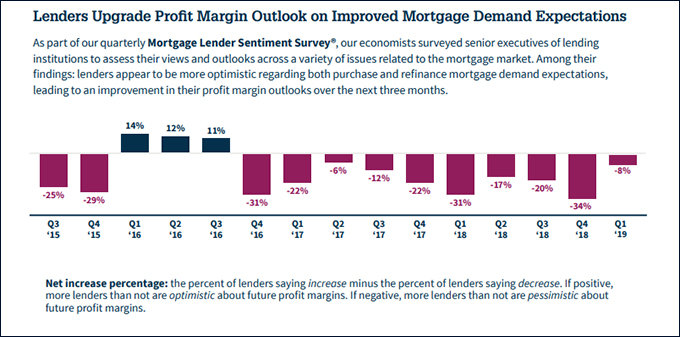

In the first quarter of 2019, Fannie Mae's Mortgage Lender Sentiment Survey revealed the net profit margin outlook for mortgage lenders retreated 8% from the previous quarter.

Although this percentage marks the 10th consecutive quarter of declines, it’s still a significant improvement from last year's Q4 survey low of -34%.

The image below (click to enlarge) highlights mortgage lenders' outlook:

“Lenders appear less pessimistic regarding mortgage demand expectations; thus their profit margin outlook over the next three months is also slightly improved," Fannie Mae Senior Vice President and Chief Economist Doug Duncan said. "While the results seem to portray the gloomiest picture of purchase mortgage demand during the prior three months in the survey's five-year history, the net share of lenders expecting rising demand over the next three months exceeded the level recorded in the same quarter last year.”

So, what’s driving mortgage lender optimism? Well, Fannie says it is the rising borrower demand for both purchase and refinance mortgages.

In fact, Duncan notes lenders' view of the refinance market has become somewhat rosier, as both recent and expected demand improved to the best showing in two years.

“For refinance mortgages, while more lenders continued to report weaker refinance demand than those seeing rising demand, the net share of lenders reporting demand growth over the prior three months increased significantly to the highest level in two years across all loan types” Fannie Mae writes. “Similarly, the net share expecting demand growth remains negative but also improved to the highest level in two years.”

That being said, for the ninth consecutive quarter, mortgage lenders still cited "competition from other lenders" as the top reason for decreased profit margin outlook.

Furthermore, when it came to purchase mortgages, across all loan types, the net share of lenders reporting demand growth over the prior three months fell to a new survey low, according to Fannie Mae.

"While more lenders anticipate declining rather than rising profit margins, continuing the trend that started in the fourth quarter of 2016, the net share expecting falling profit margins decreased from a survey high in the prior quarter to the lowest share in nearly two years," Duncan continued. "Lenders' improved demand outlook going into the spring selling season bodes well for our forecast of relatively flat mortgage volume this year following the double-digit drop in 2018."