Canada’s reverse mortgage market continues to see explosive growth while its U.S. counterpart struggles to stay afloat.

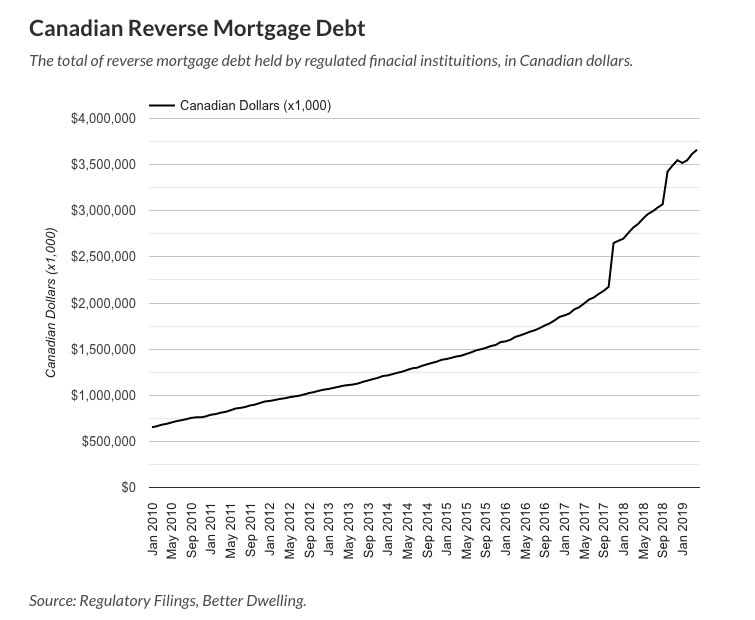

Reverse mortgage debt in the country reached an all-time high in April by climbing to $3.66 billion, according to Canada’s Office of the Superintendent of Financial Institutions.

This represents a 28.15% increase from the previous year, Canada’s Mortgage Broker News said.

Housing news outlet Better Dwelling noted that the market is doing particularly well even as other segments are underperforming. And, while the pace of growth in this market has slowed slightly, it’s still moving along with solid momentum, with Better Dwelling calling it “possibly the fastest growing segment of debt in the country,” adding that its growth rate “hasn’t fallen below 10% in the past eight years.”

Below is a chart from Better Dwelling illustrating the growth in reverse mortgage debt (click to enlarge):

Better Dwelling’s article goes on to predict that as Canada’s population ages, “more cash-poor, house-rich retirees are also going to be looking towards this segment.”

The impressive upward trajectory of Canada’s market may have something to do with the fact that more lenders have entered the business.

In the last 30-plus years, only one product was offered – HomEquity Bank's CHIP reverse mortgage. But in the last year, another player has come onto the scene, as Equitable Bank launched its Path Home Plan for consumers in British Columbia, Alberta, Ontario and Quebec.

Kim Kukulowicz, vice president of residential sales and partner relations at Equitable Bank, told The Globe and Mail that the company was prompted to enter the space because of three important factors: the size of the country's aging demographic, increasing home prices that have homeowners amassing considerable equity, and a general lack of retirement savings.

All three of these trends are evident in the U.S. as well, but so far they haven’t translated into sizable loan activity.

The reverse mortgage market in the U.S. has settled in a slump as the industry struggles to adjust to persistent government regulation, and perhaps this is the main reason for the glaring disparity: the government’s role in shaping the program.

Canada’s reverse mortgage products are completely private, with no government backing.

Since the U.S. market has been stifled by regulations, the private reverse mortgage market has seen significant growth as of late, but it is still far too small to make a real impact.

But as regulators continue to signal that more changes may be on the horizon for HECMs, perhaps lenders will look to Canada’s example and give the proprietary reverse mortgage market will get the boost that it needs.