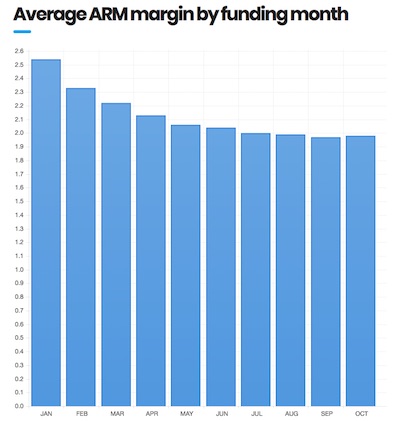

Margins on adjustable-rate reverse mortgage loans averaged 1.98% in October, according to HECM analytics provider Baseline Reverse.

This is up slightly from the recently adjusted average for September, which is now 1.97%, but down slightly from August’s 1.99%.

Baseline President Dan Ribler said the fact that margins are holding steady indicates that reverse mortgage lenders have adapted in the wake of program changes issued last year.

Immediately following those changes, the industry saw margins swing drastically as lenders struggled to find a new balance that would allow them to remain profitable and still be competitive under the new rules.

Immediately following those changes, the industry saw margins swing drastically as lenders struggled to find a new balance that would allow them to remain profitable and still be competitive under the new rules.

In July, margins averaged 2.54% before declining steadily, hovering in the 2% range for the last several months.

“We continue to see stabilization around the 2% margin as the market appears to have found its competitive footing,” Ribler said.

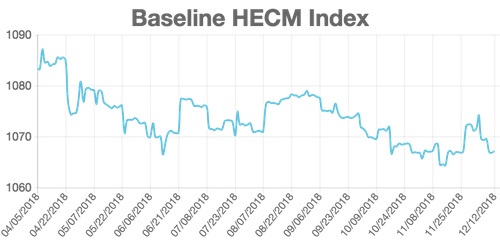

Ribler said it’s worth noting that margins have stabilized month over month while the HECM price index has shown more drastic changes.

The HECM price index reflects real-time bond pricing for a basket of 2017 PLF Annual LIBOR loans. In September, the index was 1074.56, but in October it fell to 1066.91.

“The slight drop in pricing has been fueled by slightly wider spreads, partially offset by more favorable forward interest rates,” Ribler explained.

Dan Harder, vice president at 1st Reverse Mortgage USA, said he thinks the industry will retain this margin for the first half of 2019.

“Obviously, margins are predicated on interest rates, so if rates stay where they’re at, I think we're going to be stable here first and maybe even second quarter, right around that 2% margin, with wholesale probably running slightly higher in margin as a business channel versus a retail platform,” Harder said. “I think we can look forward as an industry to having some pretty favorable margins for the first and second quarters.”