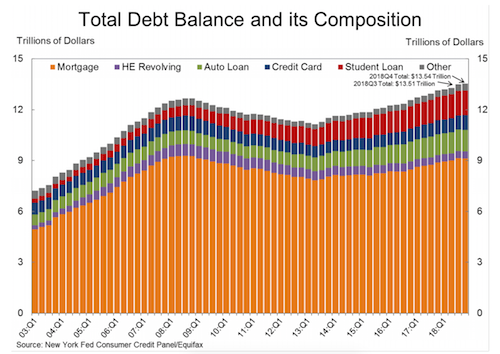

American household debt continues to climb to record levels, reaching $13.54 trillion in the fourth quarter of 2018.

According to the latest report from the Federal Reserve Bank of New York’s Center for Microeconomic Data, household debt is now $869 billion higher than 2008’s $12.68 trillion peak.

It is also 21.4% above the debt levels seen in the wake of the financial crisis in 2013.

A large portion of this collective debt is a result of auto loans, which have been climbing steadily since 2011, increasing $9 billion in Q4.

Last year saw the highest level of auto loan debt in the 19 years that this data has been collected, with $584 billion in new auto loans and leases appearing on credit reports.

But a slowdown in mortgage originations has tempered debt growth in Q4, the New York Fed said.

Mortgage originations declined from $445 billion to $401 billion, reaching their lowest level in nearly four years. Mortgage balances totaled $9.1 trillion, mostly unchanged from the previous quarter.

Delinquencies were also flat, with 1.1% of mortgage balances late by 90 days or more.

HELOC balances also declined, falling $10 billion in Q4 to $412 billion – the lowest level in 14 years.

While mortgage debt declined, credit card and student debt rose. Outstanding student loan debt climbed to $1.46 trillion from $1.44 trillion, while credit card balances increased $26 billion to $870 billion, consistent with seasonal patterns.

On a positive note, bankruptcy notations were down in Q4. About 195,000 consumers had a bankruptcy notation added to their credit reports, down 5,000 from the same time last year.

Here is a breakdown of total U.S. household debt: