In the era of the digital mortgage, banks are facing increased competition from big tech companies looking to flex their muscles in the financial services realm, and they may need to invest more deeply in tech to stay on top.

According to a Fannie Mae’s Perspectives blog post authored by Steve Deggendorf, director of Market Insights Research, banks need to “step up their digital game” and figure out how to streamline financial tasks to enhance the customer experience before big tech beats them to it.

Citing data from Fannie Mae's National Housing Survey from the third quarter of 2018, Deggendorf said more consumers have expressed a willingness to trust their favorite tech firm with their financial needs, including obtaining a mortgage.

The survey revealed that just a minority of Americans say they are “very likely” to recommend their bank, but stay with them out of convenience and trust.

Respondents also said they are less comfortable performing complex financial tasks online, including applying for a mortgage. And, of those who make mobile payments, one-third use payment services offered by Big Tech.

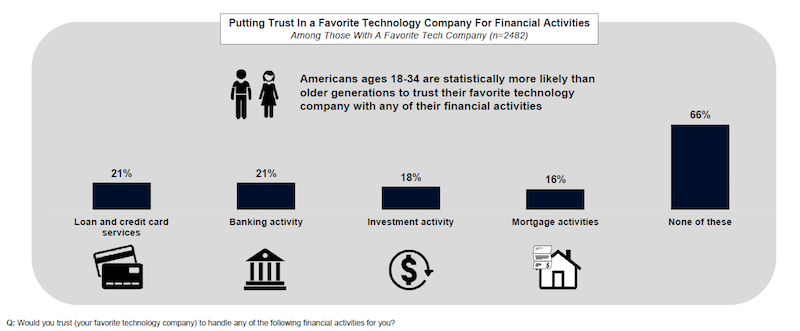

Finally, while a small share said they trust tech firms with their money, when naming their favorite tech company, respondents said they were likely to trust that particular company to handle their financial activities, including their mortgage.

Below is a graphic illustrating the financial activities respondents would trust their favorite tech company to handle (click image to enlarge):

(Source: Fannie Mae)

Deggendorf said these sentiments are particularly relevant as startups and established Big Tech – like Google, Amazon, Apple and Facebook – are looking to use their expertise to disrupt financial services.

“These new entrants are looking to offer financial services and are often credited with offering dazzling consumer digital experiences significantly better than those of traditional banks,” Deggendorf wrote. “Given the digital and customer experience prowess and resources of Big Tech firms, they may be especially well-situated to compete against traditional financial institutions.”

“Big Tech firms excel at the online digital experience in ways that most banks do not currently, and they are increasingly experimenting with fulfilling their consumers' financial needs,” Deggendorf continued. “Now is the time for banks to step up their digital game and, more specifically, to consider how to best digitize more complex financial tasks before Big Tech does.”