Homeowners keep racking up equity, and this could mean big volume for home equity loans, especially as interest rates slide.

The average U.S. homeowner gained $9,700 in equity from the fourth quarter of 2017 to the fourth quarter of 2018, according to the latest report from CoreLogic.

This equates to an 8.1% increase year over year and represents an aggregate gain of $678.4 billion since Q4 2017.

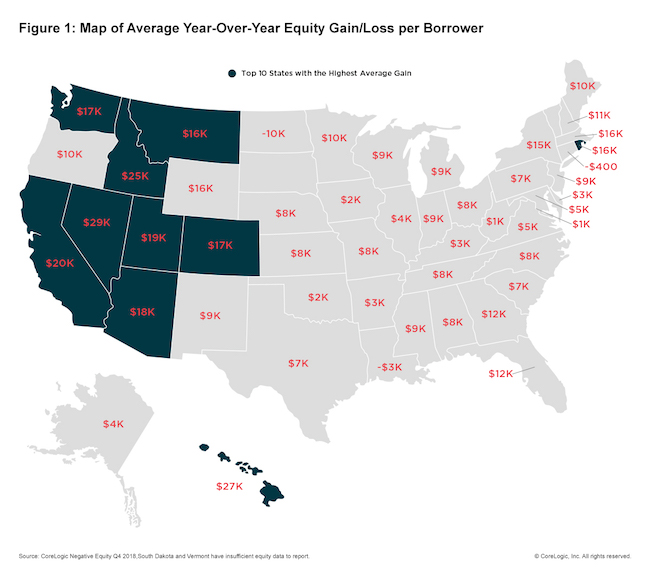

Home equity levels grew in almost every state, with the western region seeing the greatest increases, CoreLogic reported.

Nevada led the pack with an average increase of $29,400 in home equity, followed by Hawaii ($26,900), Idaho ($24,700) and California ($19,600).

Here is a map of a state-by-state breakdown:

While the total number of homes with negative equity fell 14% year over year, it did rise on a quarterly basis.

Homes with negative equity increased 1.6% to 2.2 million homes from Q3 to Q4. This equates to 4.2% of all mortgaged properties and was the first quarterly increase since 2015.

CoreLogic Chief Economist Frank Nothaft said the company is forecasting a 4.5% increase in home prices, which could help restore equity for 350,000 homeowners currently underwater.

Rising home prices coupled with increasing equity could also convince more homeowners to seek home equity loans in order to finance renovations.

"As home prices rise, significantly more people are choosing to remodel, repair or upgrade their existing homes. The increase in home equity over the past several years provides homeowners with the means to finance home remodels and repairs,” said CoreLogic President and CEO Frank Martell.

“With rates still ultra-low by historical standards, home equity loans provide a low-cost method to finance home-improvement spending,” Martell added. “These expenditures are expected to rise 5% in 2019.”