The Federal Housing Finance Agency released a new report showing Freddie Mac did not meet all of its low-income housing goals for 2017.

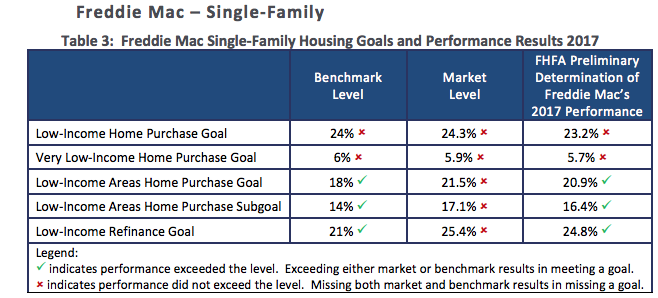

The FHFA laid out a benchmark level and a market level for each goal. If the GSE missed both levels, it failed to meet that goal. Freddie Mac failed to meet its goals for low-income home purchase and very low-income home purchase.

The chart below shows the determination of Freddie Mac’s performance for 2017. In fact, while it only failed two of its goals, it was unable to meet market level on all five goals.

Click to Enlarge

(Source: FHFA)

FHFA notified Freddie Mac of the agency’s preliminary determination that the enterprise fell short on the low-income home purchase and very low-income home purchase goals. After it receives Freddie Mac’s response and possible additional analyses, the FHFA will make a final decision regarding the GSE’s performance on its 2017 housing goals.

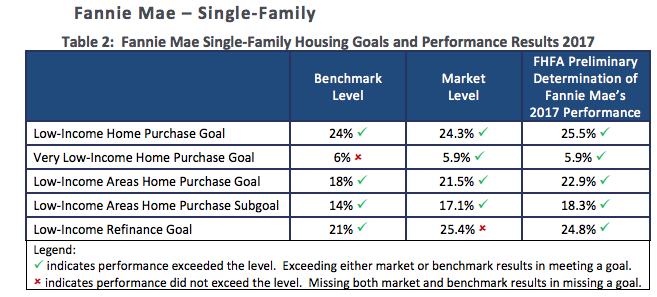

Fannie Mae, on the other hand, met all of its low-income housing goals. The chart below shows it missed the benchmark level for very low income home purchases and the market level for low income refinance goal.

Click to Enlarge

(Source: FHFA)

Once again, the FHFA explained it will release its final determination after it receives a possible response from Fannie Mae and possible additional analyses.

The Safety and Soundness Act established a duty for the enterprises to serve very low-, low- and moderate-income families in three underserved markets – manufactured housing, affordable housing preservation and rural housing – with the objective of increasing liquidity of mortgage investments and improving the distribution of investment capital available for mortgage financing in each of these markets. On December 13, 2016, the FHFA issued a final rule implementing the Duty to Serve requirements.

Photo credit: Shutterstock.com