however that is no longer the case. Now, the average rate for ARM borrowers is within 16 basis points of where they started, as the chart below shows.

Click to Enlarge

(Source: Black Knight)

Over the past 12 months, about 1.7 million borrowers saw their monthly mortgage payments increase by an average of $70. But that’s only the beginning. The report showed most of LIBOR’s increase came at the beginning of 2018, therefore the increase has yet to show up in borrowers’ mortgage interest rates.

An estimated 1 million borrowers will see their interest rates rise further on their next reset, with an average increase of 0.67% per month or about $70 in their monthly mortgage payment.

What’s more, borrowers with ARMs facing resets within the next five months could see their rates increase by an average 0.81% and their monthly mortgage payment could increase by more than $80 per month.

On the next reset, most borrowers will likely see their interest rates rise above the original rate on their loan.

Because of these rising rates, ARMs are seeing higher-than-average pre-payment speeds, and there are now fewer ARMs in the market than at any point since 2000. Total ARM inventory now stands at 3.7 million, down 7% since the start of 2018.

Currently, about 60% of all outstanding ARMs are in their adjustable phase, leaving about 2.3 million borrowers as risk of payment increases from the continued rises in short term rates.