Ten years after the housing and mortgage-market crash and subsequent reforms, there is renewed concern about the liquidity risk in the mortgage market. According to a team of researchers at the Brookings Institution who published a research paper in 2018 entitled “Liquidity Crises in the Mortgage Market,” the threat is now greater than ever, as nonbank mortgage companies increase their share of the market without having the resources to support stress scenarios.

Ginnie Mae, in the Ginnie Mae 2020 position paper, seems to be agreeing with this assessment of increased counterparty risk as they suggest a series of stress tests that they will be imposing on nonbank lenders in the near future.

Of growing concern is the volume of originations and servicing that has shifted from banks to nonbanks in recent years. As cited in the Brookings report, nonbanks represented nearly 50% of all originations in 2016 versus 20% in 2007, and they represent an astounding 80% of GNMA origination dollars and 60% of servicing rights in 2017.

These numbers are sure to be even higher in 2019. Meanwhile, rising interest rates, lower volumes, anticipated increases in delinquencies and defaults, as well as nonbanks’ increasing reliance on short-term credit lines, could leave nonbanks without resources to bring to bear in a stress scenario, creating the perfect liquidity storm.

A stick or a carrot?

Ginnie Mae is proposing stress test requirements on its counterparties, which we see as the stick that may drive a change in how nonbank mortgage business are run. But where is the carrot?

Put simply, the same tools you need to predict results for a set of stress testing based negative market or business conditions, can also serve you to prepare for any set of conditions. So why not use these tools to find the upside by trying out solutions to multiple sets of conditions, being prepared to call an audible, and running a different play when a different market presents itself?

Why not plan for a successful outcome no matter the conditions? This is the carrot — where you get to switch from a reactive to a proactive mindset!

What does it mean to have a proactive mindset? It means implementing best-practice processes for monitoring liquidity and financial health; it means having the ability to conduct forward-looking scenarios that illuminate the effects on your business of any possible changes in conditions — such as margin pressure, increased default rates, rising interest rates’ impact on volume, etc. — on your profitability and liquidity.

It is this upside potential that makes it well worth the short-term pain of making a change now in order to better your business, as well as being better prepared for new regulations when they go into effect.

Riivos has introduced continuous value chain management expressly for this purpose – to provide a strategic view of the mortgage value chain, giving visibility into how changes to business drivers affect results, before such conditions occur.

With end-to-end visibility into the transactional flow — past, present and future — Riivos lets you see where profitability and liquidity may be leaking out and how changes to business drivers would ripple throughout the financials. This allows you to make the necessary changes in advance of critical times to ensure greater profitability and liquidity.

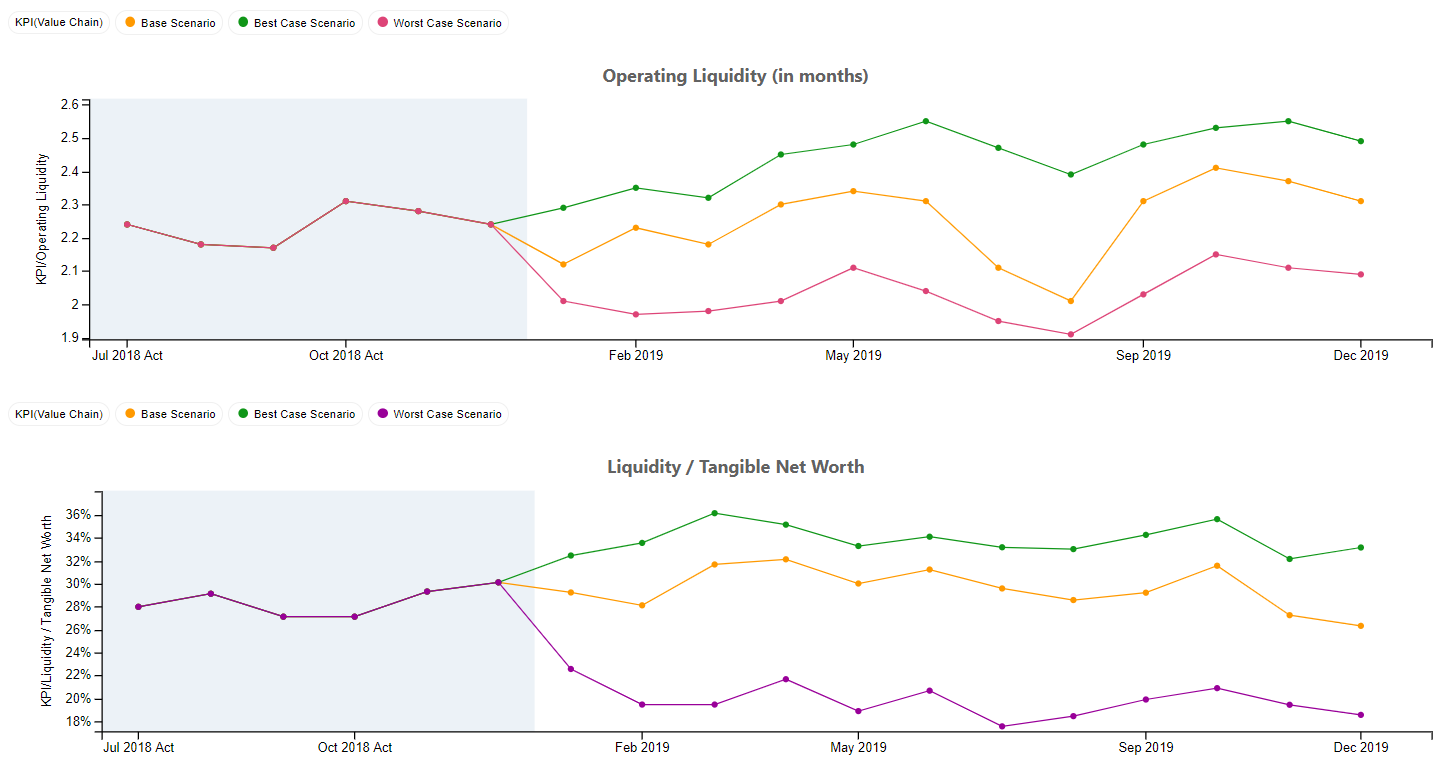

(Click to enlarge)

How three different stress scenarios impact profitability and liquidity.

Additionally, Ginnie Mae will have more confidence in the results of a stress test if you are using an enterprise application such as Riivos rather than forecasting in Excel or the back of a napkin.

In summary, the shift of market share to nonbank originators has created liquidity concerns in the mortgage industry. But with a proactive, rather than reactive, mindset supported by appropriate technology and process, you can sleep well at night knowing that you are set for success in any market conditions. This will not only strengthen your individual firm, but also this core American industry.