Many multifamily lenders are preparing for the end of LIBOR, but are waiting on regulators to make decisions before they take action.

In a recent survey conducted by the Mortgage Bankers Association, 92% of firms said they have begun transition plans, and 77% are now including LIBOR fallback language in new loan documents.

But despite this preparation, only 56% said they are on track for preparing for a life without LIBOR. There is little uniformity when it comes to the details, according to the results of the new survey by the MBA’s LIBOR Outreach Committee.

LIBOR, the London Interbank Offered Rate, dubbed the world’s most important number, is a scandal-plagued benchmark that undergirds about $350 trillion in loans, and it is about to be phased out. LIBOR is a common benchmark for determining short-term interest rates. ARMs, for example, are often linked to LIBOR.

“LIBOR is a benchmark interest rate for global financial markets and many adjustable-rate mortgages are linked to LIBOR so they will need to be linked to a new replacement interest rate once LIBOR is phased out at the end of 2021,” explained Roelof Slump, Fitch Ratings managing director in the company’s U.S. RMBS group.

In the U.S., the New York Federal Reserve announced the creation of SOFR, the Secured Overnight Financing Rate, that could take the place of LIBOR over the next several years – or so it hopes. This rate uses Treasury securities as collateral.

In the MBA’s survey, 41% of participants said they anticipate using SOFR, while 3% said they won’t and 44% are still unsure.

“The vast majority of commercial and multifamily mortgage lenders report they are working on the transition away from LIBOR, but the devil is in the details,” said Jamie Woodwell, MBA vice president of commercial real estate research. “Most firms are already taking some steps, including changing language in loan documents, but they also report relying on regulators and industry-bodies to make decisions before they take certain actions.”

“The net result is a fair amount of uncertainty about the mechanics of the transition away from LIBOR, and an overall hesitation as many firms wait for others to lead the way,” Woodwell said.

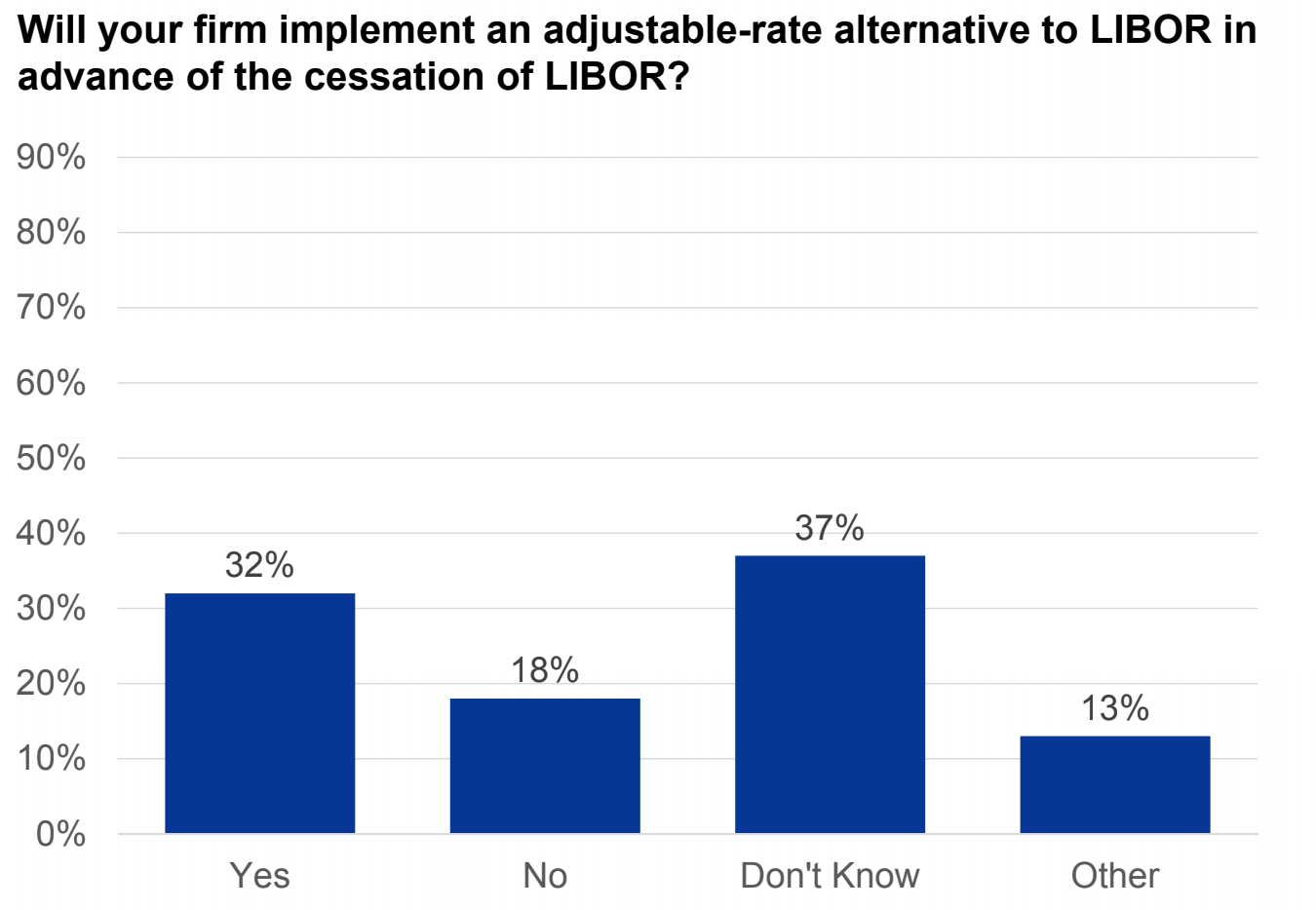

But they are planning to start the transition from LIBOR sooner rather than later. The chart below shows 32% of applicants said they will implement an adjustable-rate alternative to LIBOR in advance of the cessation of LIBOR.

Click to Enlarge

(Source: MBA)

But many are waiting, with 59% saying they are waiting on regulators and industry bodies to make decisions before they take action.

“With more than $1 trillion in commercial and multifamily mortgage debt tied to adjustable rate indices, the LIBOR transition has the potential to create major disruptions for borrowers, lenders, investors and everyone in-between,” said Andrew Foster, MBA director of commercial real estate finance.

“MBA and its LIBOR Outreach Committee of members are developing resources to educate market participants and help ensure all stakeholders are focused on the important issues, with the goal of a smooth transition,” Foster said. “Given all that is at stake for the commercial real estate debt markets, as well as many other asset classes that utilize LIBOR, an ounce of preparedness is worth a pound of cure.”