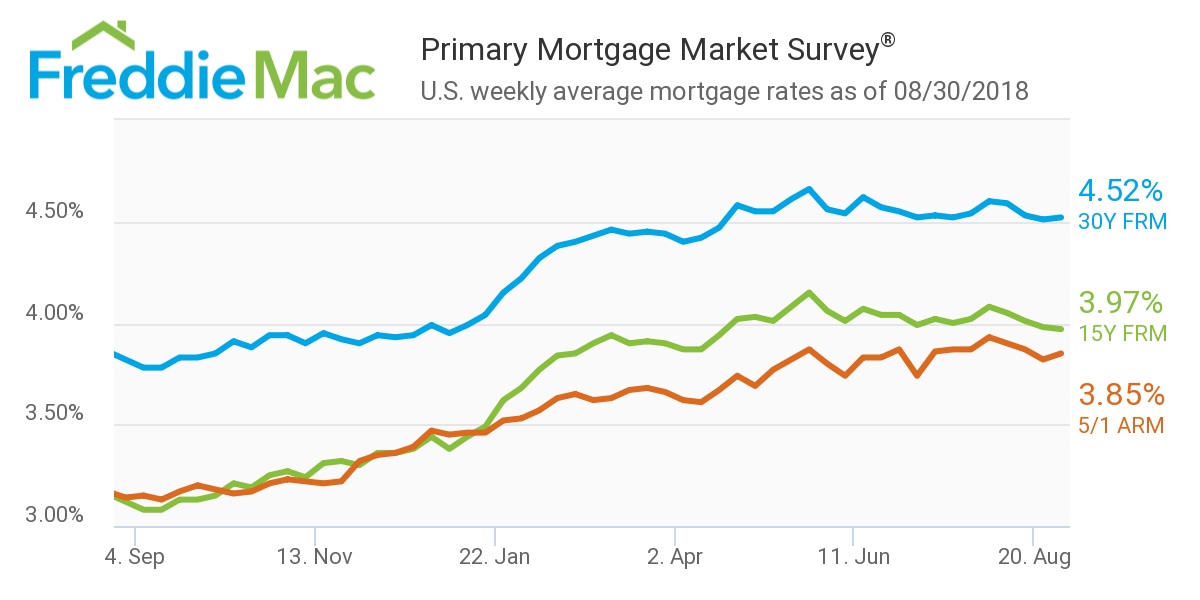

Mortgage rates are finally seeing an uptick, according to Freddie Mac’s latest Primary Mortgage Market survey.

Freddie Mac Chief Economist Sam Khater said mortgage rates are now seeing a steadiness which was last seen in the fall of 2016.

According to the Primary Mortgage Market survey, the 30-year fixed-rate mortgage averaged 4.52% for the week ending Aug. 30, 2018, increasing from 4.51% last week, and is still a substantial increase from last year’s rate of 3.82%.

“The 30-year fixed-rate mortgage barely inched up this week, continuing the summer trend of essentially being flat,” Khater stated. “While sales and price growth have softened these last few months, this leveling of rates may be helping more buyers reach the market. Purchase mortgage applications this week were once again modestly above year ago levels.”

Khater believes the recent slowdown in price appreciation in several markets is good news for the many prospective buyers who were priced out earlier this year.

However, despite the economy in the second quarter expanding at its fastest rate in nearly four years, Freddie Mac expects only a 0.2% increase in total home sales in 2018. This equates to only 6.14 million homes sold this year, compared to 6.12 million in 2017.

(Source: Freddie Mac)

The 15-year FRM averaged 3.97 this week, down from last week's 3.98%. This time last year, the 15-year FRM was 3.12%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage averaged this week at 3.85%, up from 3.82% last week, but still up from this time last year when it was 3.14%.

“Given the strength of the economy, it is possible for home sales to pick up even more before year’s end,” Khater concluded The key factor will be if affordably-priced inventory increases enough to continue this recent trend of cooling price appreciation.”