Just six months after the Royal Bank of Scotland reached a $500 million settlement with the state of New York over the bank’s mortgage practices in the run-up to the housing crisis, RBS has reached the settlement’s $400 million consumer relief goal, by providing just under $130 million in actual relief.

As part of the settlement with New York, RBS was required to pay a fine of $100 million to New York and provide $400 million in consumer relief to New York homeowners and communities.

Late last week, the monitor of RBS’ settlement with New York stated that RBS has satisfied its $400 million consumer relief obligation by providing less than 33% of the total settlement amount in actual relief to consumers.

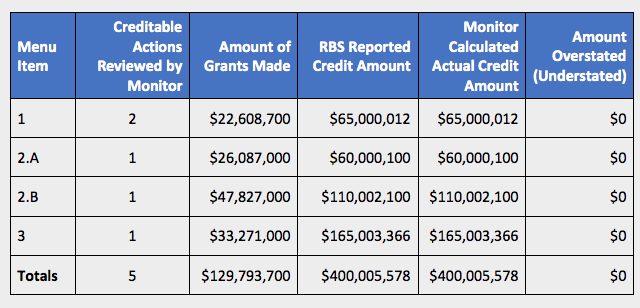

In total, RBS provided $129,729,700 in relief in the form of various grants, but received credit for just over $400 million in relief, thanks to various credit multipliers that were included as stipulations in the settlement.

RBS’ relief was broken down into several categories, each that came with its own credit multipliers.

In the “community restoration/loan remediation” category, for example, RBS provided grants of $11,304,350 to two separate organizations: the State of New York Mortgage Agency Community Restoration Fund, which is part of New York’s response to the foreclosure crisis, and the Preserving City Neighborhoods Housing Development Fund Corporation, a nonprofit that advances neighborhood stabilization by fixing up abandoned homes and establishing “responsible third-party ownership.”

That category carried a credit multiplier where each actual dollar of relief would actually be worth $2.50 in credit. Additionally, RBS was entitled to a 115% “Early Incentive Credit,” which it earned because the funding for the grants was provided by Sept. 30, 2018.

Therefore, the total grant amount of $22,608,700 in that category actually equaled just over $65 million in relief credit.

In the “grants for certified land banks or land trusts” and “grants for housing quality improvement and enforcement programs” categories, the multiplier was $2 in credit for each $1 of actual relief provided.

According to the settlement’s monitor, RBS provided just over $26 million in “grants for certified land banks or land trusts” to Enterprise Community Partners, a nonprofit that delivers capital, develops programs, and advocates for policies to create and preserve affordable housing.

Double that amount, as per the credit multiplier stipulation, and add in the same 115% “Early Incentive Credit” because the relief was provided before September 30, and RBS gets credit for just over $60 million in relief.

In the “grants for housing quality improvement and enforcement programs” category, RBS provided $47.83 million to Enterprise Community Partners, resulting in just over $110 million in consumer relief credit due to the same multipliers referenced above.

The final category, “affordable rental housing,” contained the largest multiplier of any of the categories.

In that category, each dollar RBS provided is worth $3.75 in relief credit. RBS would also receive the same 115% “Early Incentive Credit” as with the other categories, plus an additional 115% credit because the projects that RBS’ grant money will go towards are located in cities or counties where RBS has not funded a “Critical Need Housing Development” in the last four years.

In the “affordable rental housing” category, RBS provided $33.27 million to Enterprise Community Partners. Multiply that by the various factors and RBS’ $33.27 million in actual credit turns into more than $165 million in relief credit.

In total, RBS provided $129,793,700 in relief and received credit for more than $400 million in relief (as seen in the chart below, provided by the settlement’s monitor).

(Click to enlarge)

As stipulated by the settlement, RBS was eligible for all those credit multipliers if the bank completed the relief efforts before Dec. 31, 2019.

But the bank did it in six months, ensuring that it needed to only provide $130 million in actual credit.

These types of stipulations are common among massive mortgage-related settlements, where the offending bank gets credit for relief for providing it in a timely manner.

And now, six months after agreeing to provide $400 million in relief for “deceptive practices and misrepresentations to investors in connection with the packaging, marketing, sale, and issuance of residential mortgage-backed securities,” RBS has met its goal.

RBS subsequently agreed to pay out nearly $5 billion in a settlement with the Department of Justice that covers civil claims that RBS misled investors in the underwriting and issuing of residential mortgage-backed securities from 2005 through 2008.