Home prices rose 5.1% in the first quarter from a year earlier, the slowest annualized pace in four years, the Federal Housing Finance Agency said in a report.

“Although price growth is still positive, the upward pace is softening across the country, especially among states with the largest supplies of housing,” said William Doerner, FHFA Supervisory Economist William Doerner. House prices have risen consistently over the last 31 quarters, he said.

Nationally, home prices in all 50 states and the District of Columbia increased since the fourth quarter of last year.

The states with the largest gains were Idaho at 13.4%, Nevada at 10.6%, Utah at 8.9%, Tennessee at 7.7% and Georgia at 7.5%.

The states that showed the least amount of annual appreciation are Maryland at 0.5%, Delaware at 0.7%, Louisiana at 1.0%, Alaska at 2.1% and Wyoming at 2.1%.

According to FHFA, home prices rose in 95 of the 100 largest metropolitan areas in the U.S. over the last four quarters.

The largest annual price increases were in Boise City Idaho, where prices gained a whopping 16%. However, prices were weakest in Honolulu, where they fell by 4.5%.

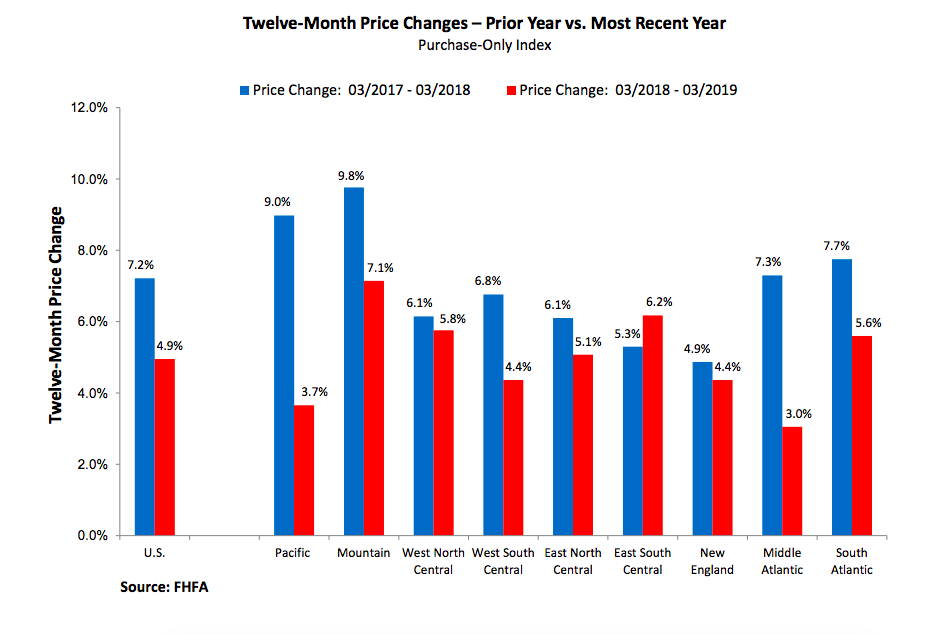

Additionally, the report explains across the nine census divisions, the Mountain division once again saw the strongest appreciation growth, climbing 7.2% annually and increasing 1.7% in the first quarter of 2019.

Notably, annual house price appreciation was the weakest in the Pacific division, where house prices rose by only 3.7% year over year.

The chart below compares 12-month price changes to the prior year:

The FHFA monthly HPI is calculated using home sales price information from mortgages sold to, or guaranteed by, Fannie Mae and Freddie Mac. Because of this, the selection excludes high-end homes bought with jumbo loans or cash sales.